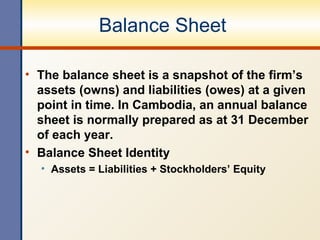

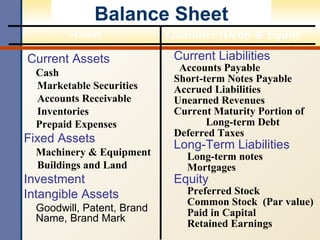

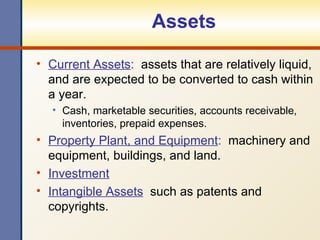

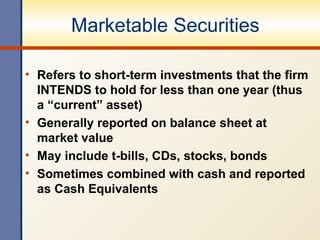

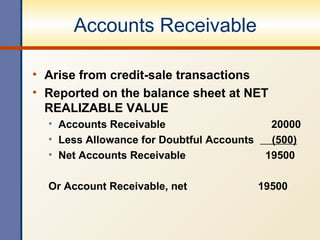

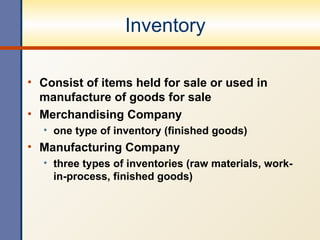

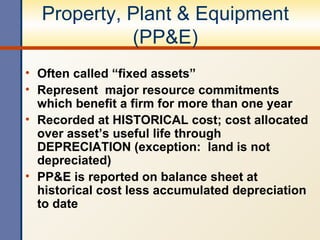

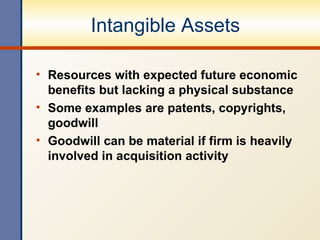

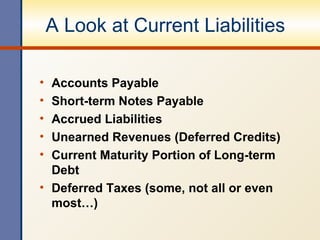

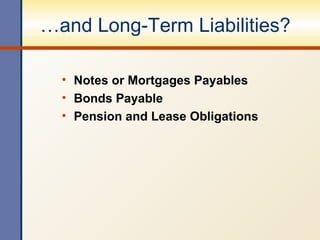

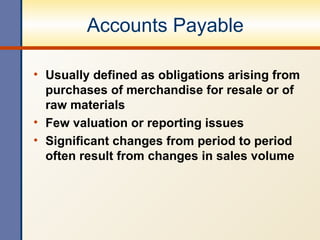

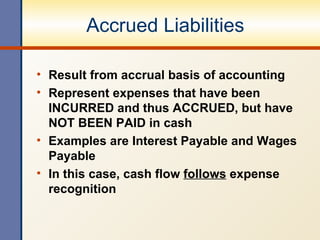

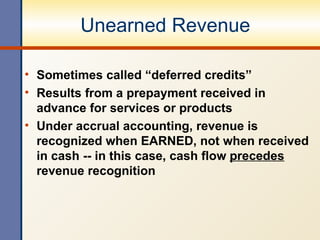

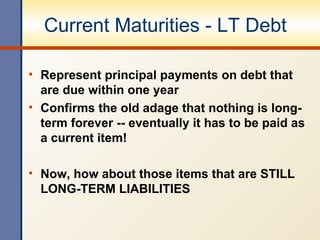

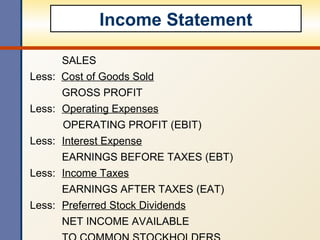

The document provides an overview of key financial statements including the balance sheet, income statement, and statement of cash flows. It explains the purpose and components of each statement. The balance sheet presents assets, liabilities, and equity of a company at a point in time. It lists current assets like cash, receivables, and inventory as well as long-term assets. Liabilities include current obligations and long-term debt. Equity encompasses share capital and retained earnings. The income statement displays revenues and expenses over a period of time to arrive at net income. It is used to analyze a company's profitability.