The document discusses key aspects of process costing, including:

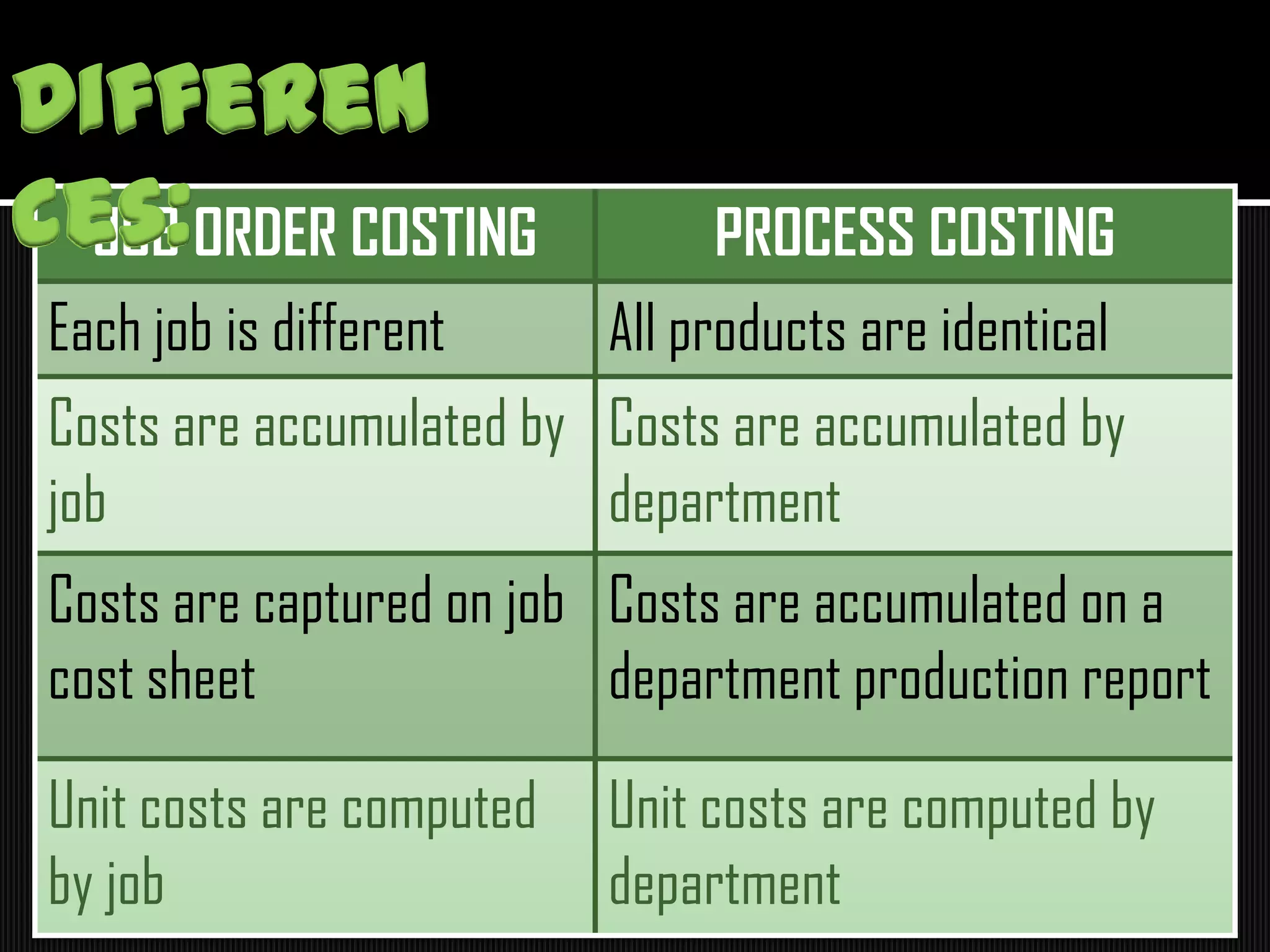

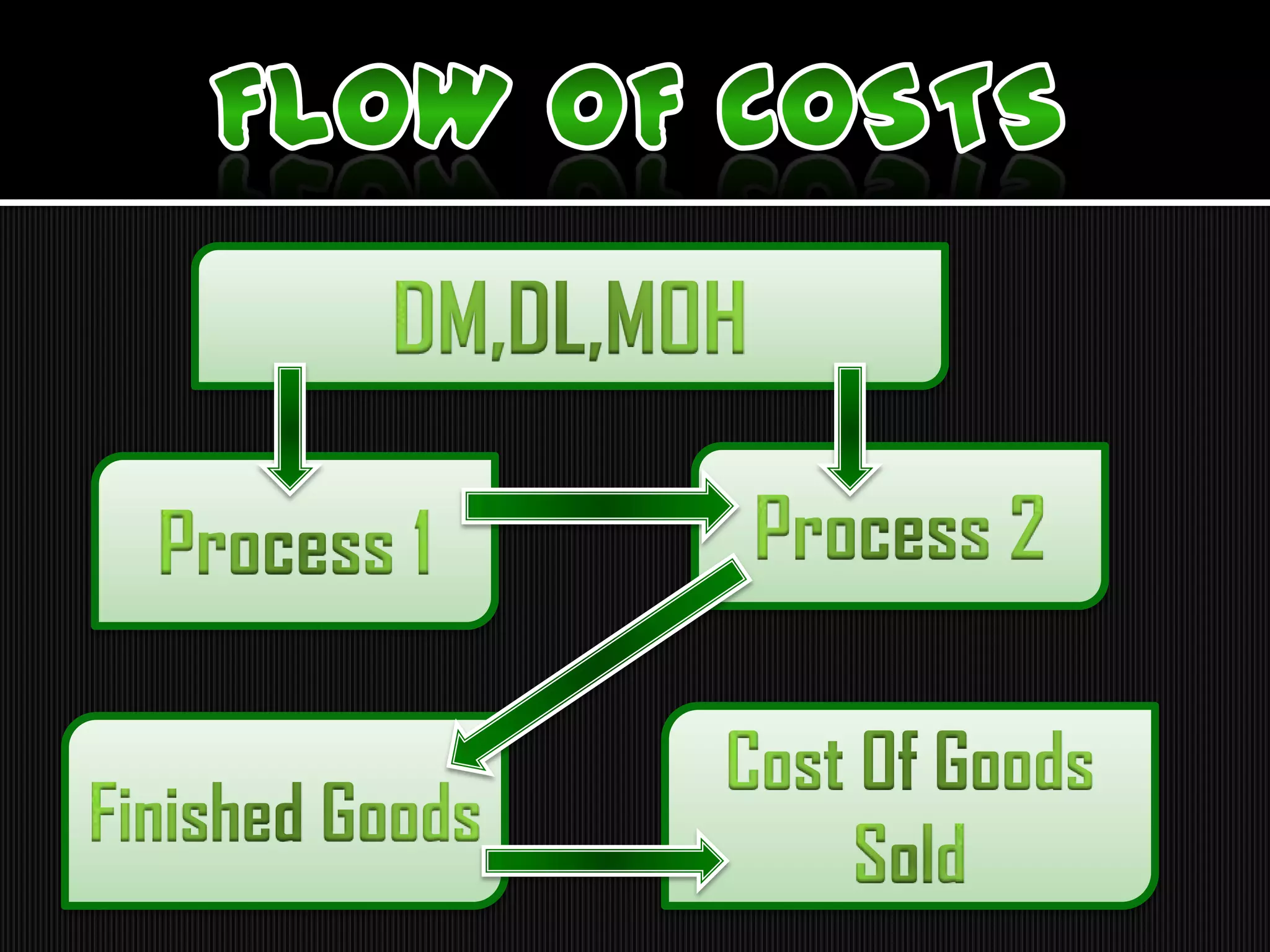

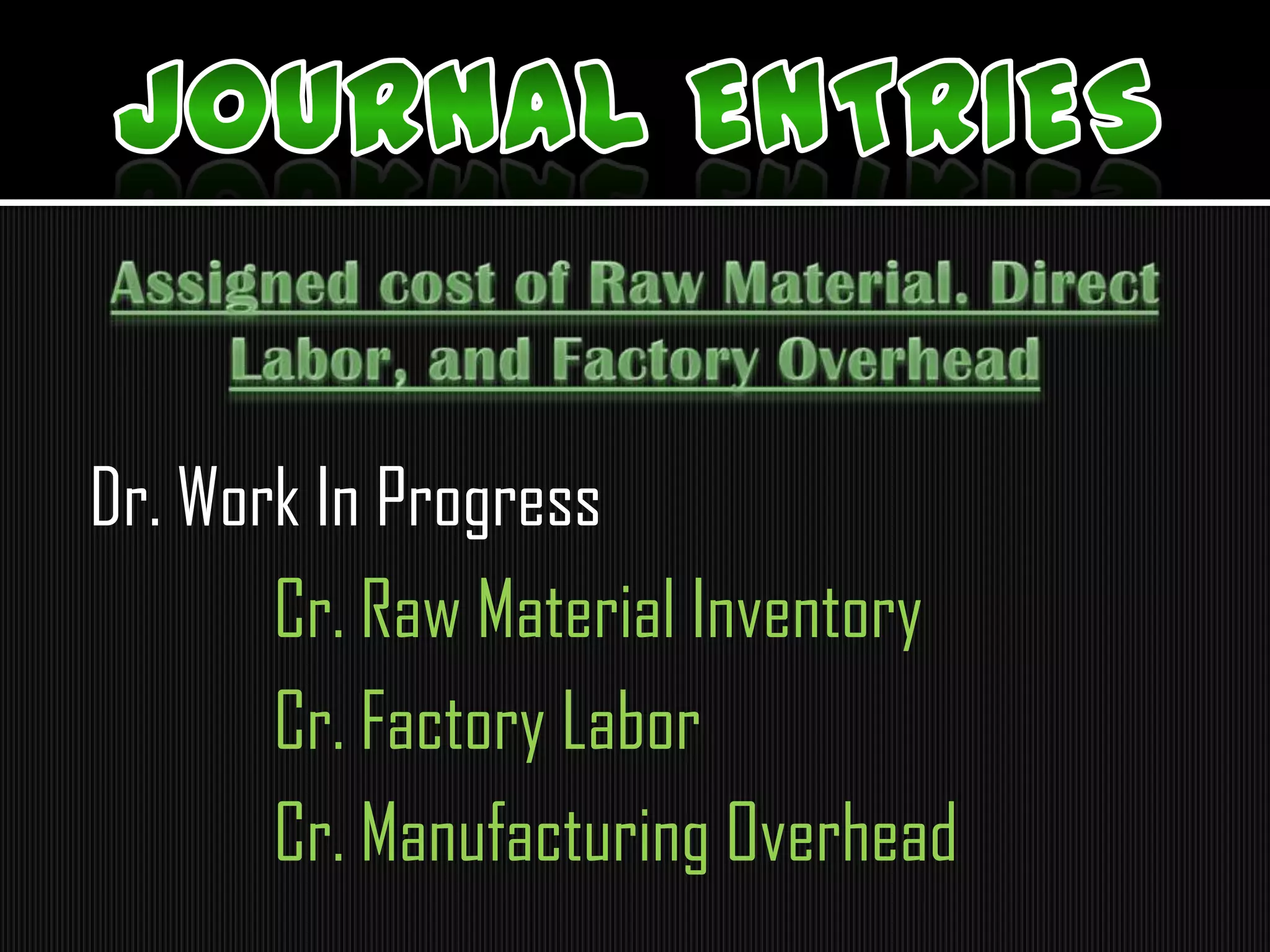

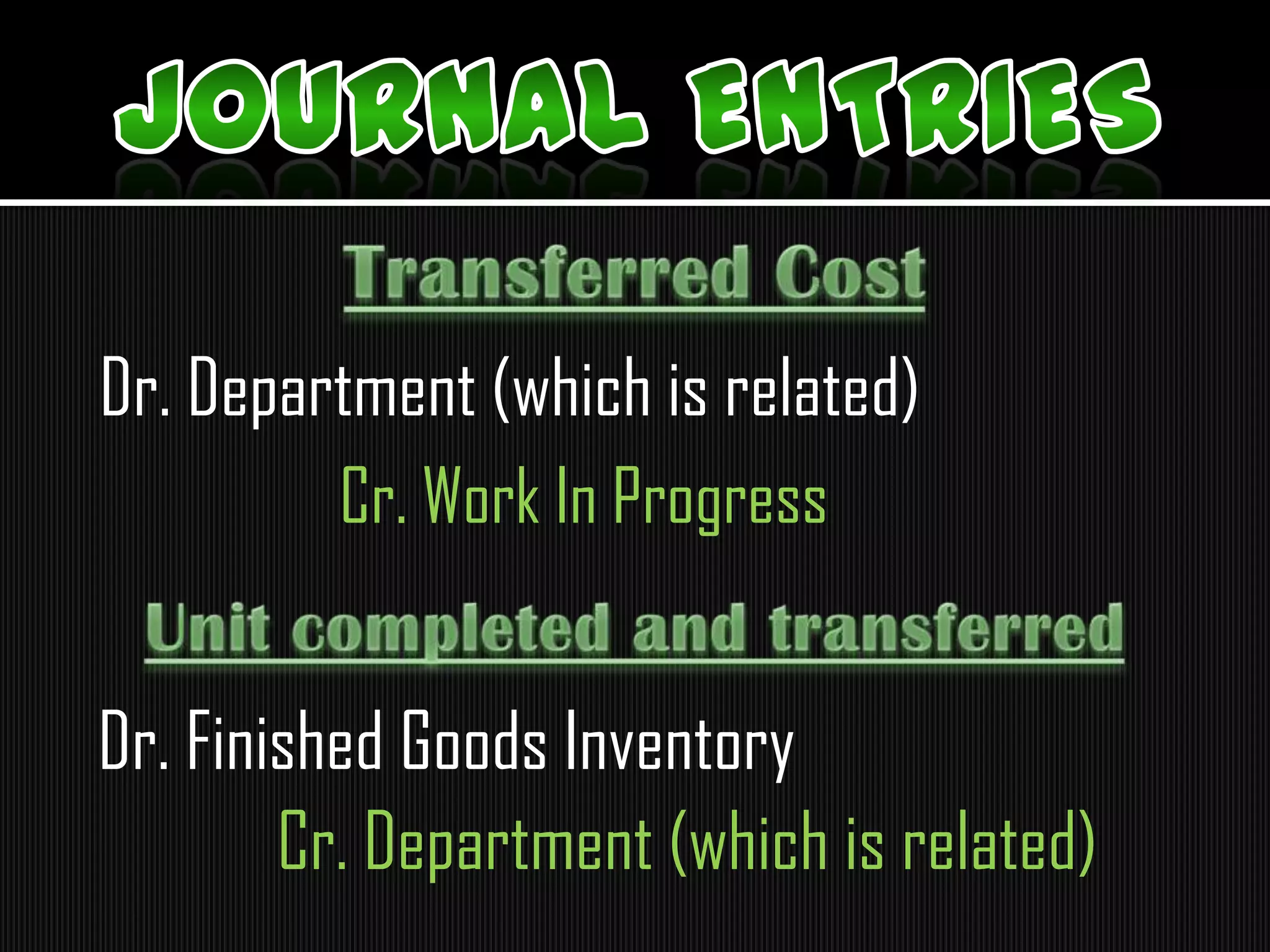

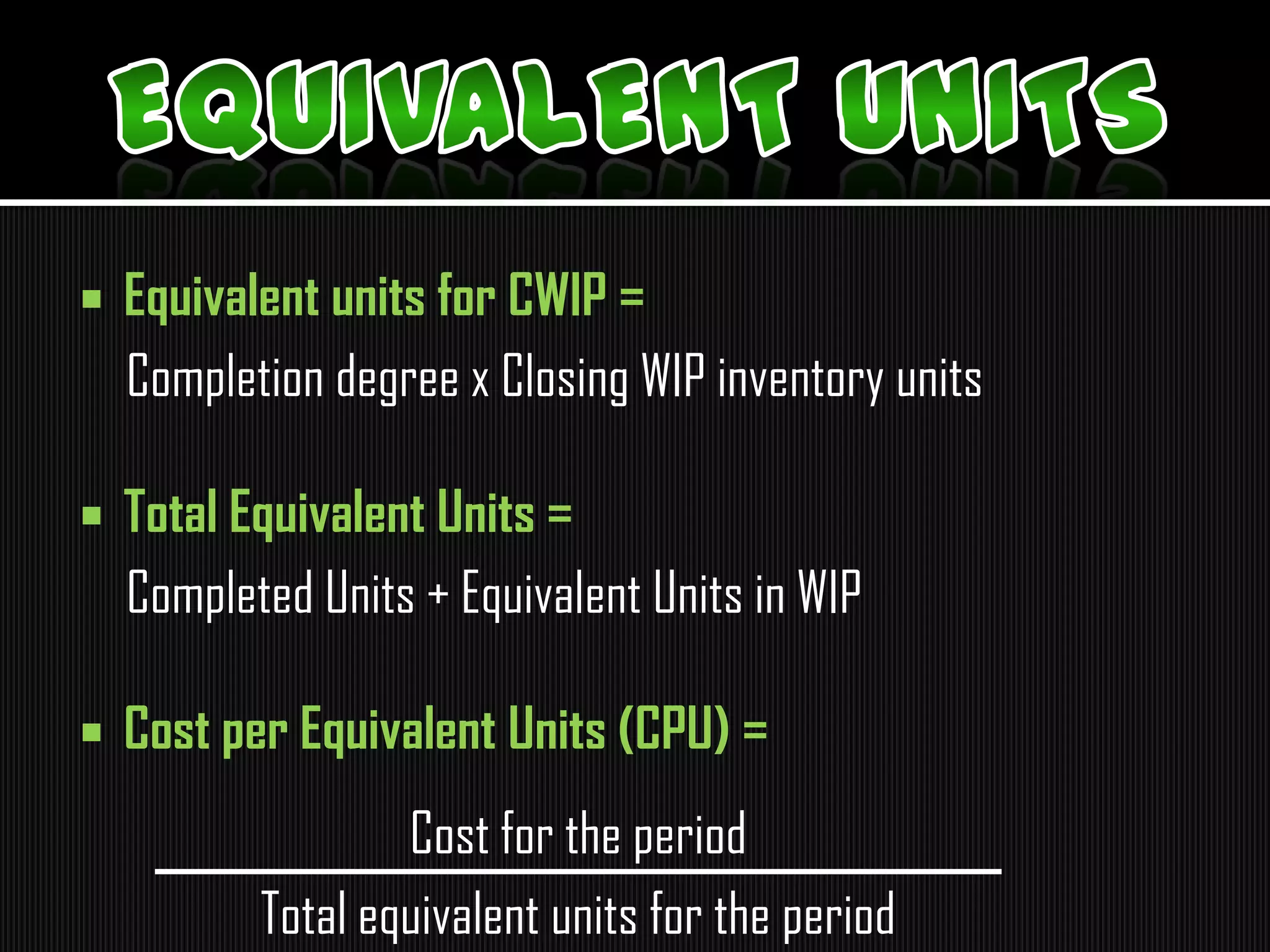

- Process costing is used when identical products are produced continuously through multiple stages. Costs are accumulated by department rather than by individual job.

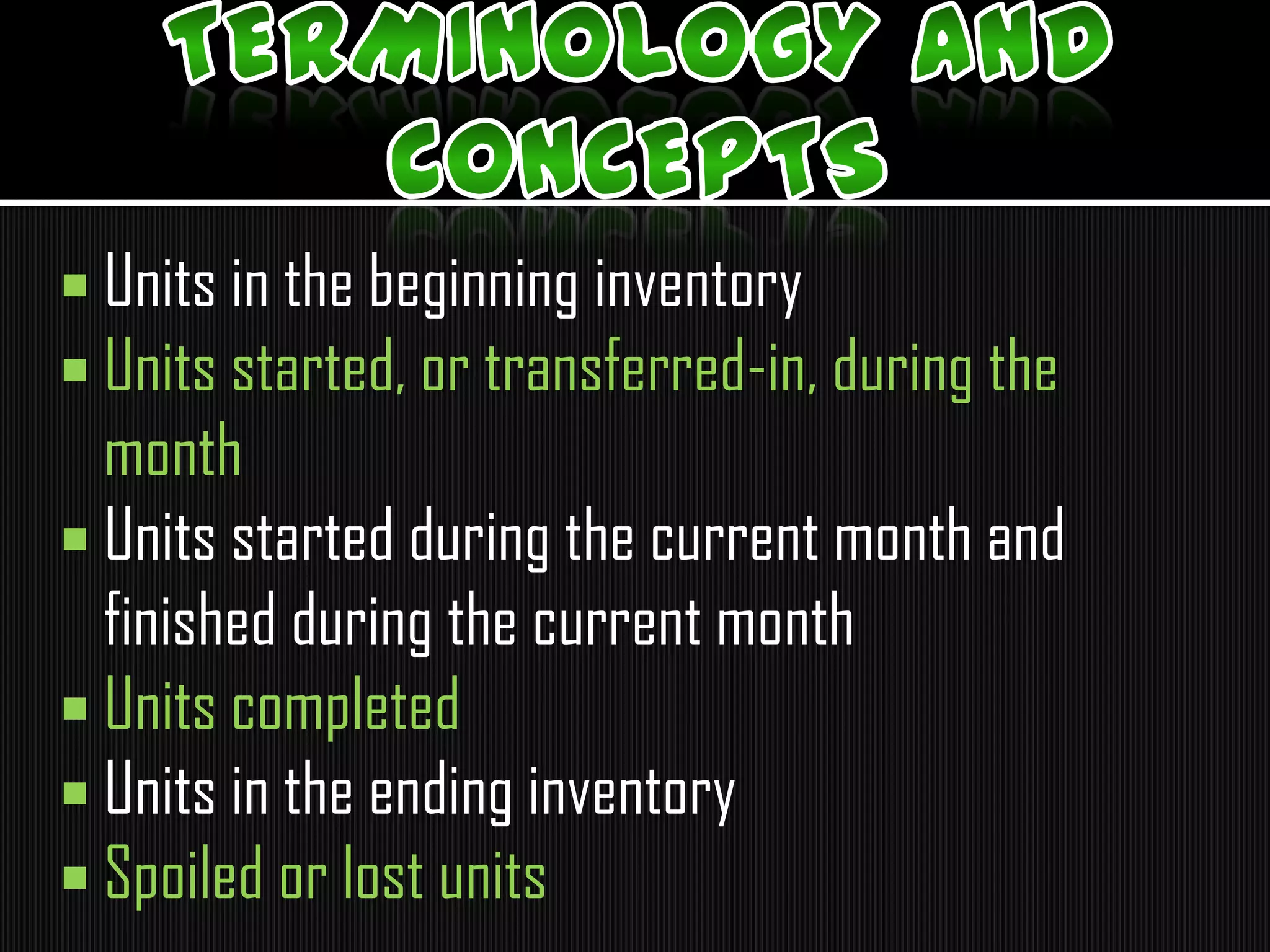

- Units are tracked as they move through each department/process, including beginning inventory, units started/transferred, finished, and ending inventory.

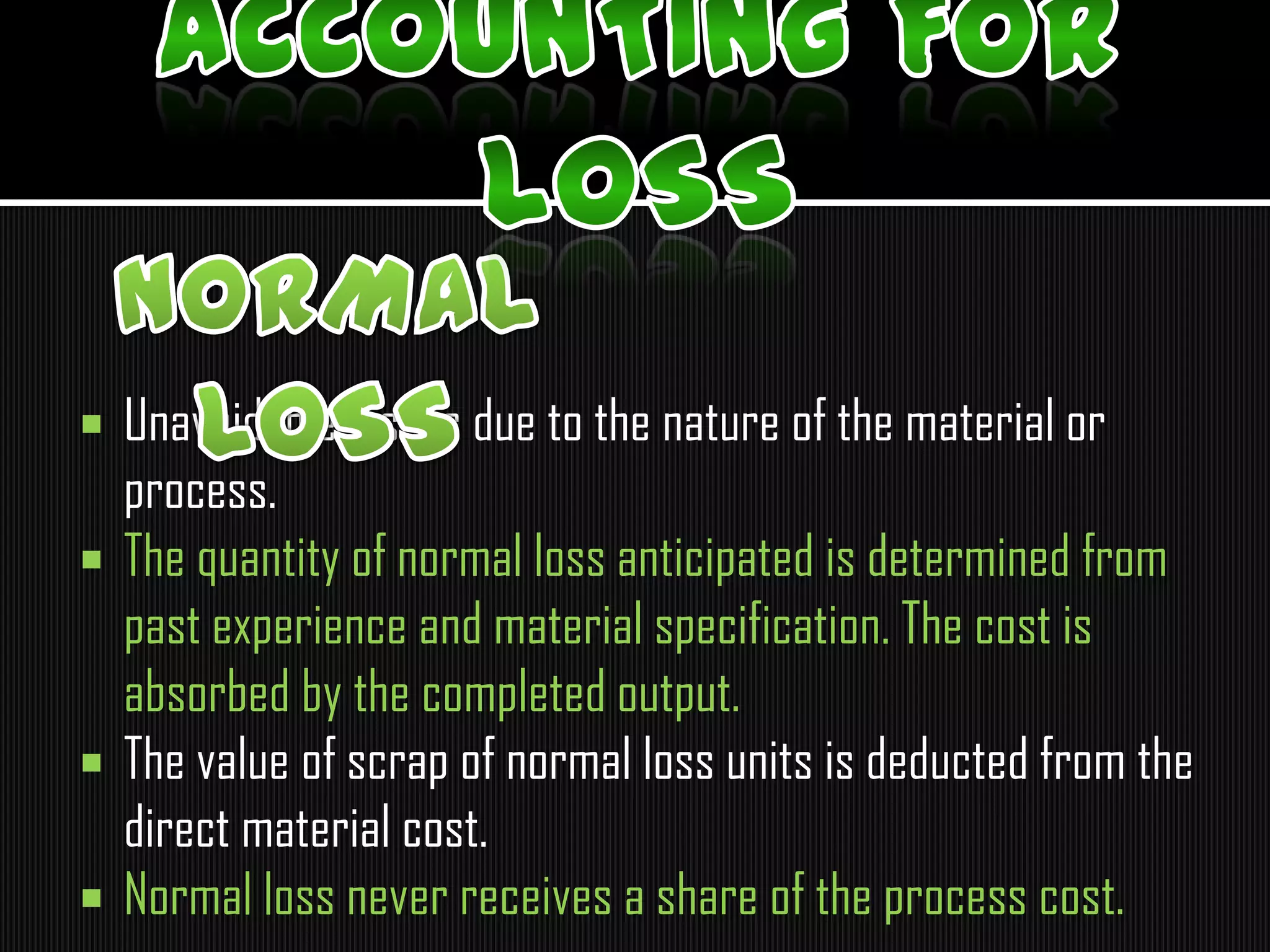

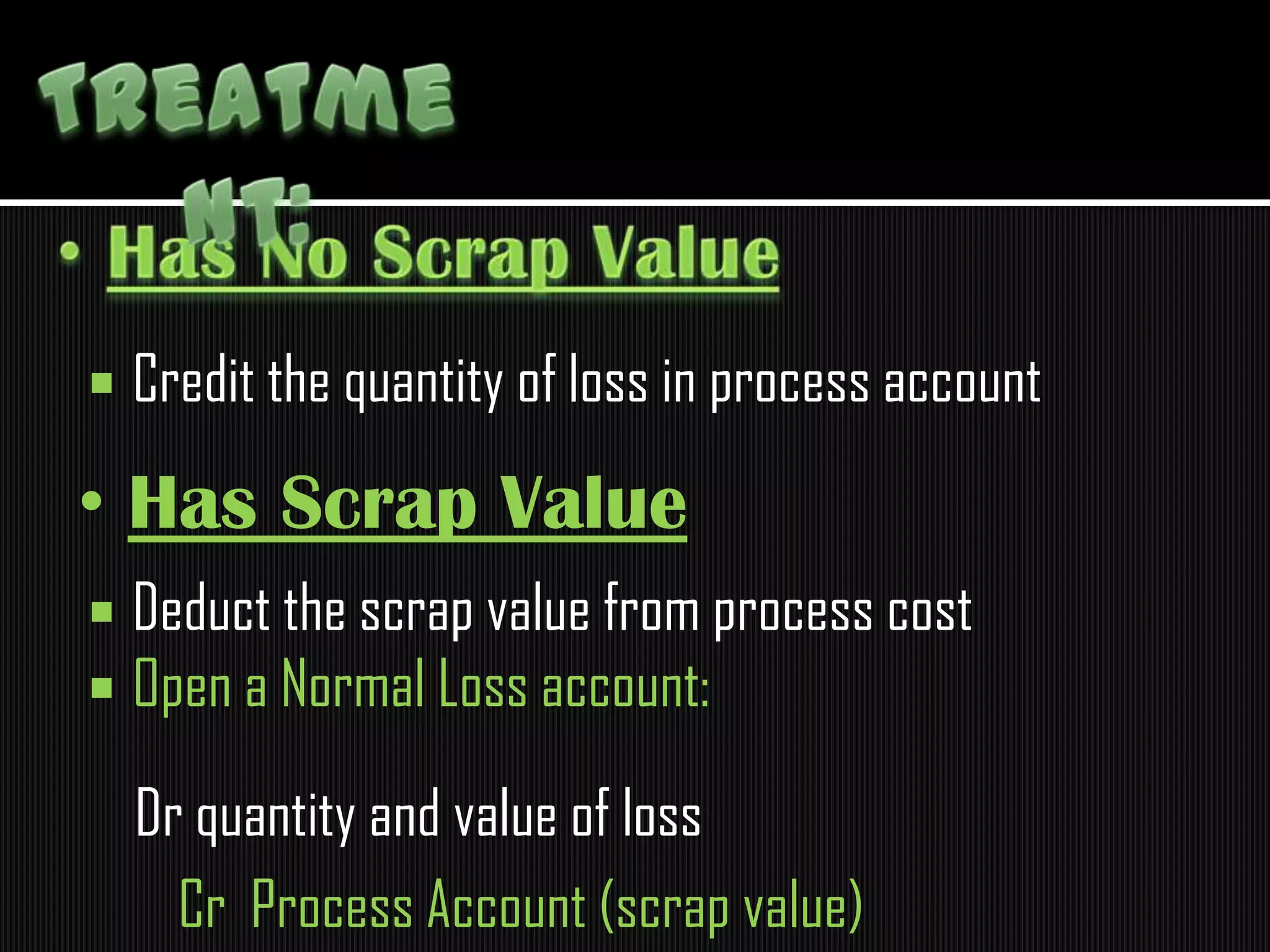

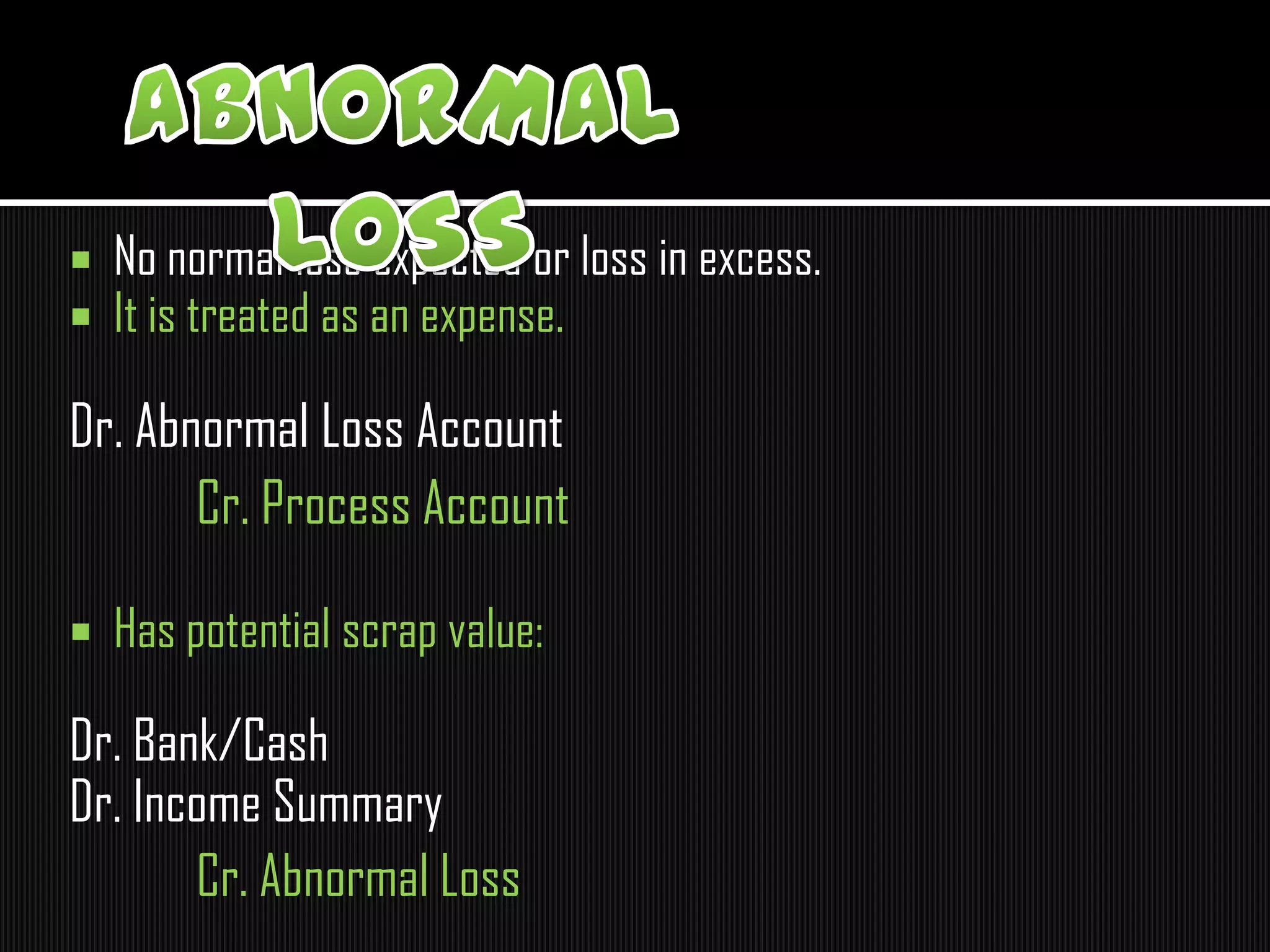

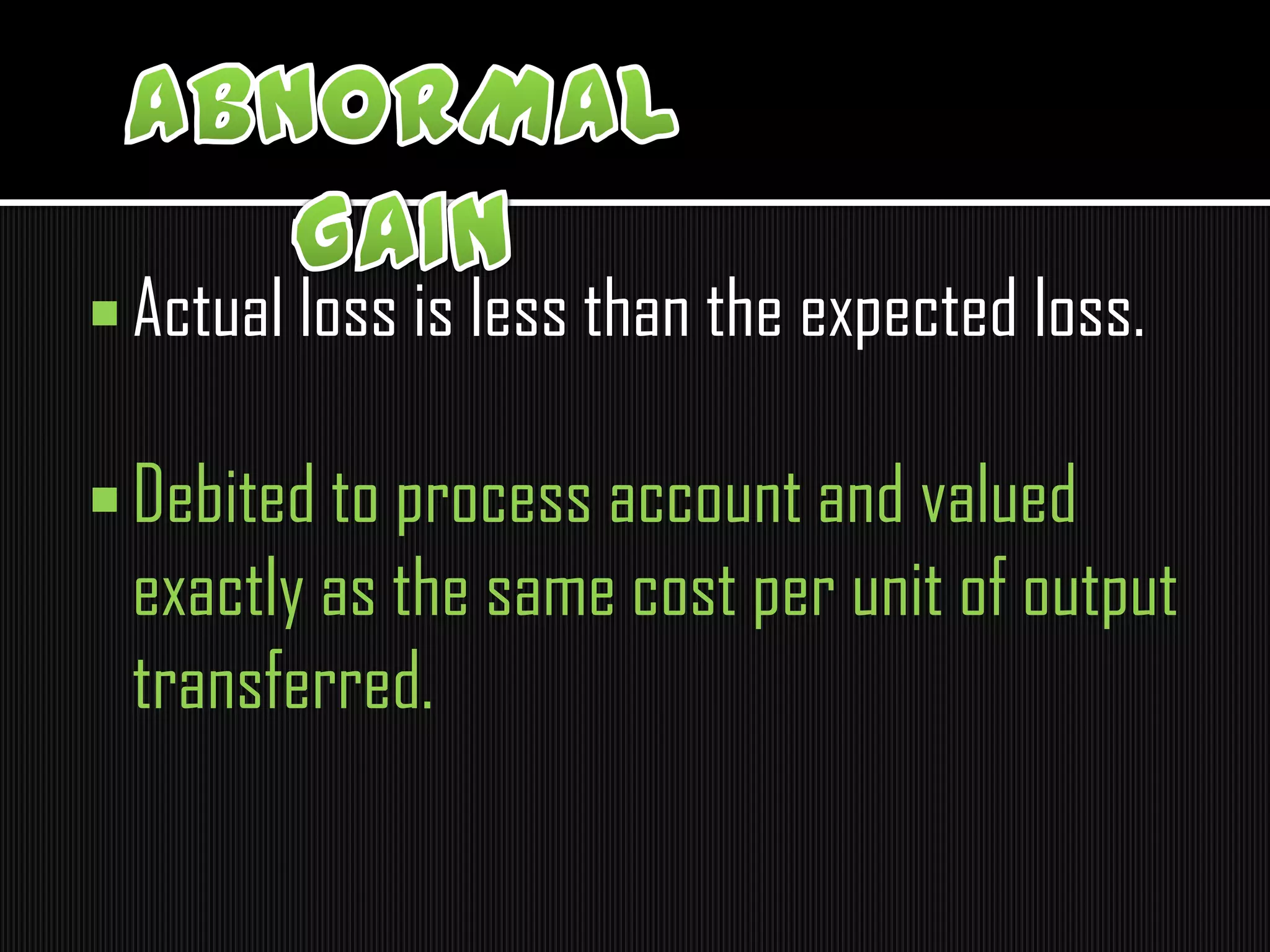

- Normal losses that occur due to the production process are estimated and their costs are absorbed into finished units, while abnormal losses are treated as expenses.