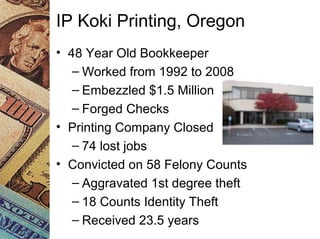

This document discusses common employee fraud schemes like embezzlement, provides examples of fraud cases, and outlines the fraud triangle of opportunity, pressure, and rationalization that can lead employees to commit fraud. It then details specific fraud methods like skimming cash receipts, payroll and billing schemes, check tampering, and expense reimbursement fraud. The document recommends internal controls, accounting software controls, reconciliation practices, and analytical procedures to help prevent and detect occupational fraud. It also discusses investigating potential fraud and the services of fraud prevention expert Dennis Thompson.