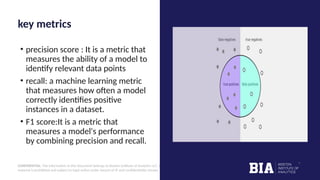

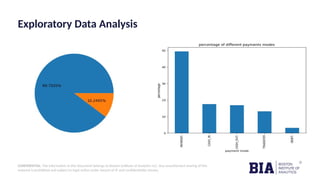

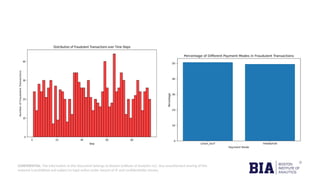

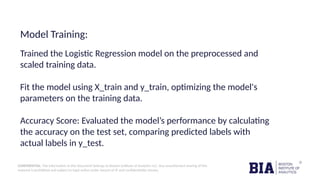

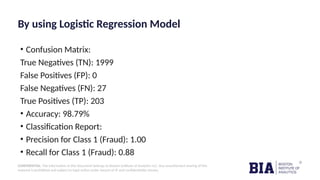

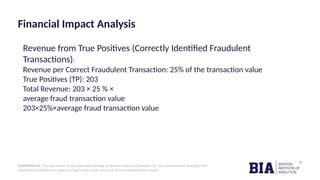

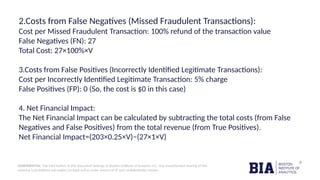

The document outlines a fraud detection analysis conducted by Boston Institute of Analytics for a company named Block Fraud, which aims to enter the Brazilian market with a pricing strategy based on their high accuracy. It describes the process of data cleaning, model training using logistic regression, and evaluation metrics, resulting in a high accuracy of 98.79% in detecting fraud. The conclusion emphasizes a positive financial impact from identifying fraudulent transactions, after accounting for missed and incorrectly labeled transactions.