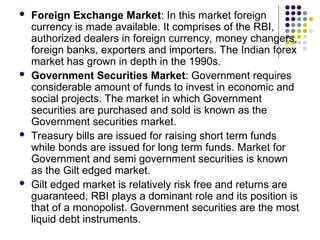

The financial system of a country includes various institutions, instruments, and services that facilitate the mobilization of savings for investment in productive assets. It encompasses both capital and money markets, which involve long-term and short-term lending and borrowing respectively, and includes entities such as banks, financial institutions, and markets for securities and currencies. Additionally, financial services like mutual funds, venture capital, and merchant banking play a key role in supporting economic activities and investment opportunities.