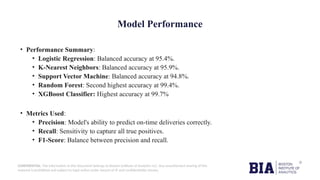

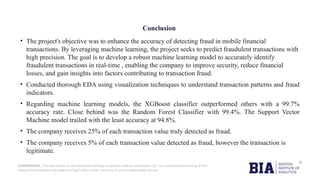

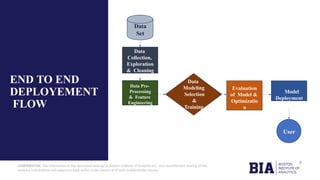

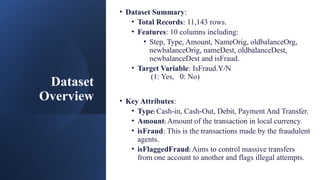

The document outlines a project by the Boston Institute of Analytics focused on enhancing fraud detection in mobile financial transactions using machine learning techniques. It details the project's objectives, dataset characteristics, data preprocessing, exploratory data analysis, and the performance of various machine learning models, with the XGBoost classifier achieving the highest accuracy of 99.7%. The conclusions highlight the effectiveness of the models and the financial implications of accurately identifying fraud.

![CONFIDENTIAL: The information in this document belongs to Boston Institute of Analytics LLC. Any unauthorized sharing of this

material is prohibited and subject to legal action under breach of IP and confidentiality clauses.

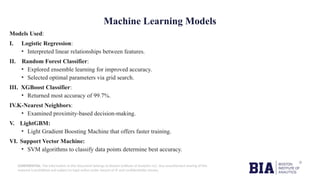

Exploratory Data Analysis

1.Is fraud:

• Yes – 10.2%, No – 89.8%.

2.Bivariate Analysis:

• The majority fraud transaction occurs for the same user [True].

• All the fraud amount is greater than 10,000 [True].

• 60% of fraud transaction occurs using cash-out-type method [False].

• Values greater than 100.000 occurs using transfers-type method [False].

• Fraud transactions occurs at least in 3 days [True].

3. Multivariate Analysis:

• Numerical Analysis represented through Heatmap.

• Categorical Analysis represented through Heatmap.](https://image.slidesharecdn.com/frauddetectionppt-250207071844-2cab47ce/85/Fraud-Detection-in-Cybersecurity-Advanced-Techniques-for-Safeguarding-Digital-Assets-7-320.jpg)