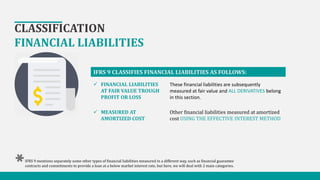

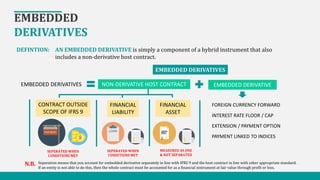

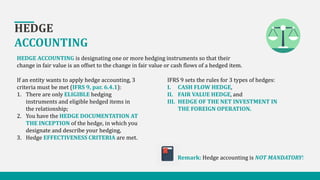

This document provides an overview of IFRS 9: Financial Instruments. IFRS 9 addresses the classification and measurement of financial instruments, impairment of financial assets, and hedge accounting. The key topics covered in IFRS 9 include recognition and derecognition of financial instruments, classification of financial assets and liabilities, measurement of financial instruments, impairment of financial assets, embedded derivatives, and hedge accounting. IFRS 9 establishes principles for the financial reporting of financial assets and financial liabilities.