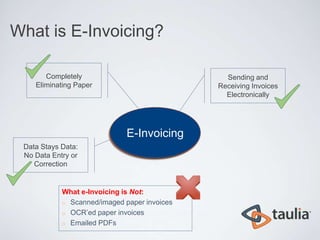

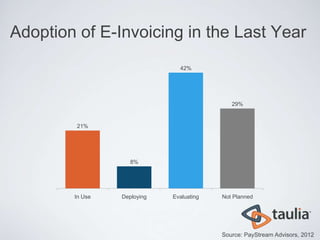

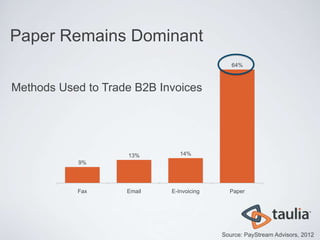

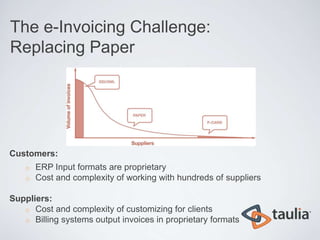

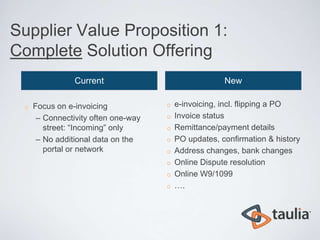

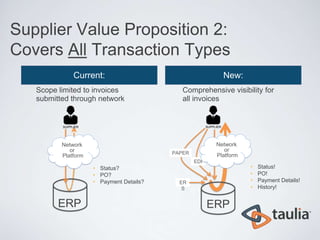

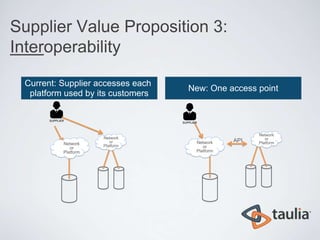

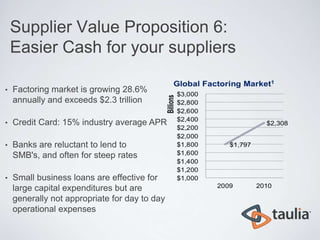

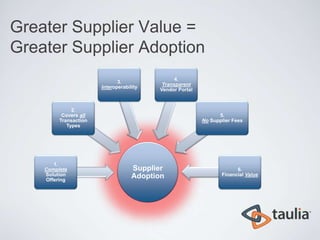

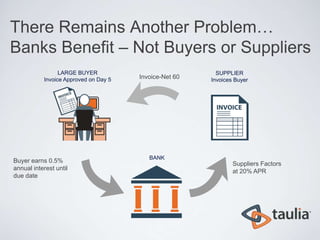

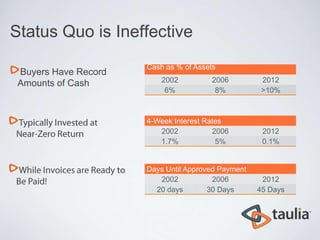

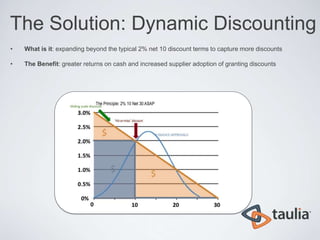

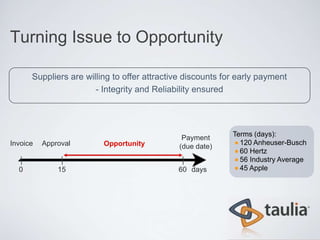

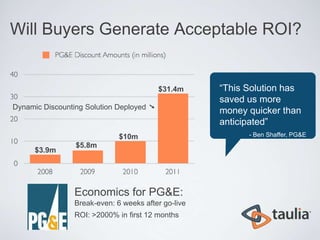

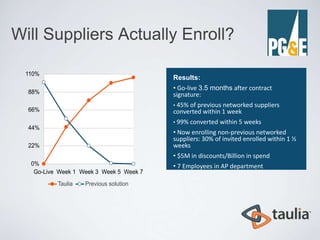

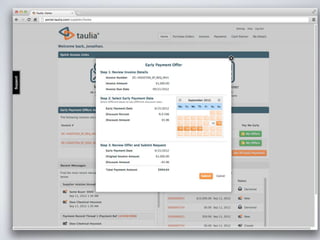

This document summarizes a presentation about advancing e-invoicing. It discusses how e-invoicing can eliminate paper, errors and calls by achieving high supplier adoption. Supplier adoption is driven by offering value like a complete solution, covering all transaction types, interoperability, transparency, no supplier fees and financial benefits like dynamic discounting. Dynamic discounting allows buyers to pay early and save money while suppliers access cheaper financing. Case studies show dynamic discounting solutions generating high ROI for buyers through significant cost savings and high supplier enrollment rates. The vision is for buyers to have free e-invoicing and visibility while suppliers benefit at no cost, creating a win-win through increased profits and better relationships.