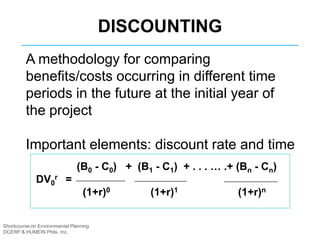

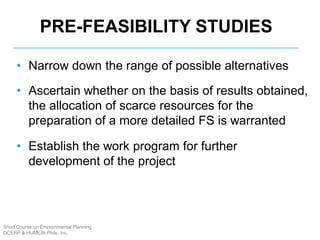

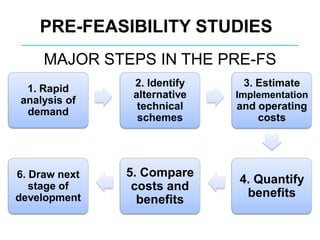

The document discusses various aspects of conducting feasibility analyses for projects. It explains that feasibility studies are done during the project preparation stage to determine if a project can and should be undertaken. The document outlines seven key aspects studied in a feasibility analysis: market, financial, economic, institutional, technical, environmental, and social. It also discusses pre-feasibility studies, measures of project worth like net present value, internal rate of return, and benefit-cost ratio, and factors to consider like discount rates.

![Short Course on Environmental Planning

DCERP & HUMEIN Phils. Inc.

POSSIBLE DECISIONS

AFTER THE PRE-FS [1]

Reject the

project

Defer conduct

of detailed FS

Proceed to detailed

design and

implementation

Conduct a

detailed FS](https://image.slidesharecdn.com/jan20feasibilitystudy-170623024831/85/feasibility-study-6-320.jpg)

![Short Course on Environmental Planning

DCERP & HUMEIN Phils. Inc.

POSSIBLE DECISIONS

AFTER THE PRE-FS [2]

Rejection Analysis should conclusively reveal that none of the

possible project alternatives is feasible, even in the

remote future

Deferment Project can be feasible only if implemented in a

relatively distant future

Detailed

design and

implementatio

n

Economic and technical soundness of the project may

turn out to be highly evident during the Pre-FS, thus, No

need to have detailed FS

Need for a FS If results of the Pre-FS indicate: (1) more detailed

information to produce more conclusive results; (2)

alternative schemes of the project are nearly the same

degree of feasibility and/or show marginal feasibility; (3)

new alternative solutions have emerged and has to be

ascertained through detailed FS](https://image.slidesharecdn.com/jan20feasibilitystudy-170623024831/85/feasibility-study-7-320.jpg)