Credit default swaps (CDS) are contracts that transfer credit risk from one party to another. A CDS controls credit risk, while an interest rate swap controls interest rate risk. If a reference entity experiences a credit event like default, the protection seller compensates the buyer. Restructuring is a controversial credit event because it can trigger a payout even for routine debt restructurings. A CDS has an option-like payoff because payment depends on a credit event occurring. For asset-backed securities, the focus is on cash flow adequacy rather than bankruptcy. Physical settlement of a CDS involves delivery of the reference obligation, while cash settlement involves a payment equal to the price difference.

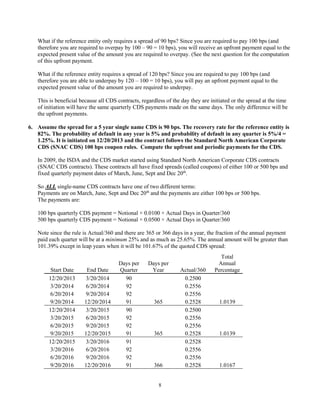

![9

What if, given the default risk and recovery rate of the reference entity, you should only be paying 90 bps but

are forced by the SNAC standardized contract to pay 100 bps?

Then you receive a cash payment at the initiation of the contract for the present value of each of the 100 – 90

= 10 bps overpayments.

Consider a 5 year CDS on $100,000,000 notional amount initiated on December 20, 2013.

There are 4 x 5 = 20 quarterly payments. Each payment is approximately equal to (ignoring the Actual/360

rule and just multiplying by ¼):

Quarterly CDS payment = $100,000,000 × 0.0100 × ¼ = $250,000

But since the spread is 90 bps, you should only be paying:

Quarterly CDS payment = $100,000,000 × 0.0090 × ¼ = $225,000

So the standardized contract requires you to overpay $250,000 - $225,000 = $25,000 per quarter for 20

quarters.

Therefore, you will receive at the initiation of the contract, the present value of 20 quarterly payments of

$25,000 discounted at LIBOR (assume LIBOR 2.00% APR so 0.50% per quarter).

But it’s not so simple. There is a chance (if the reference entity defaults) that you will not have to make the

next payment of 100 bps (and therefore NOT pay the extra 10 bps x $100,000,000 x ¼ = $25,000).

So how likely is it that the CDS will still be in force when a payment time comes?

Consider the first year (4 payments) and assume the default probability is 5% is any year to .05/4 = 1.25%

quarter.

There is a 100% - 1.25% = 98.75% chance of making it to the first payment.

There is a (0.9875)2

= 97.52% chance of making it to the second payment.

There is a (0.9875)3

= 96.30% chance of making it to the third payment.

There is a (0.9875)4

= 95.09% chance of making it to the fourth payment.

Let: qP = probability of default in any period = q/4 = 5%/4 = 1.25%

(1 – qP) = probability of not default in any period = 98.75%

Qt = (1 – qP)t

= Prob of making it to time t (and therefore making the CDS payment) = 0.9875t

r = periodic LIBOR = 2.00%/4 = 0.50%

The expected excess payment in any period = Qt × (100 – 90)/4 = Qt × 2.50

The PV of that excess payment = Qt × 2.50/(1 + r)t

The present value of all the excess payments you have to make over the life of the swap given that you are

forced by the SNAC CDS to pay 100 bps when you should only pay 90 is:

PV = Q1[(100 – 90)/4]/(1 + r) + Q2[(100 – 90)/4]/(1 + r)2

+ … + Q20[(100 – 90)/4]/(1 + r)20

= 0.9875 x 2.50/(1.0050) + .9752 x 2.50/(1.0050)2

+ … + 0.7776[(100 – 90)/4]/(1.0050)20

= 41.7919 bps

So on $100,000,000 notional amount with a spread of 90 bps, but 100 BPS SNAC coupon,

You would make quarterly payments of 0.0100/4 × $100,000,000 = $250,000 to the protection seller.

But since you should only be making payments of $225,000 to the protection seller, the protection seller will](https://image.slidesharecdn.com/creditref-questionsans-230802145635-8f48b283/85/credit-ref-questions-ans-docx-9-320.jpg)