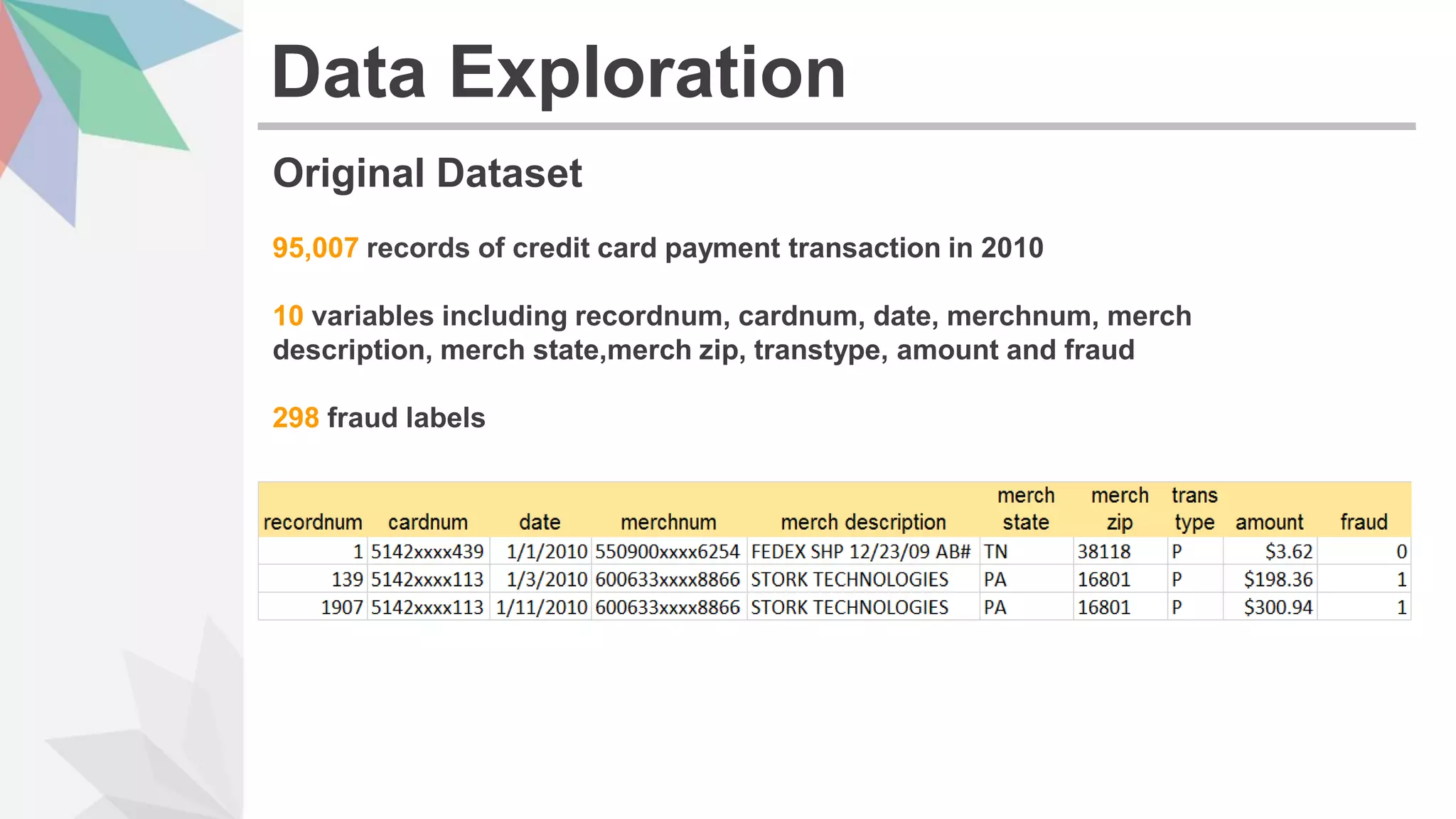

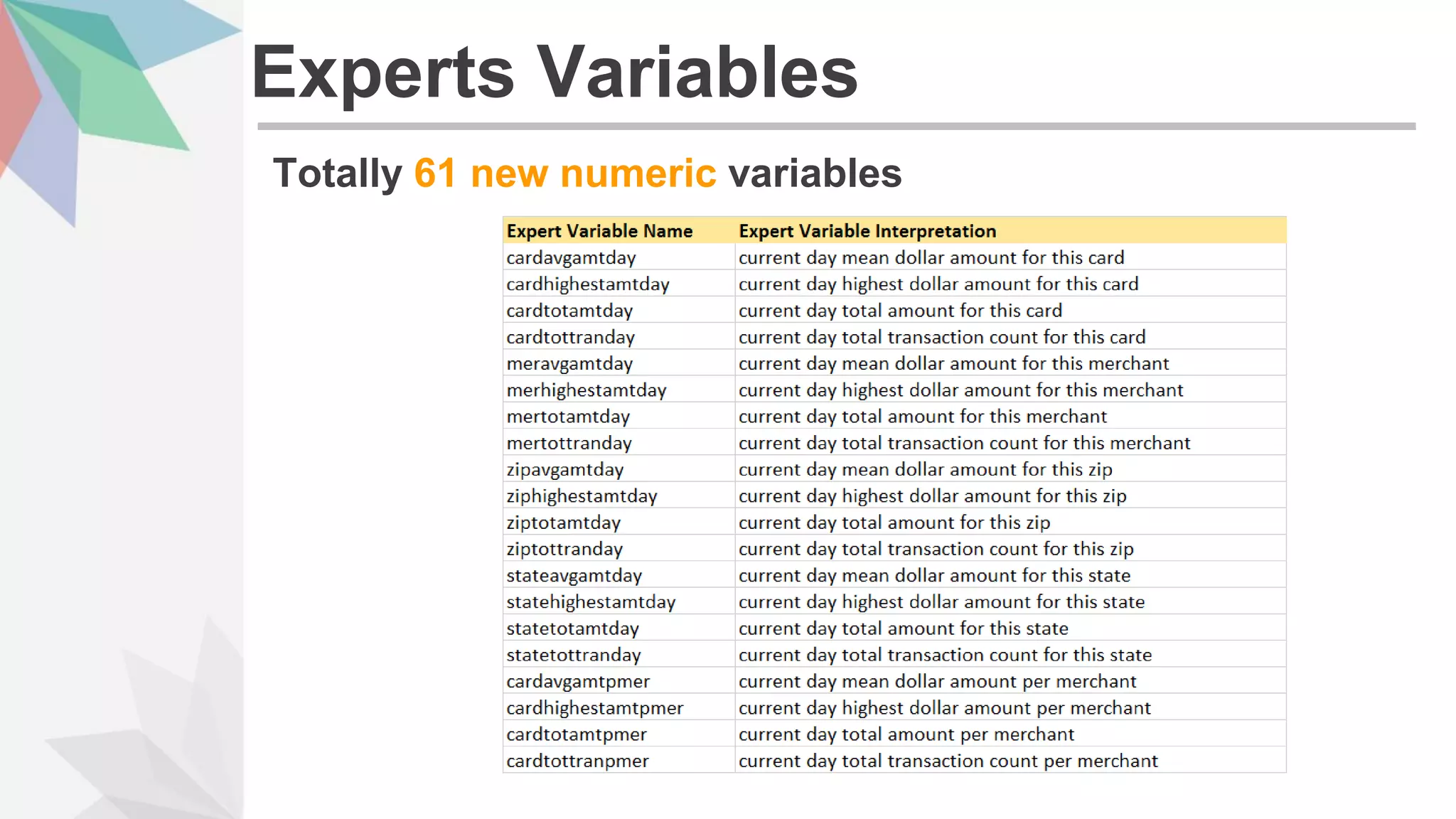

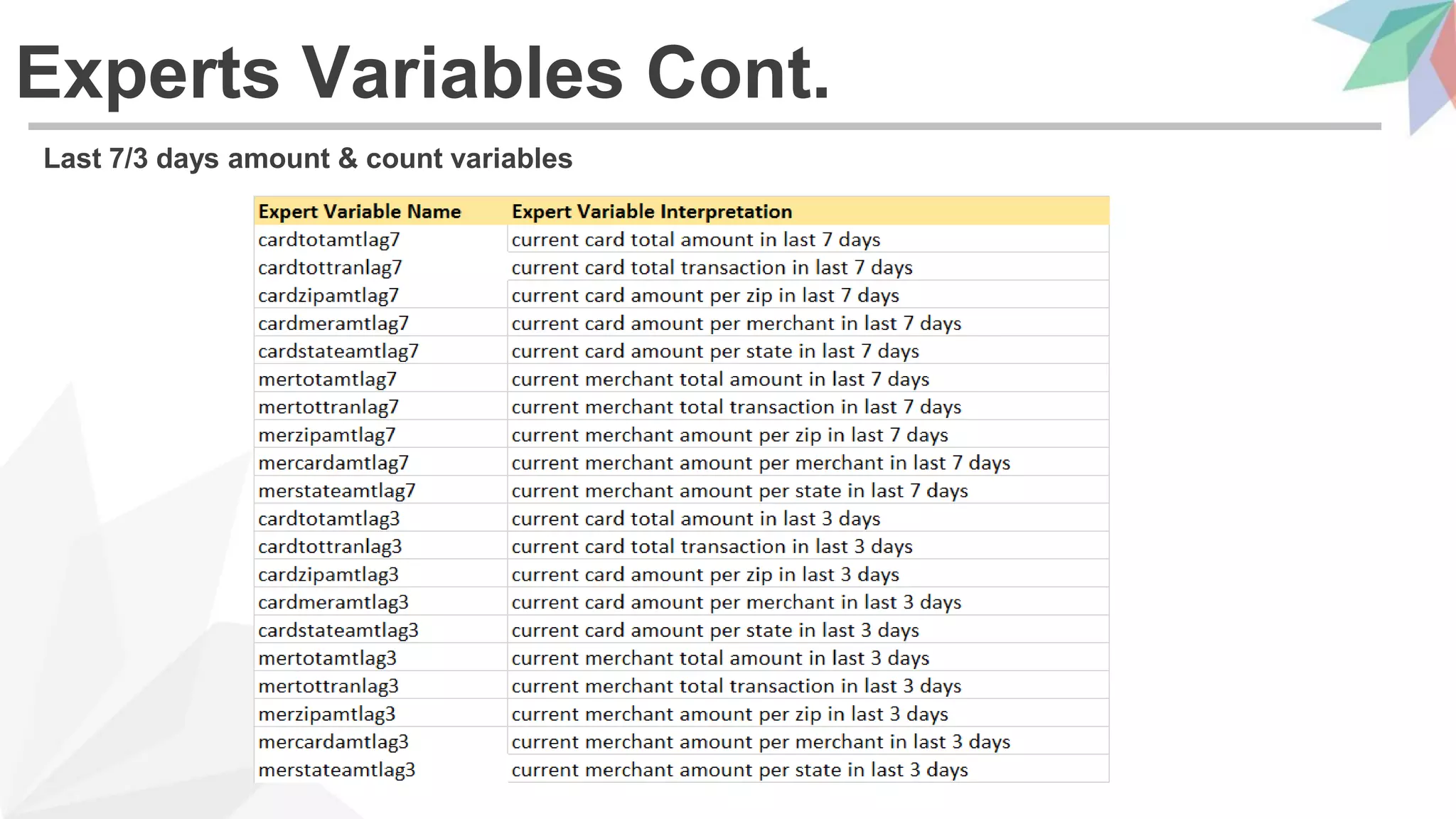

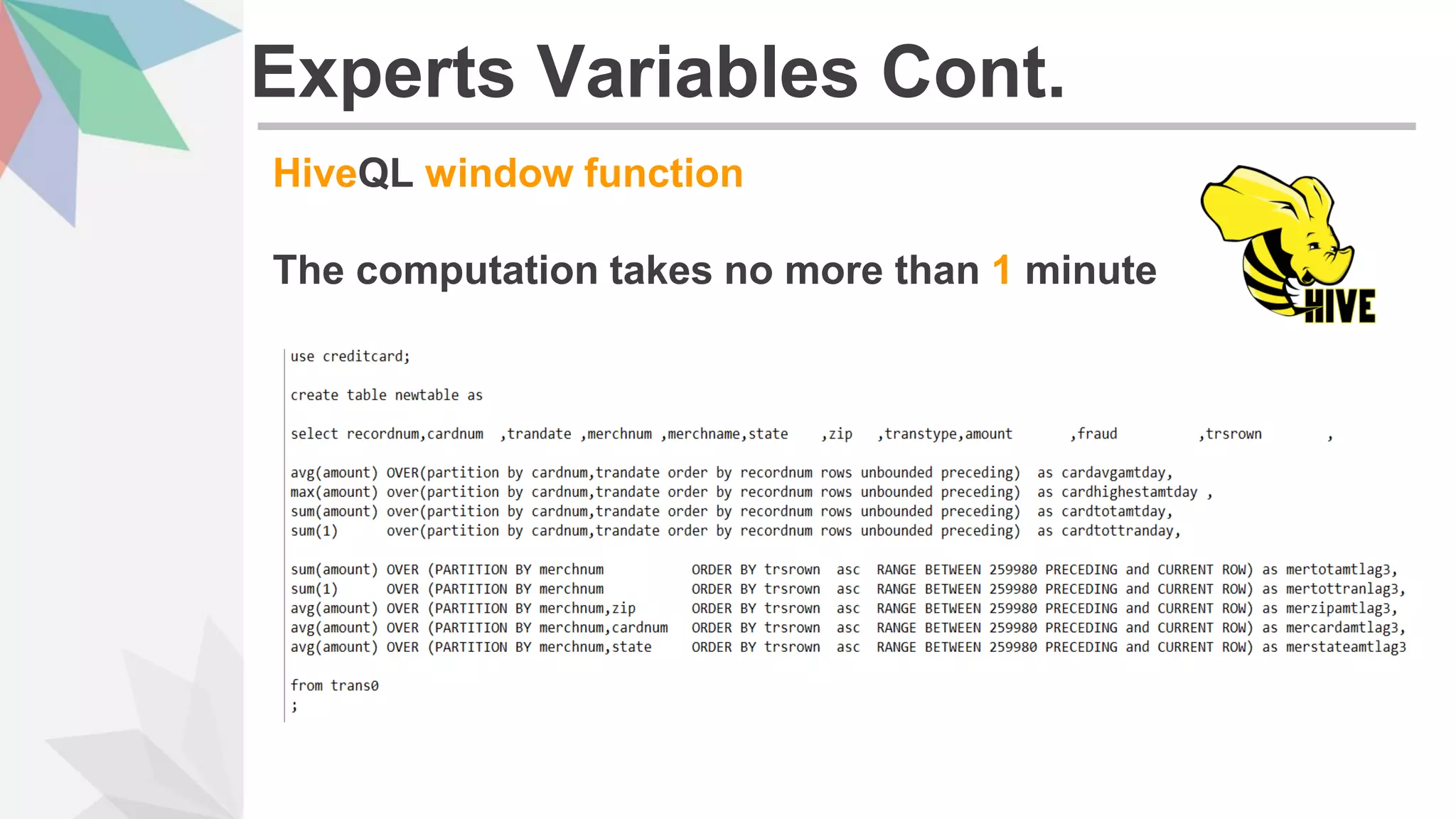

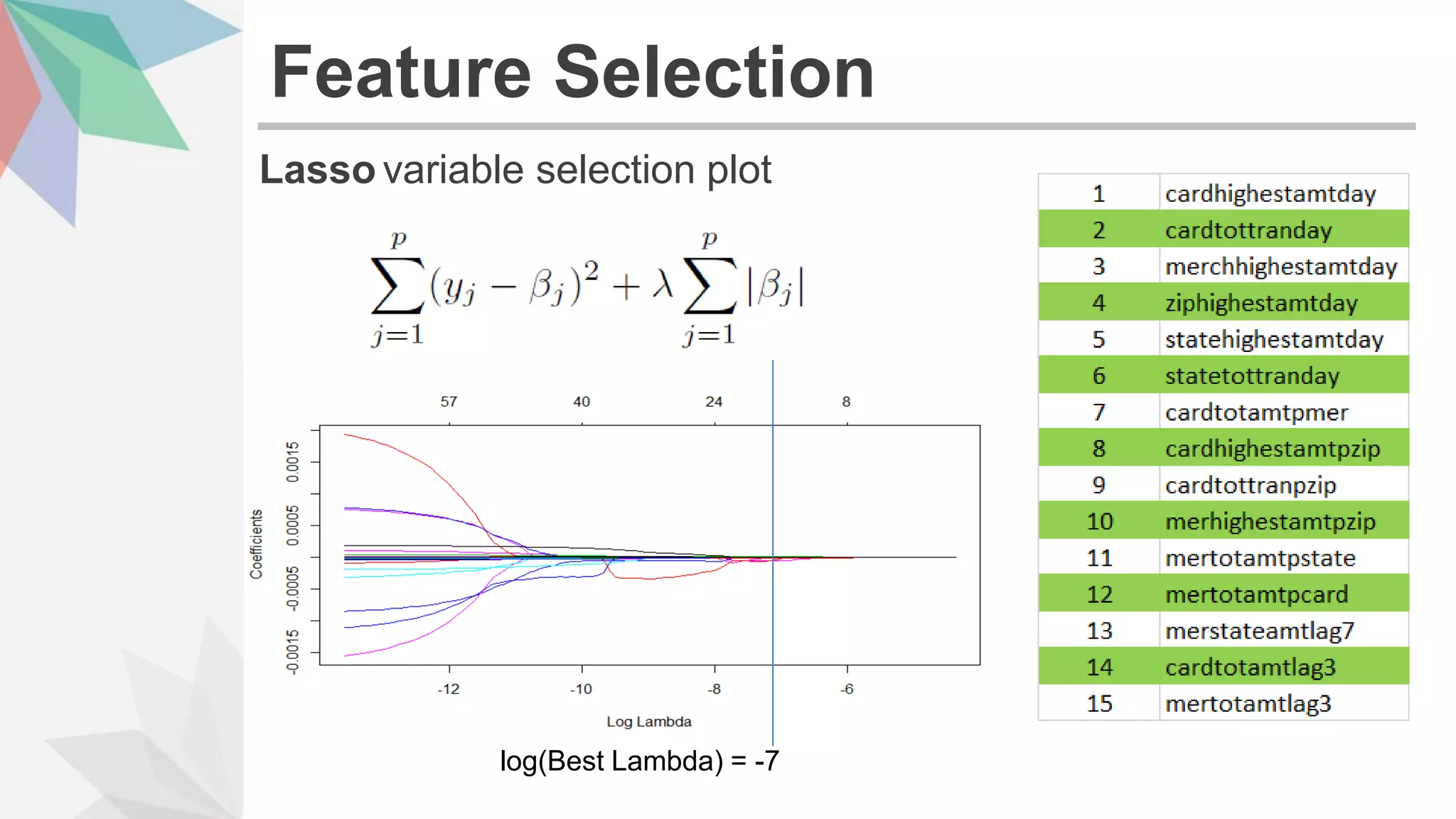

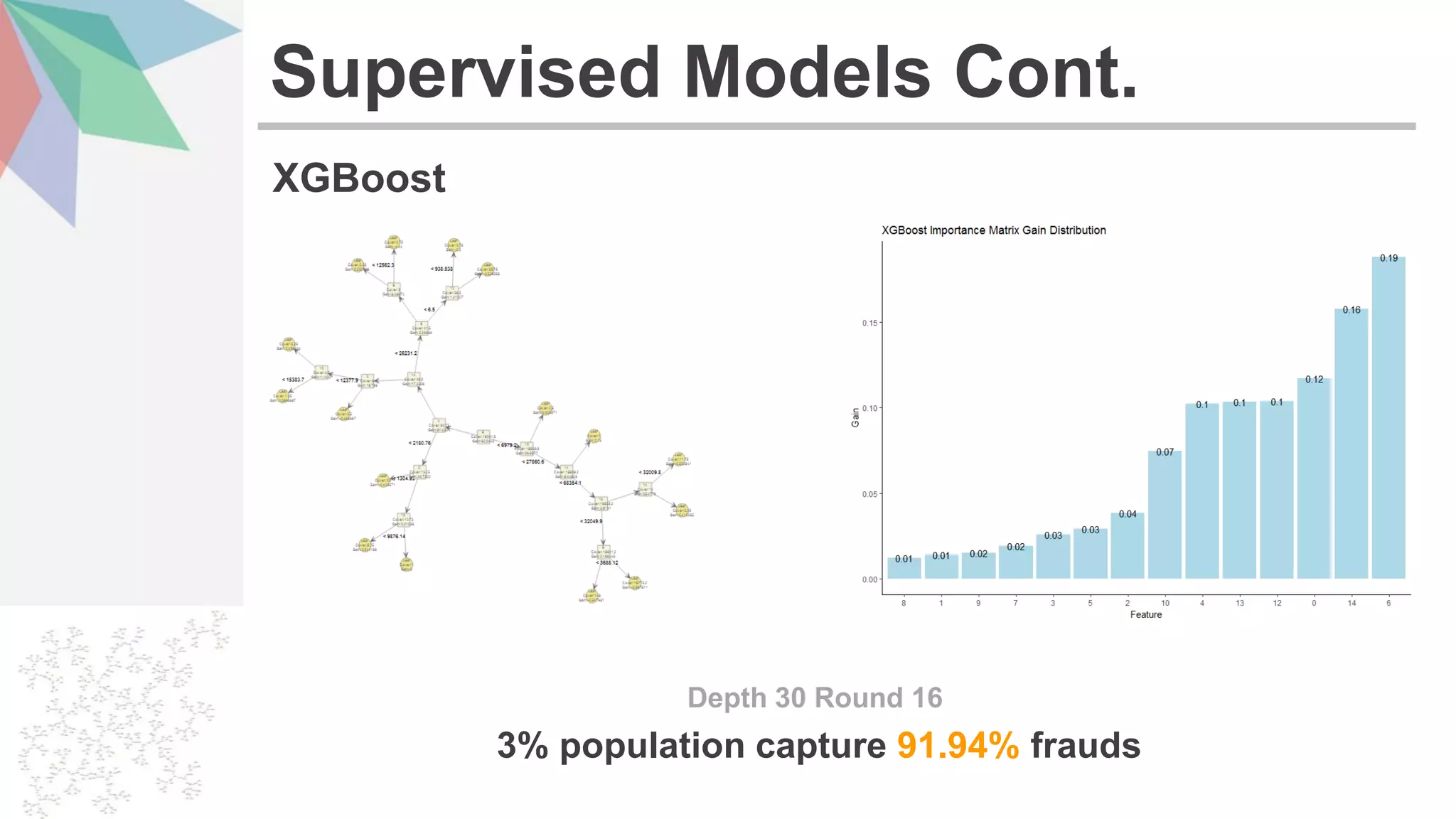

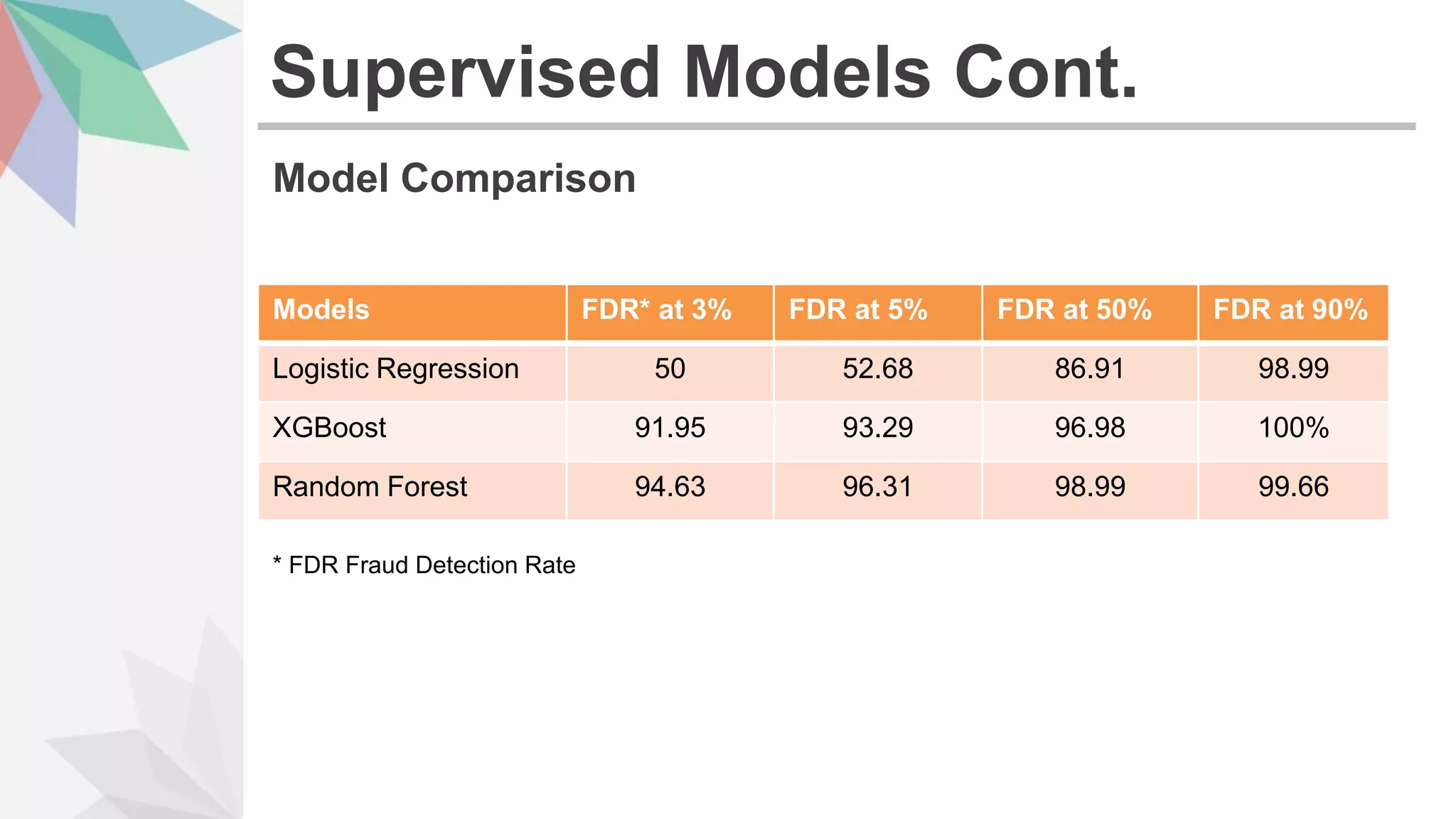

The document details a credit card payment fraud detection project from USC's Marshall School of Business, focusing on building supervised models to predict potential fraud transactions from a dataset of 95,007 records. It explores data patterns, feature selection, and various models, including logistic regression, XGBoost, and random forest, with performance metrics indicating high effectiveness in capturing fraud. The final analysis emphasizes the maximum return on investment achieved through effective fraud detection strategies.