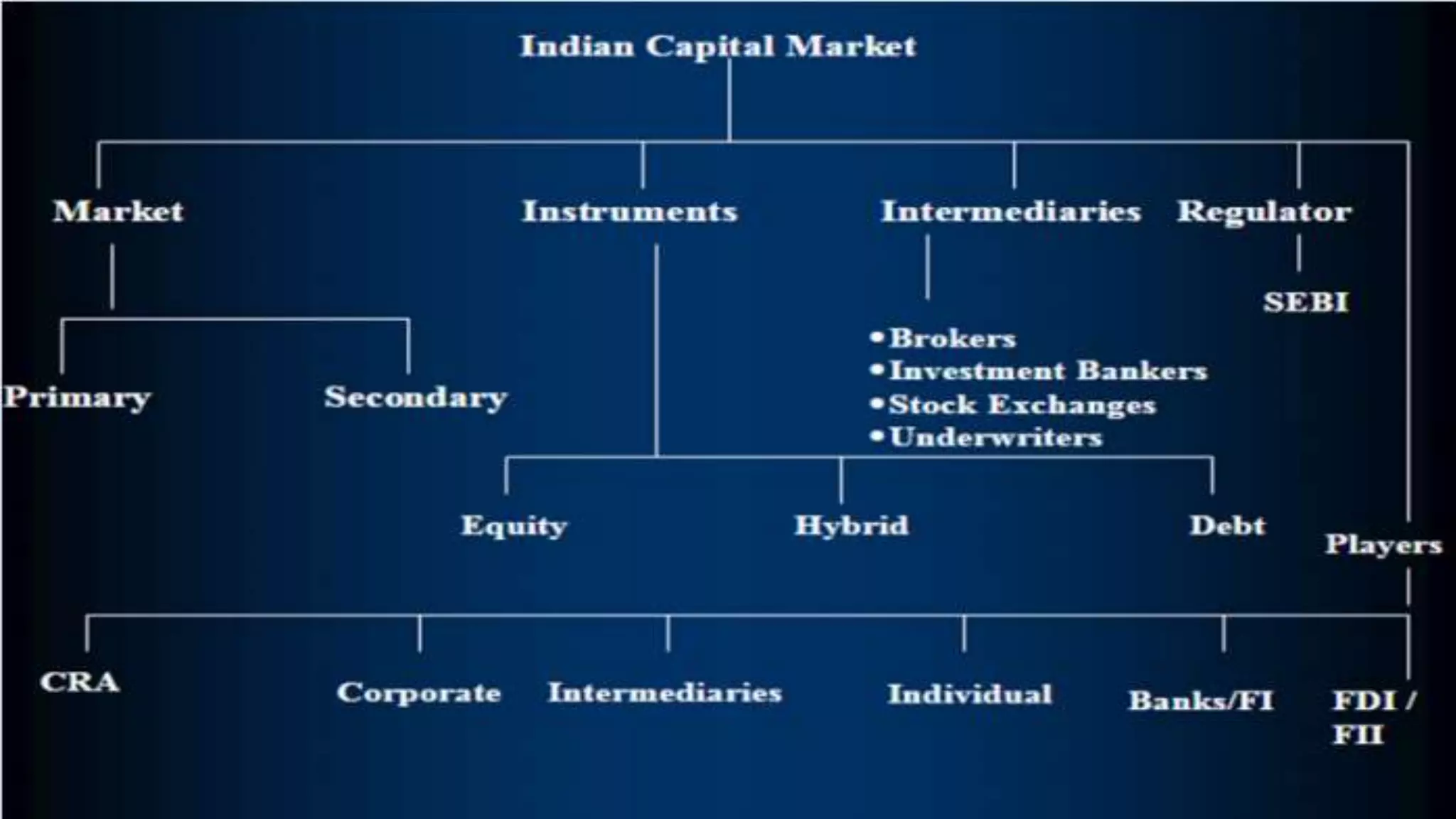

The document provides an overview of capital market instruments and the capital market in India. It discusses that the capital market consists of the money market and debt market. The money market deals in short term instruments like treasury bills and commercial paper, while the capital market deals in long term instruments like shares and debentures. The capital market has a primary market where new securities are issued and a secondary market which is the stock exchange where existing securities are traded. Key regulatory bodies for the Indian capital market are SEBI and RBI. The capital market helps raise long term funds for businesses and the government while providing investment opportunities.