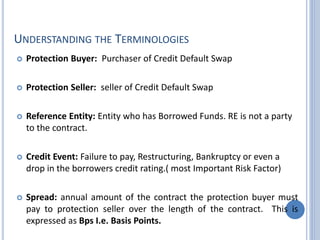

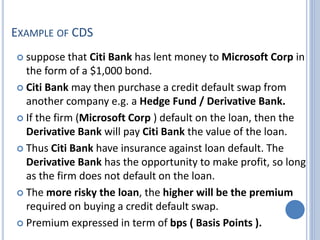

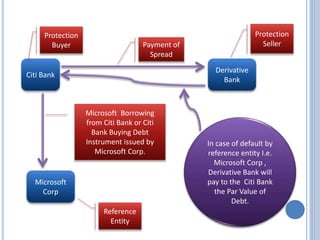

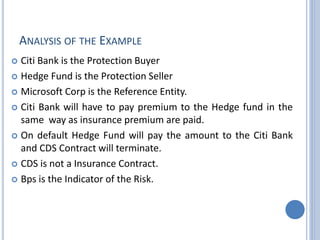

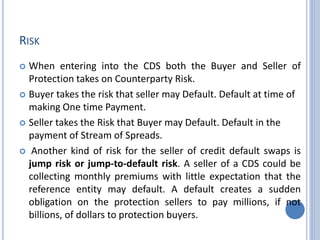

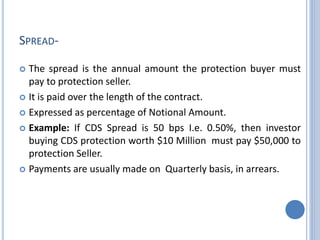

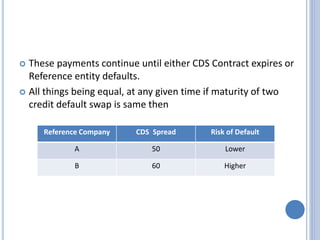

The document provides an overview of credit default swaps (CDS). It defines a CDS as a contract where the protection buyer makes periodic payments to the protection seller in exchange for a payout if a loan defaults. The document outlines the key parties in a CDS deal including the protection buyer, protection seller, and reference entity. It provides an example of how CDS can protect a bank if the company it loaned money to defaults. Overall, the document summarizes what a CDS is, how it works, and some of the risks involved.