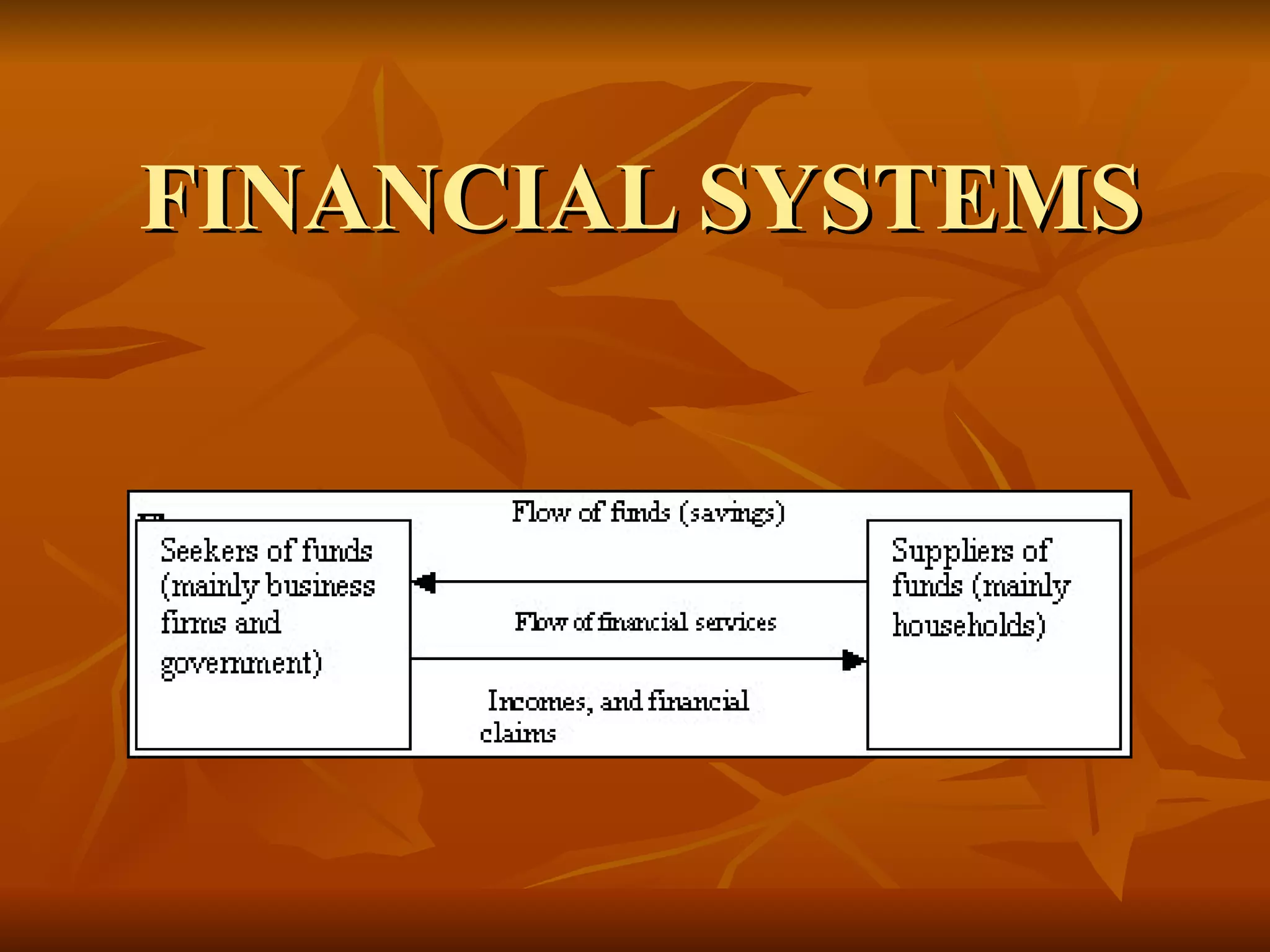

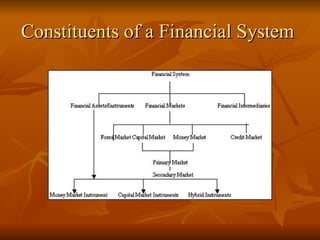

The document discusses the key constituents of a financial system in India including money markets and capital markets. The money market is for low-risk, short-term instruments up to one year and is regulated by the Reserve Bank of India. The capital market finances long-term investments over one year and is regulated by the Securities and Exchange Board of India. It includes equity, debt, and hybrid instruments traded on primary and secondary markets. The government securities market and industrial securities market make up the capital markets.

![Capital Market Capital Market - The capital market is designed to finance the long-term investments . The transactions taking place in this market will be for periods over a year. Securities Exchange Board of India (SEBI) [ www.sebi.gov.in ] regulates capital market](https://image.slidesharecdn.com/financialsystems-090721112053-phpapp02/85/Financial-Systems-on-17th-July-09-5-320.jpg)