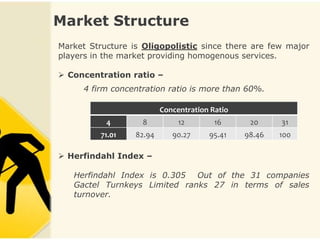

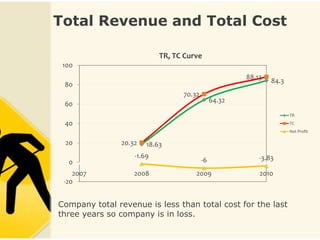

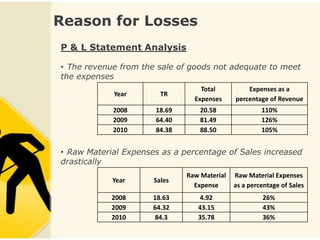

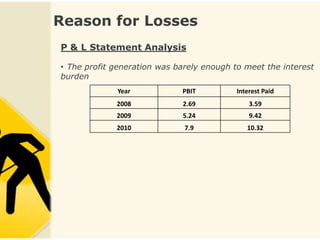

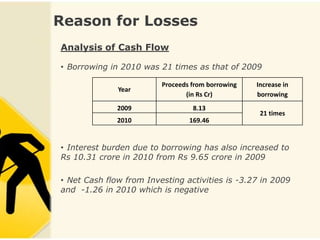

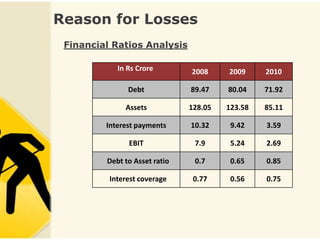

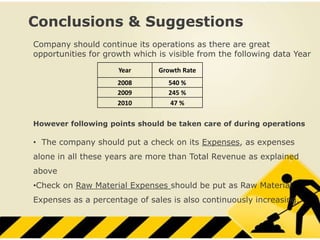

Gactel Turnkey Projects Limited is an Indian company that provides cooling towers and systems. It has experienced losses for the past three years due to total revenue being less than total costs. Expenses as a percentage of revenue and raw material expenses as a percentage of sales have increased significantly. The company also struggles with generating positive cash flow regularly and a high debt burden that exceeds assets. To improve performance, the company needs to reduce expenses, control raw material costs and borrowing to reduce interest payments, while pursuing aggressive sales to utilize growth opportunities in the market.