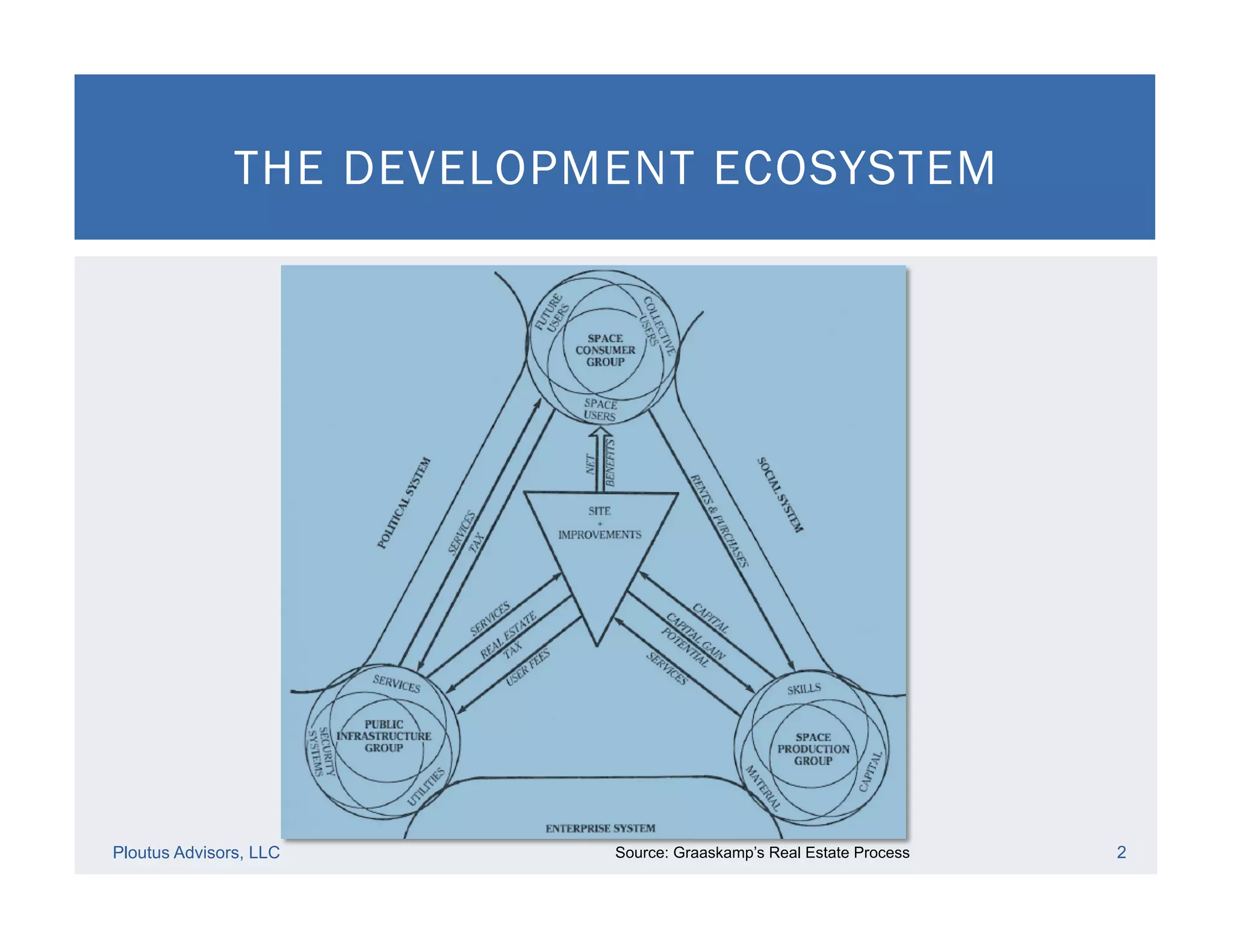

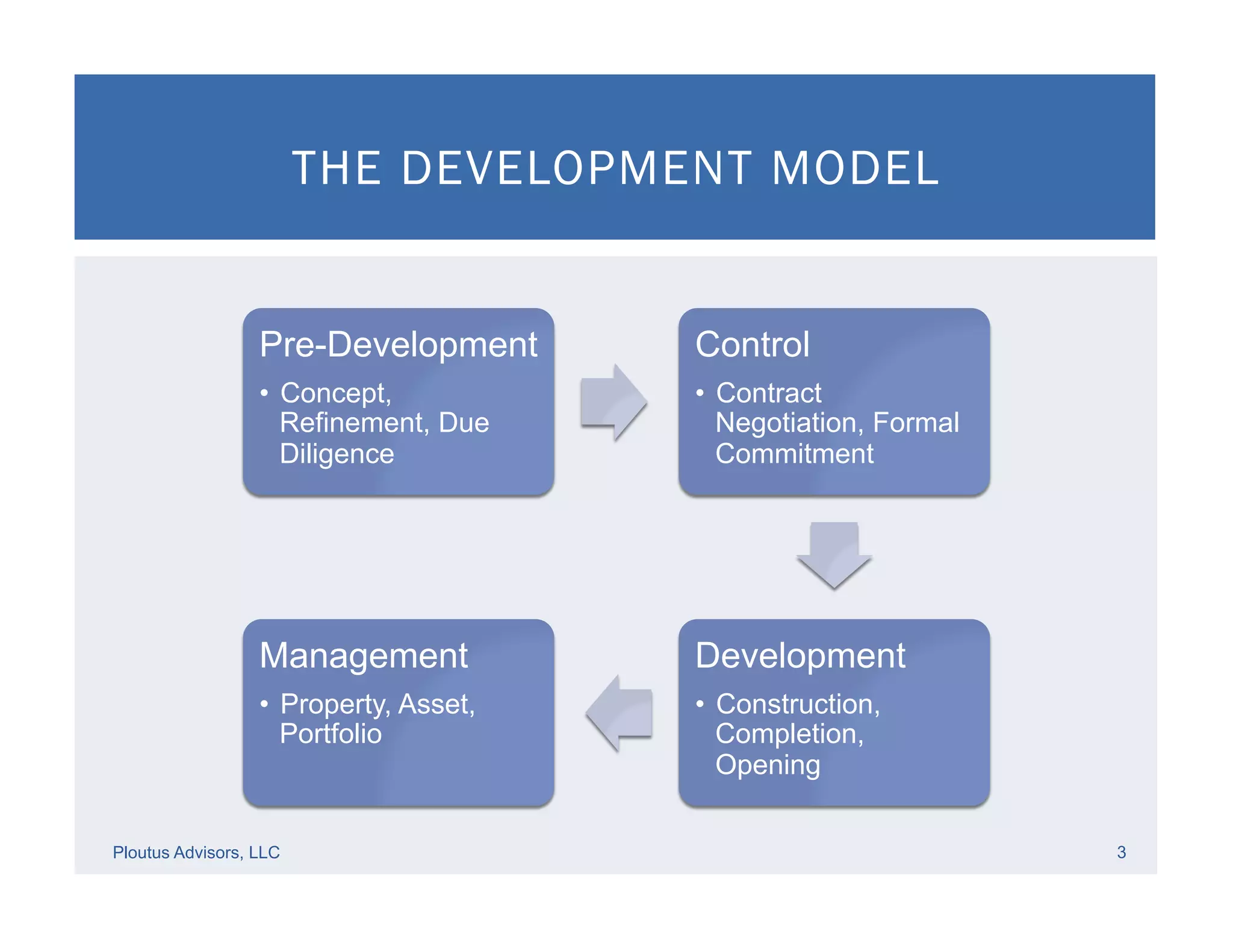

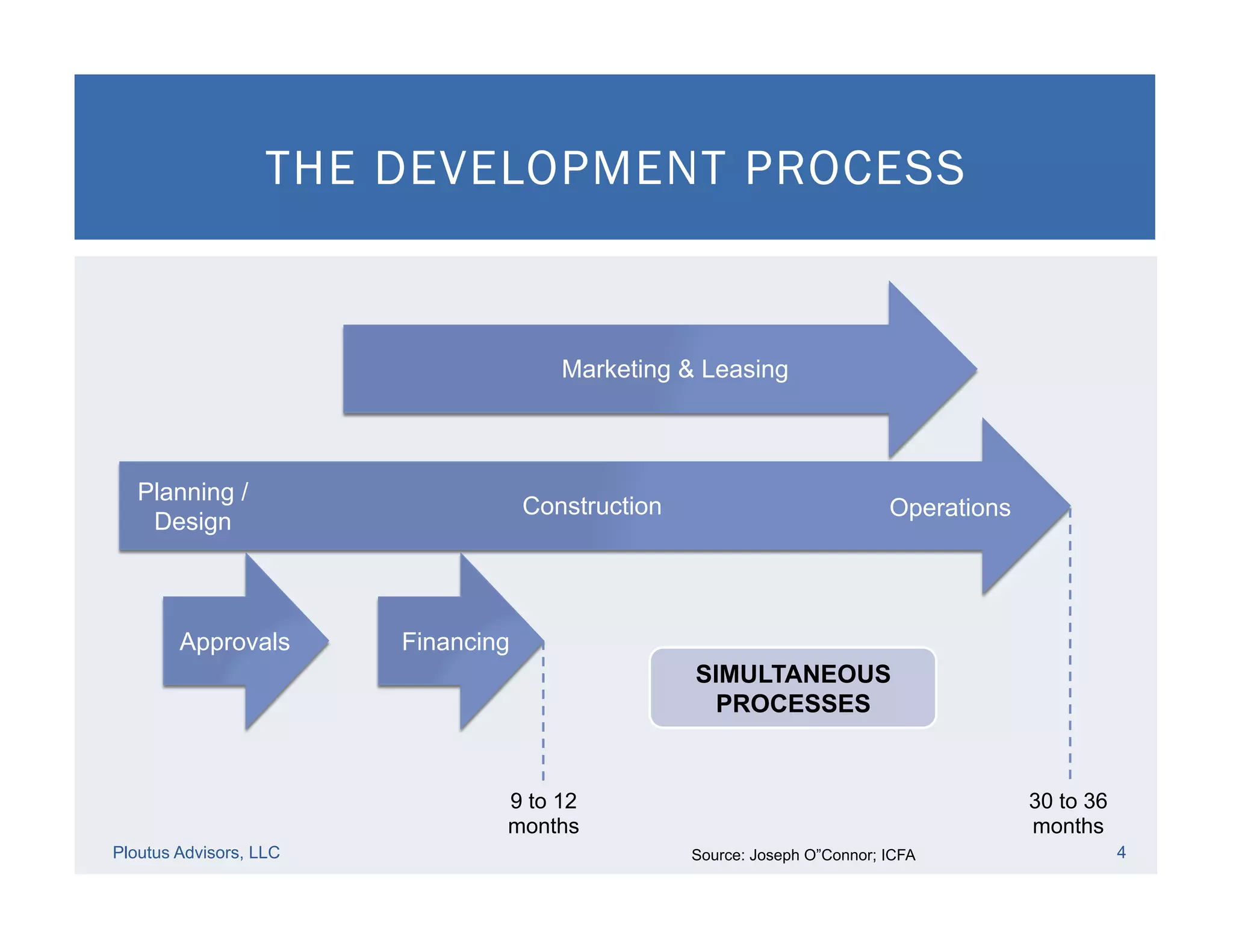

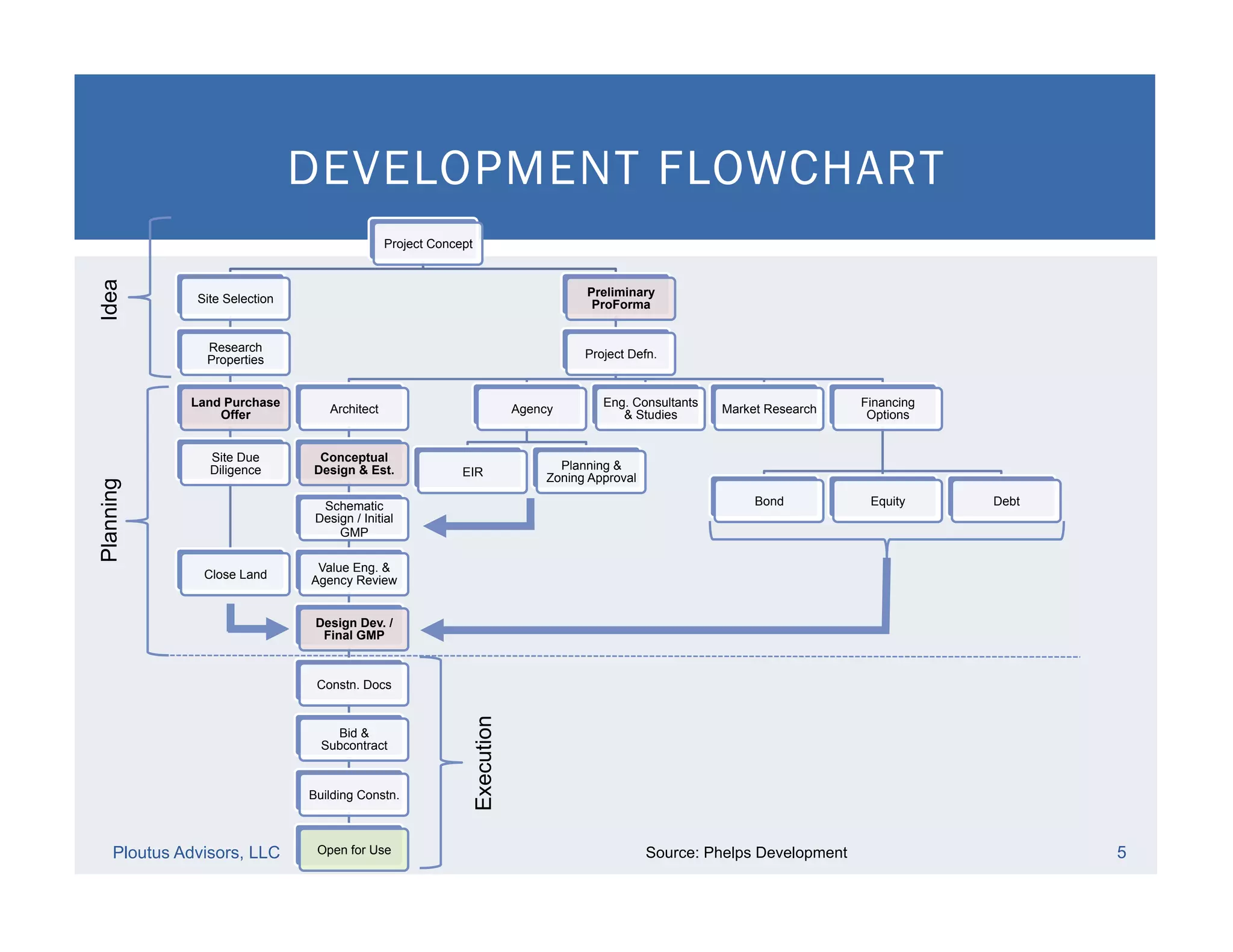

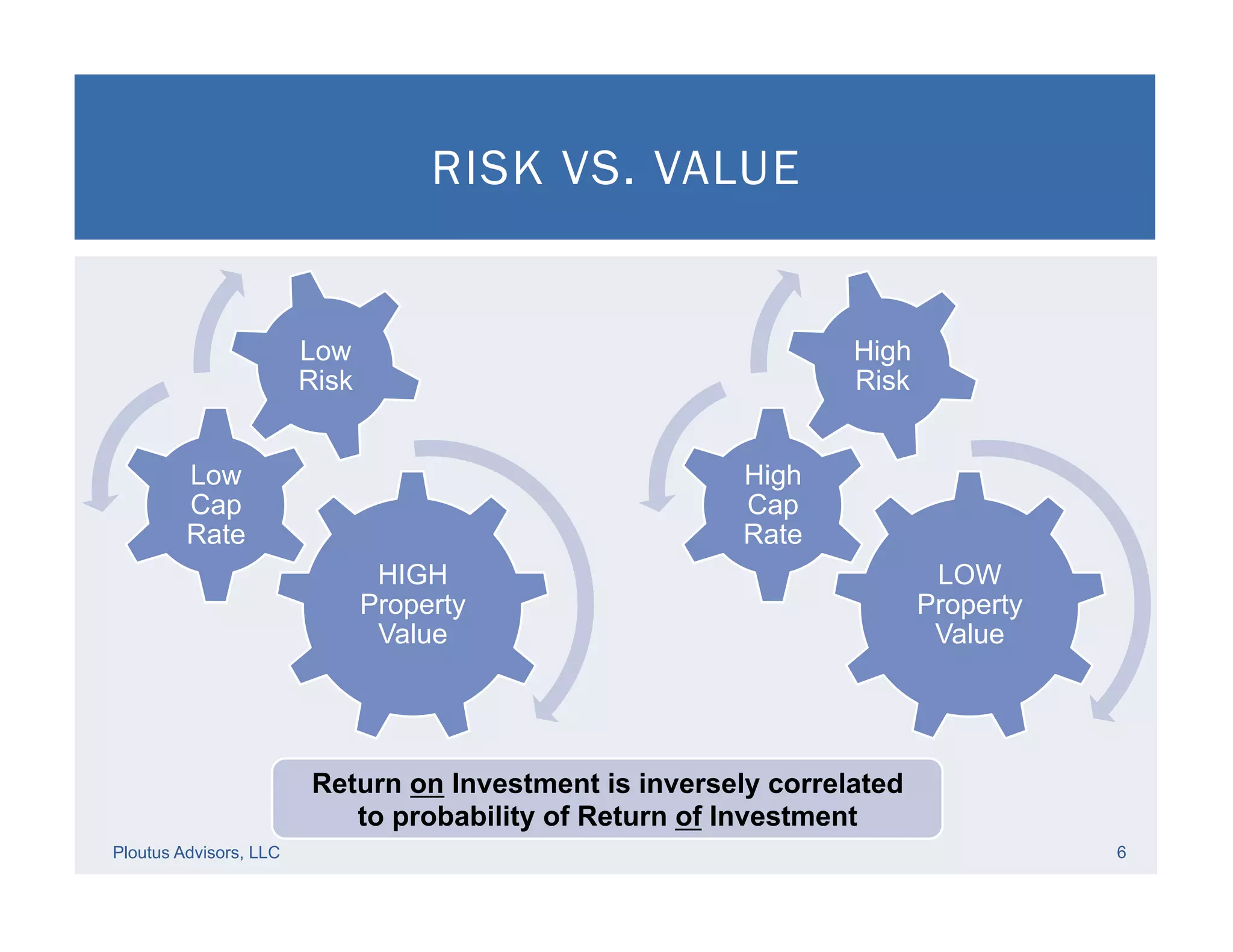

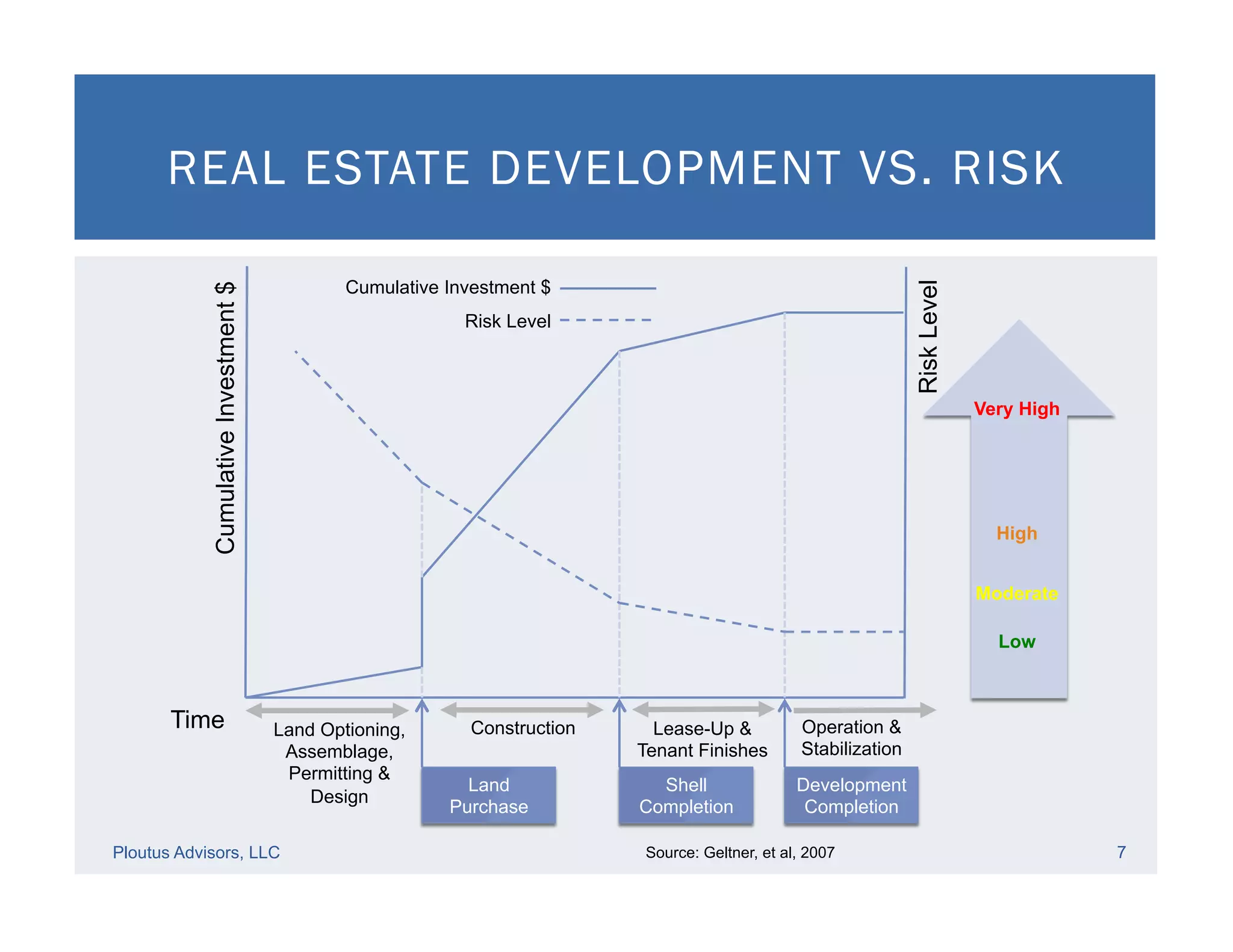

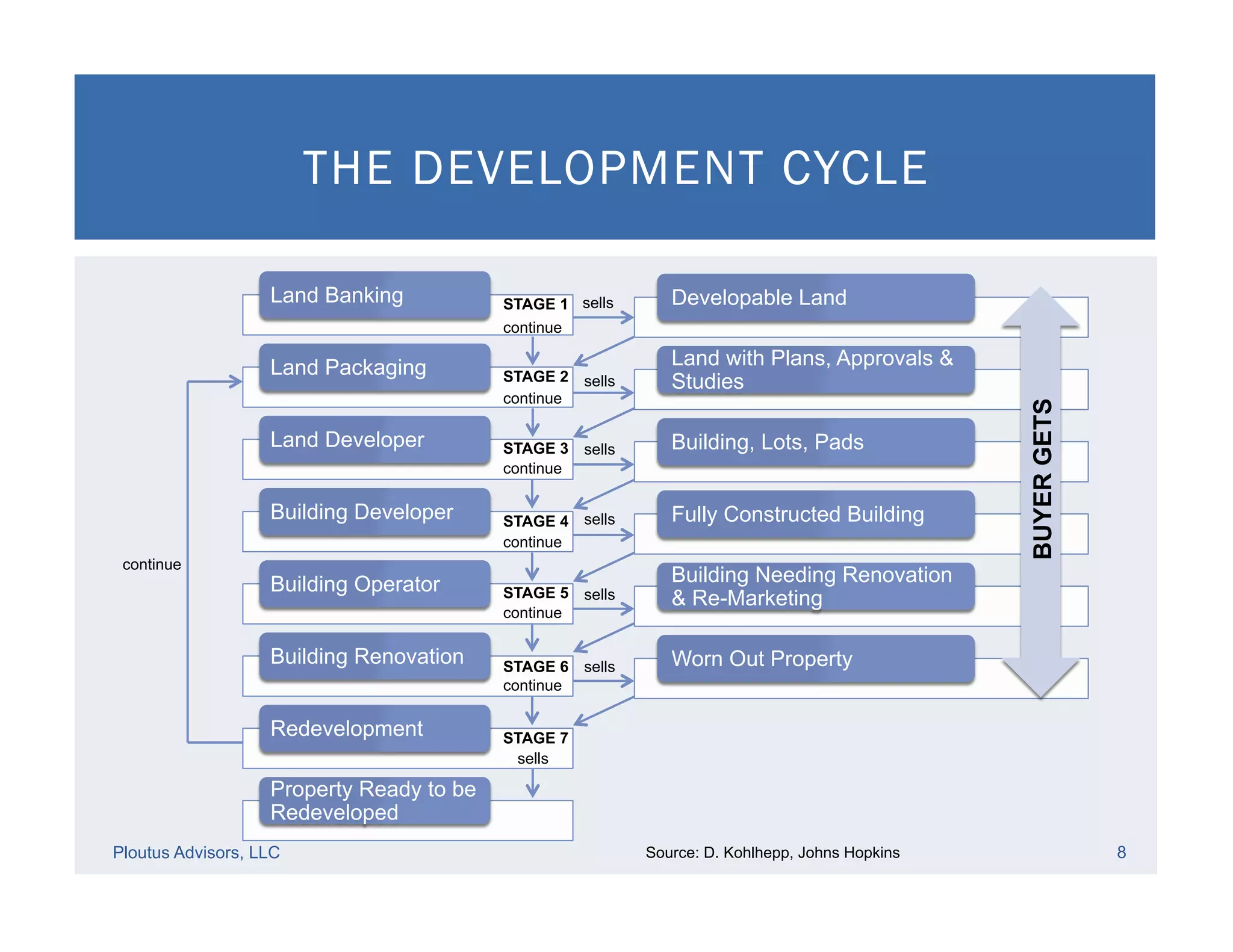

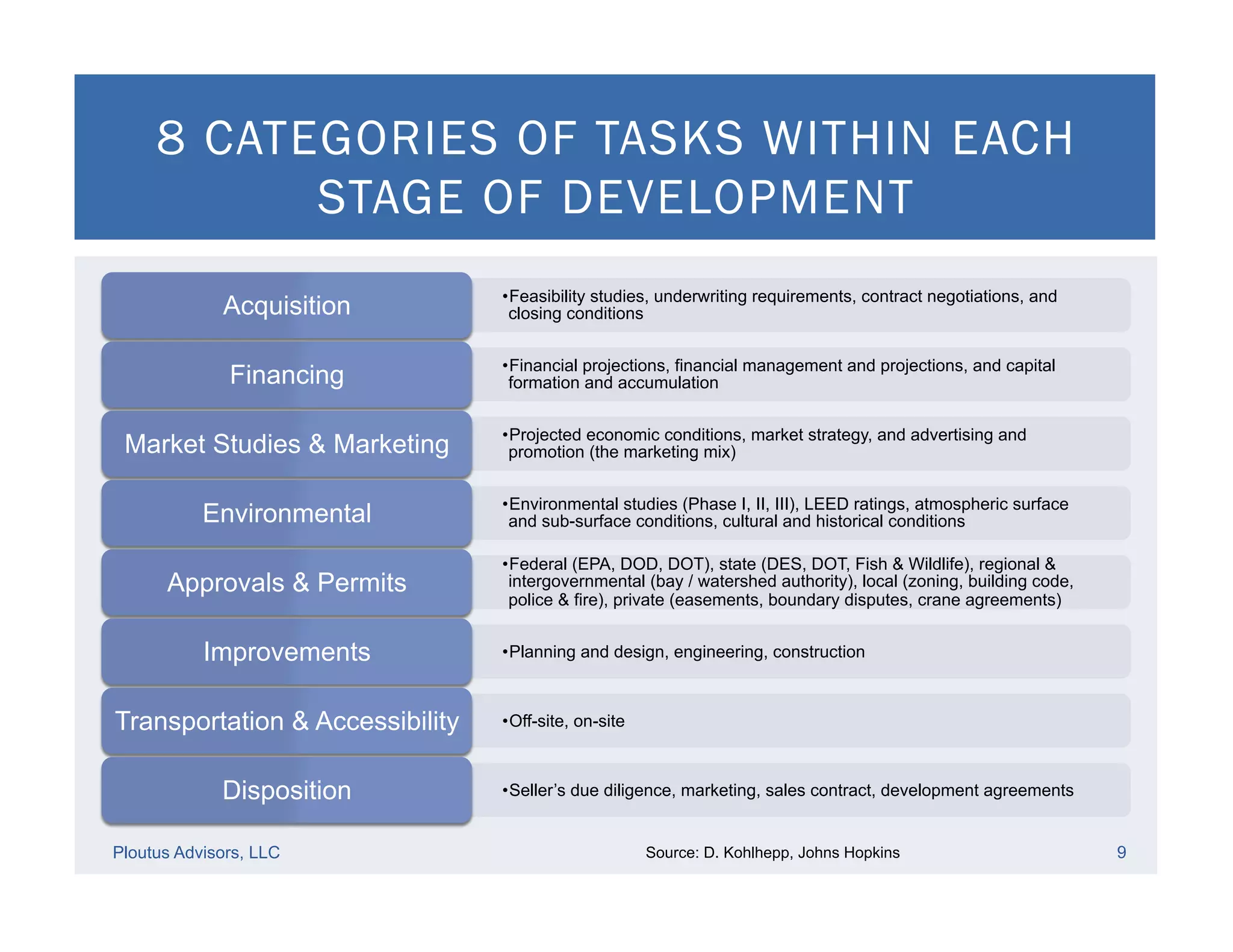

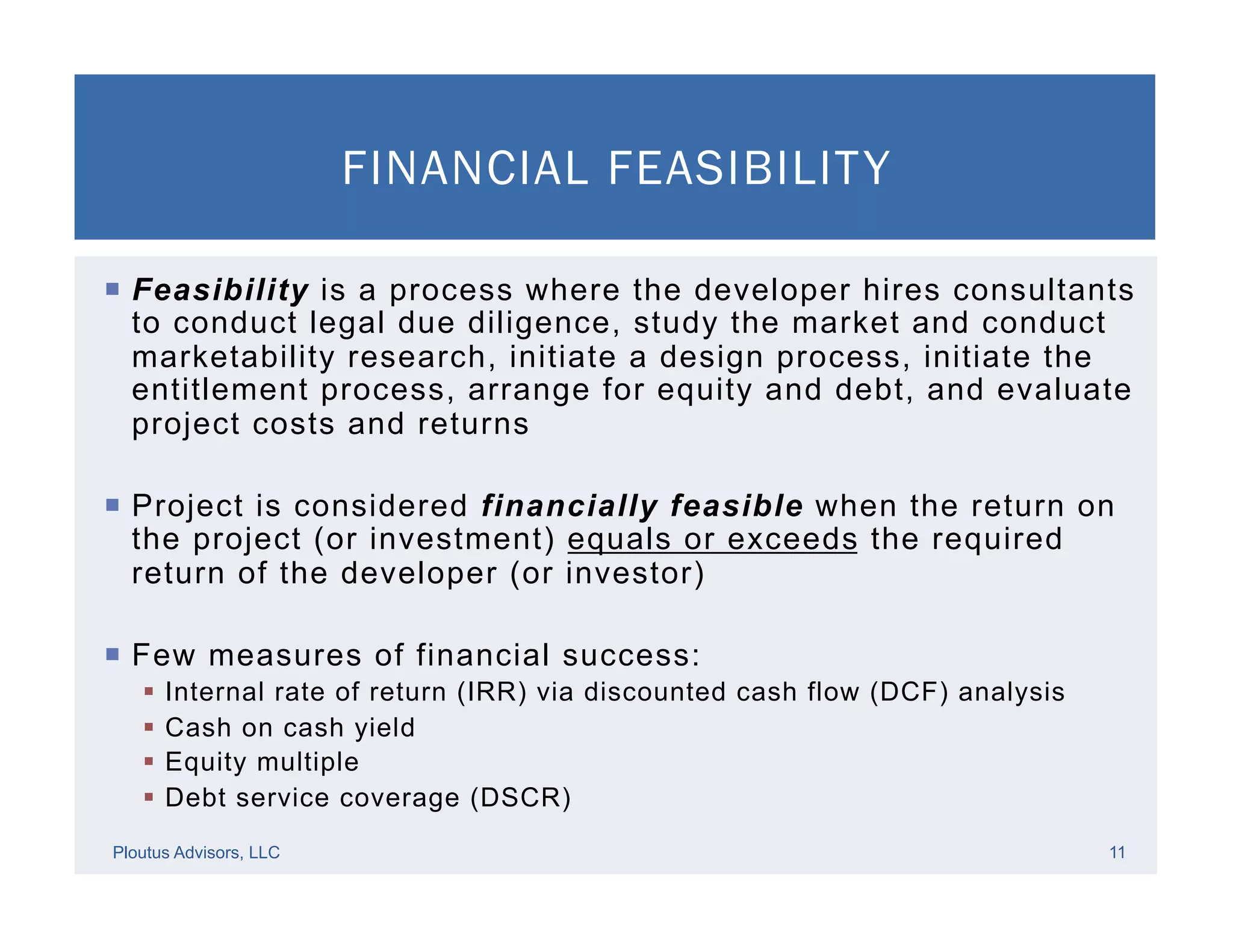

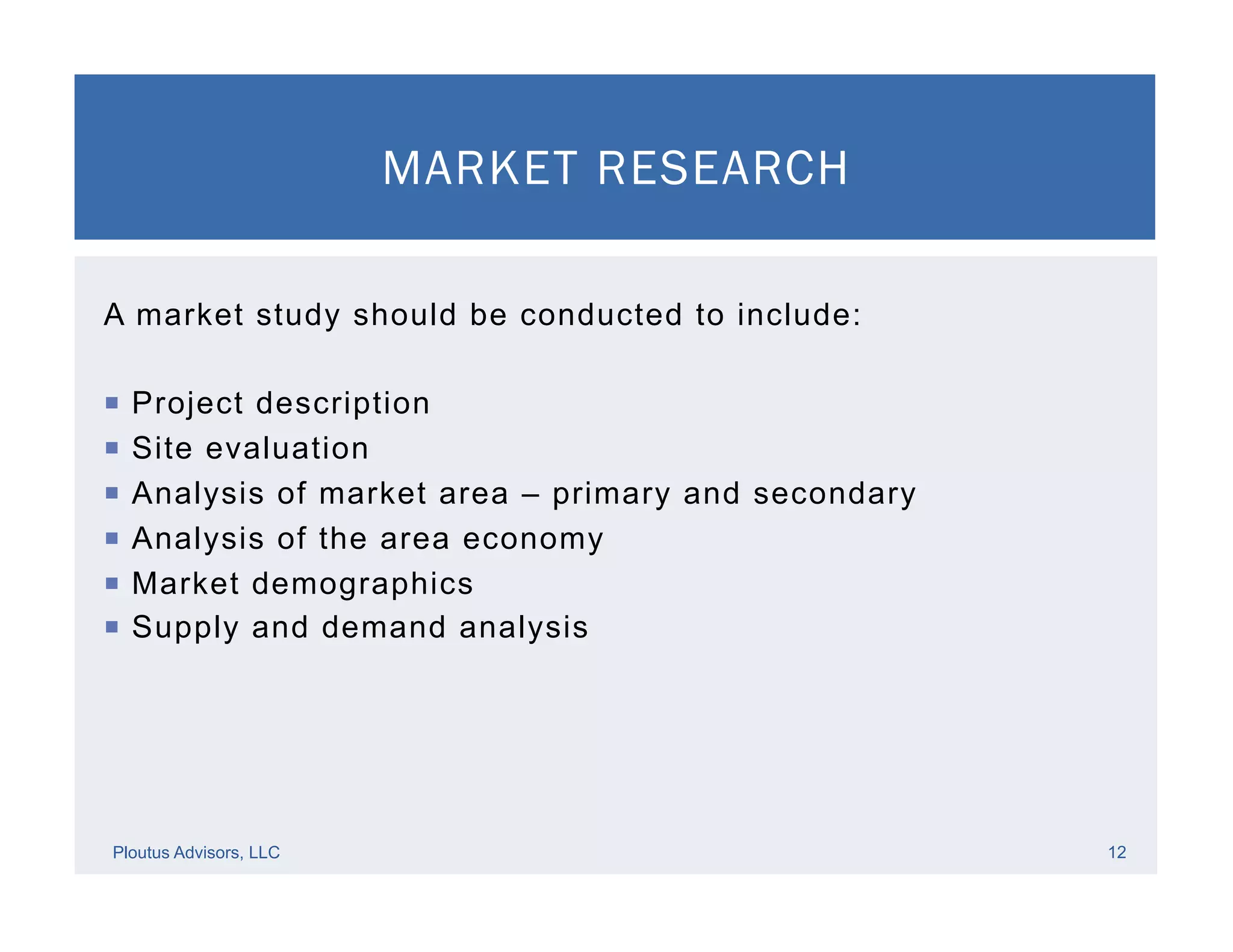

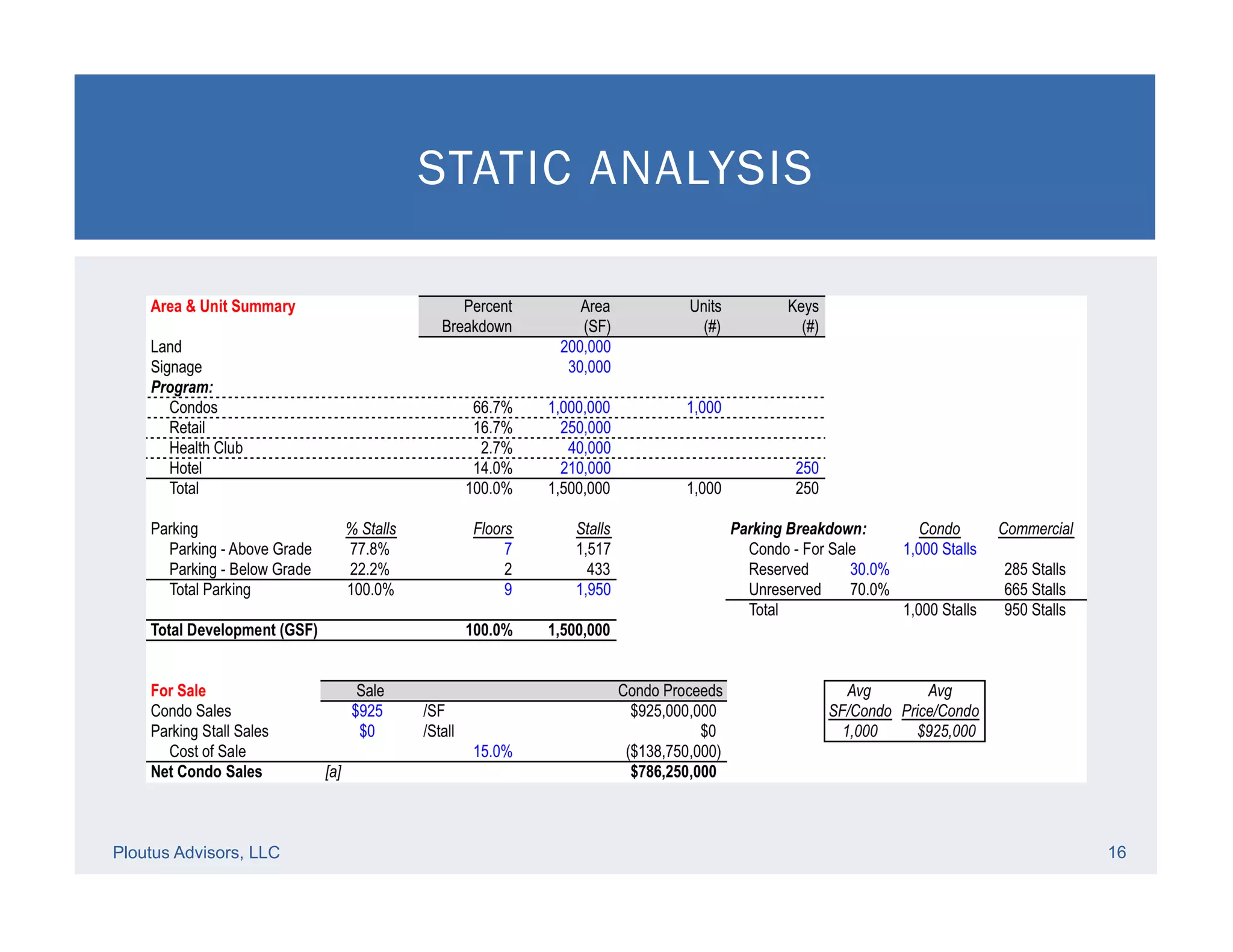

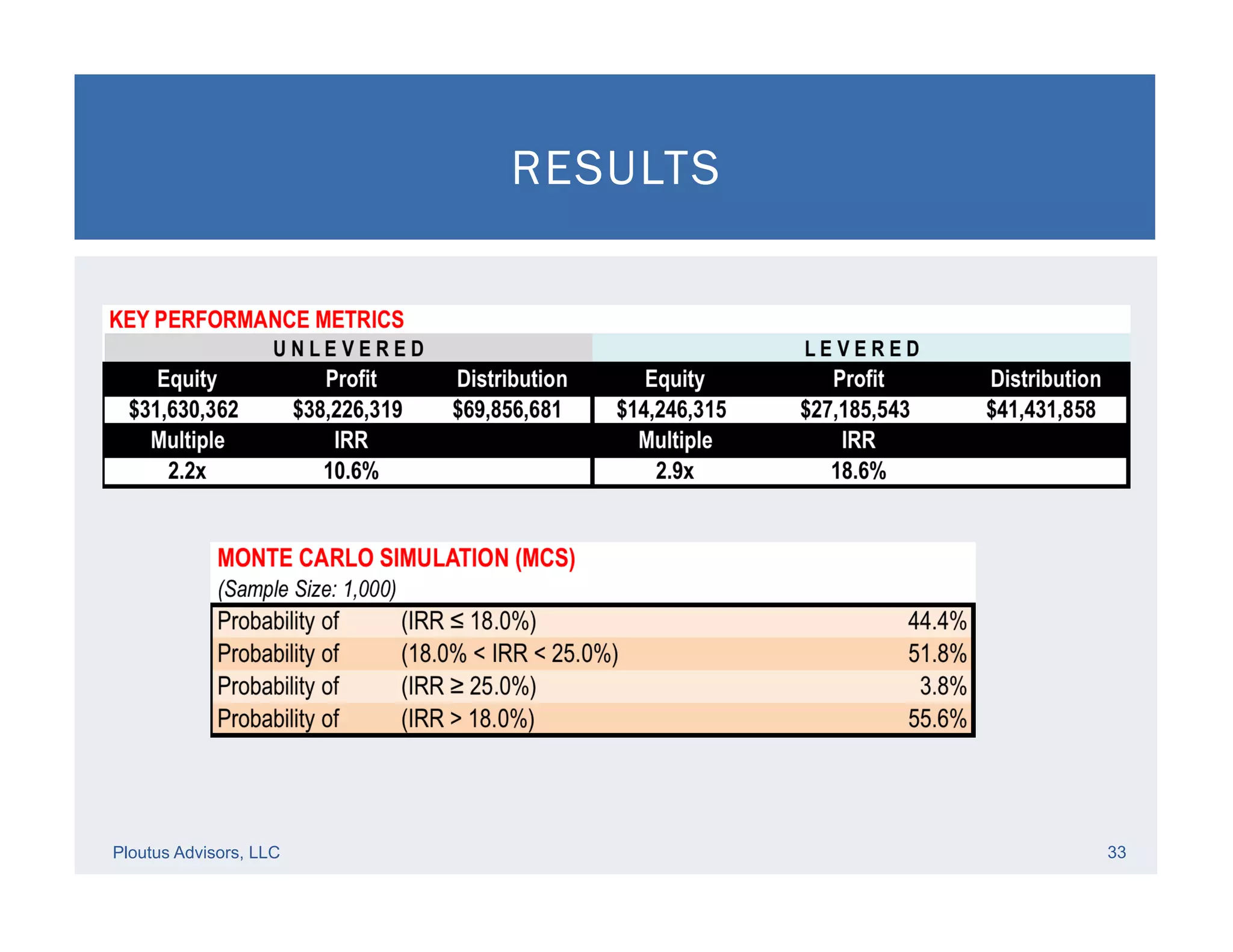

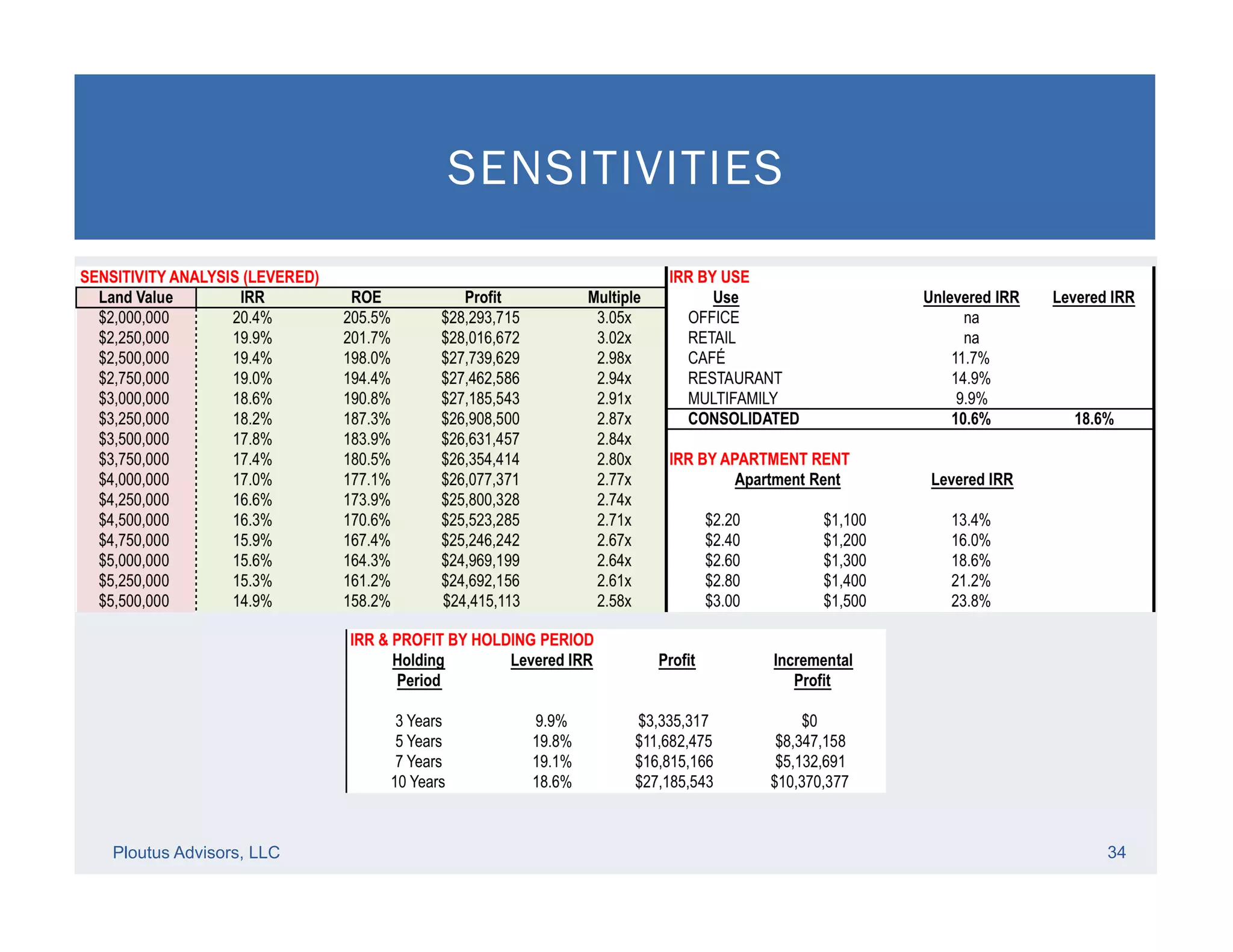

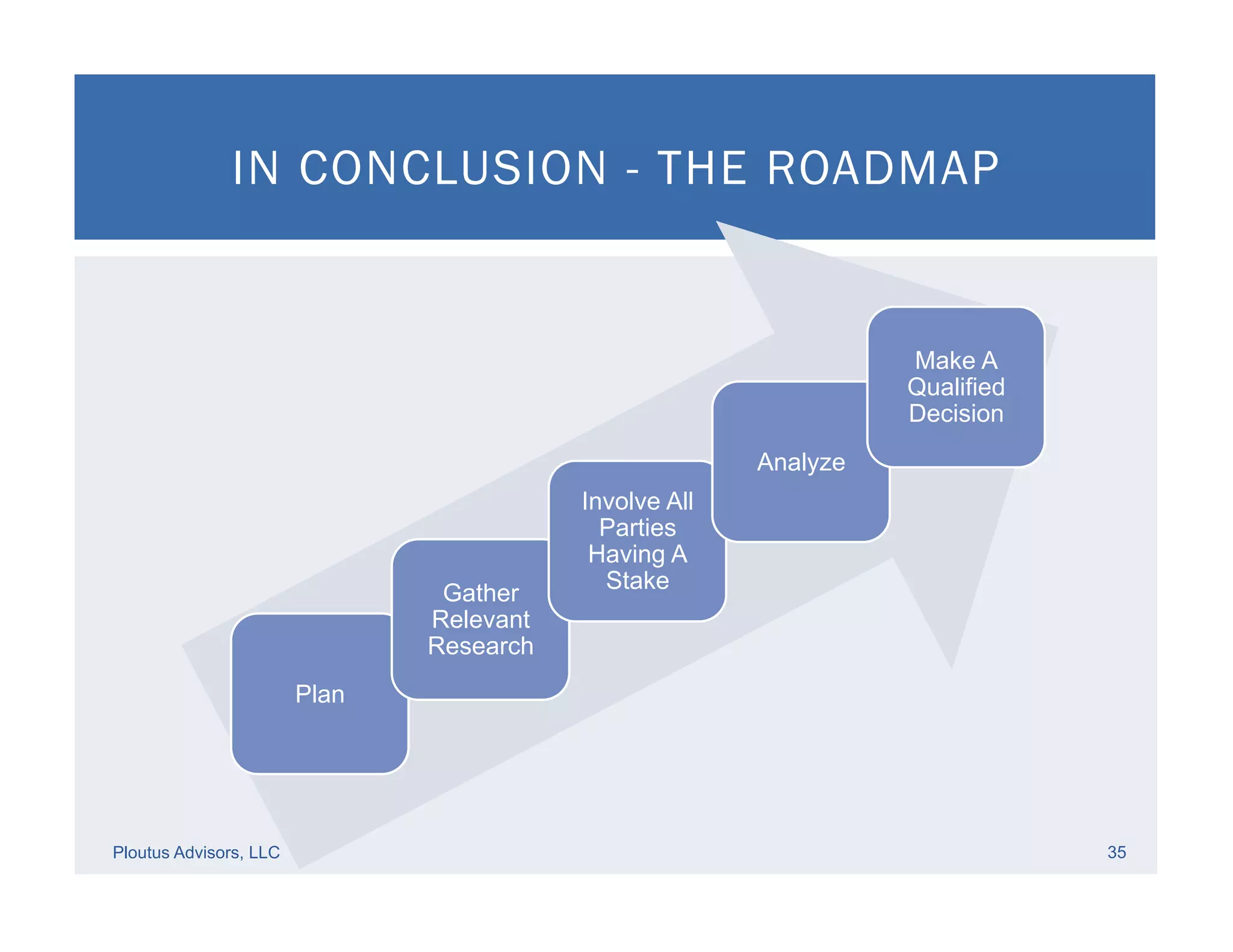

The document outlines the real estate development process, emphasizing financial feasibility, market research, and project execution stages. Key components include concept development, construction, and management, alongside considerations for risk and investment return. It also highlights the need for thorough planning, legal due diligence, and collaboration among stakeholders to ensure project success.