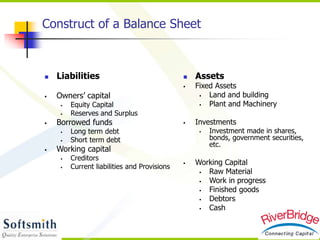

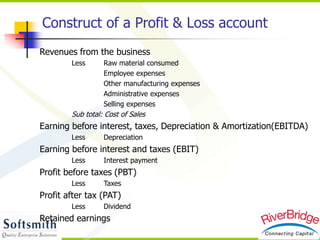

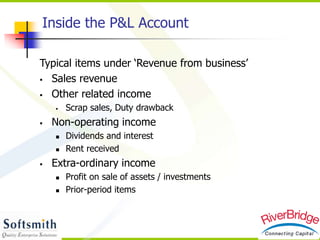

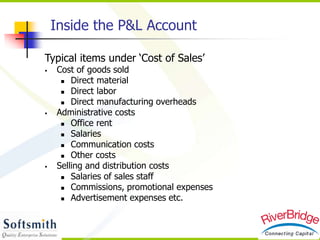

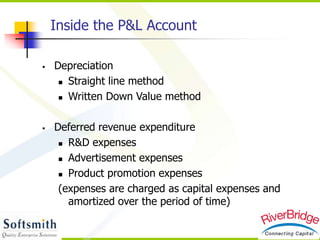

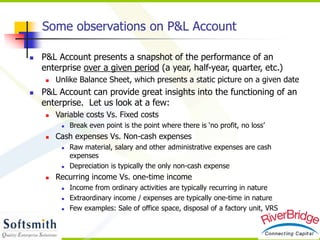

Financial statements report the financial state of companies and include a balance sheet, profit and loss statement, and cash flow statement. The balance sheet outlines a company's assets and liabilities, showing what it owns and owes. The profit and loss statement shows revenues, expenses, and profits over a period of time. Both public and some private companies must file financial statements with regulatory agencies and make them publicly available.