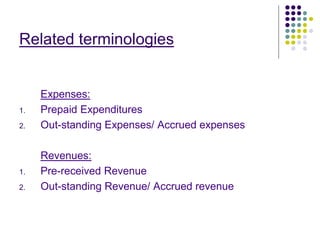

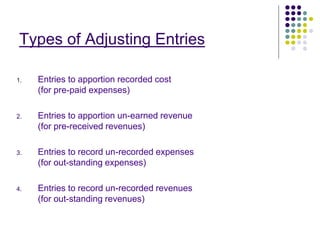

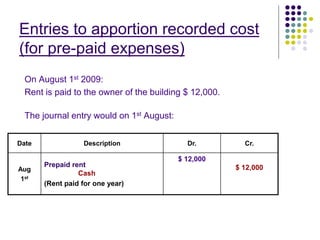

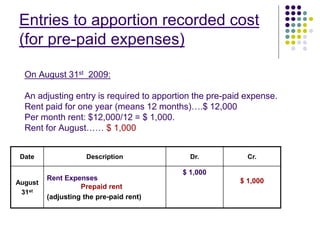

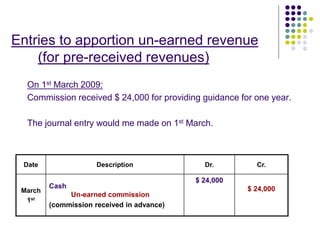

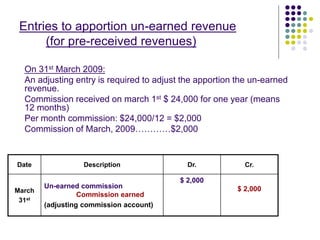

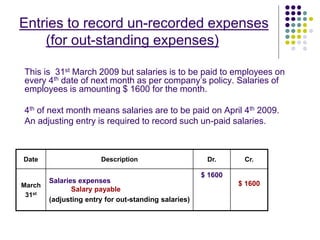

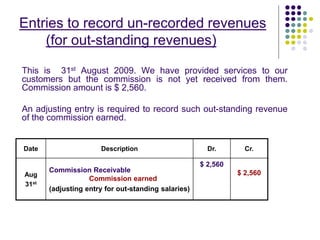

Adjusting entries are required at the end of each accounting period to account for transactions that affect more than one period. This includes prepaid expenses that are recorded as assets and amortized over multiple periods, accrued expenses that are recorded as liabilities, unearned revenue that is initially recorded as a liability and recognized over multiple periods, and accrued revenue that is initially recorded as an asset. Examples of adjusting entries provided include entries to allocate prepaid rent over a year, recognize accrued salaries, and record accrued commission revenue.