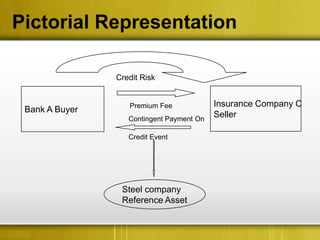

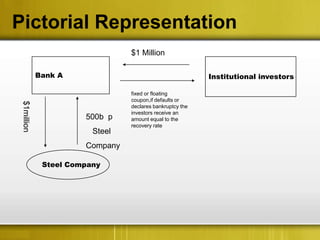

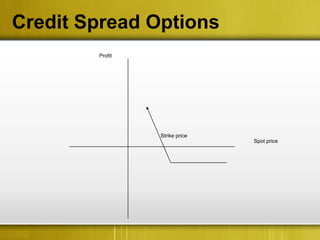

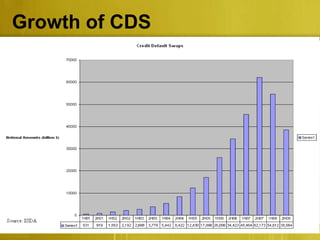

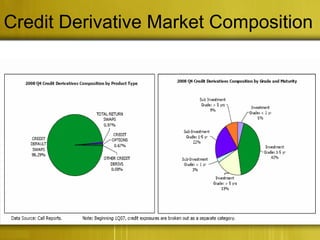

The document discusses credit derivatives and the credit derivatives market in India. It provides information on different types of credit derivatives including credit default swaps (CDS), credit linked notes (CLN), and credit spread options (CSO). It then discusses the growth of the CDS market globally and the composition of the credit derivatives market. It outlines the benefits of credit derivatives for banks and other financial institutions in India. Finally, it discusses the role of the Clearing Corporation of India in facilitating CDS trading and settlement and provides details on the first CDS trades in India in 2011.