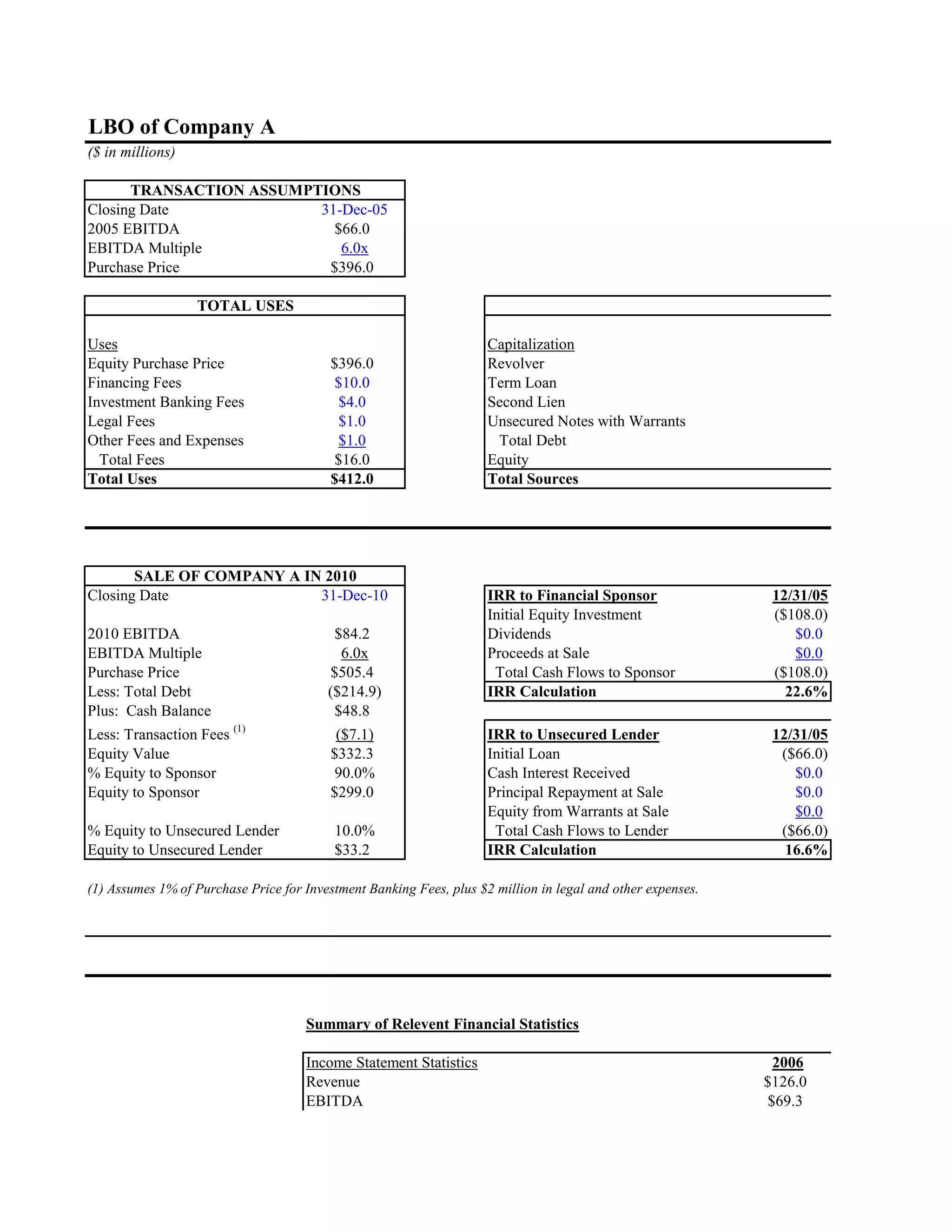

The document summarizes the leveraged buyout of Company A that occurred in 2005 and its subsequent sale in 2010. In 2005, the private equity firm acquired Company A for $396 million by contributing $108 million in equity and obtaining $304 million in debt financing. By 2010, the company's value had increased substantially and was sold for proceeds of $299 million to the private equity firm and $33.2 million to the unsecured lender, providing annualized returns of 22.6% and 16.6%, respectively.