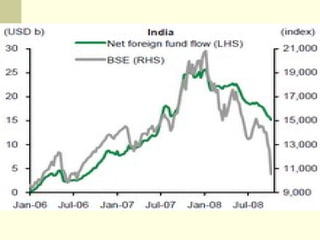

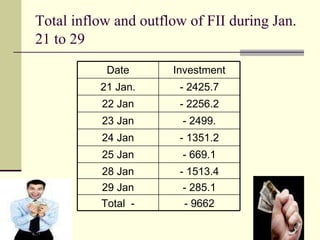

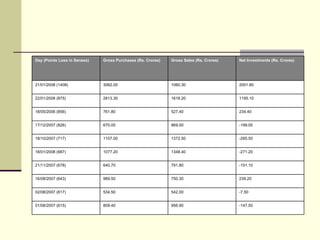

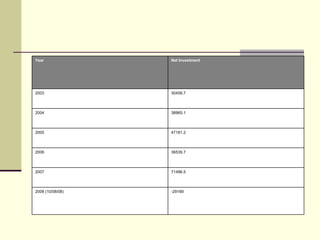

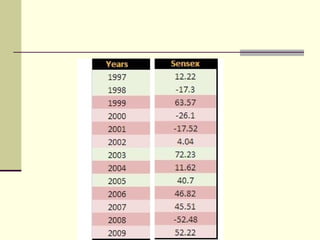

FIIs and DIIs have significantly impacted the Indian stock market. FIIs first began investing in India in 1992 and there are now over 1500 registered FIIs. FIIs bring foreign capital into India which increases stock prices and improves liquidity, but they also introduce more volatility as they frequently move large investments in and out of the country based on short-term prospects. Their outflows have been a major factor in several crashes of the Indian stock market.