The document discusses different models of project cycles including the Baum cycle, DEPSA cycle, and UNIDO cycle.

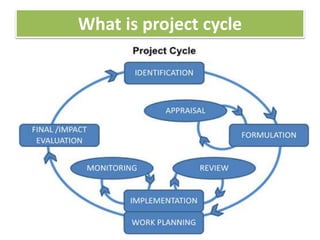

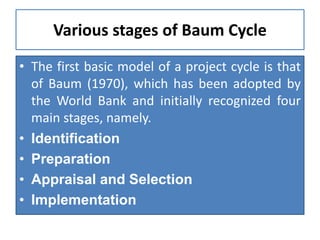

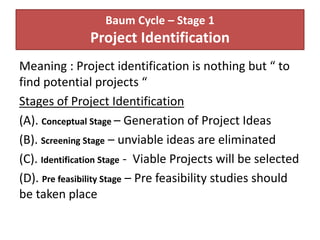

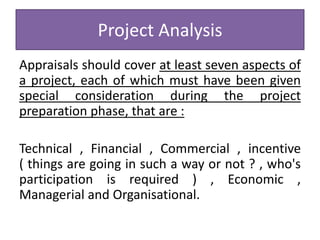

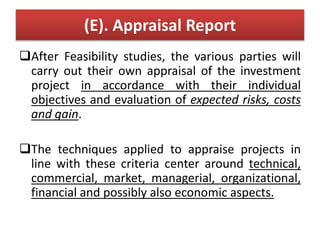

The Baum cycle originally had 4 stages (identification, preparation, appraisal/selection, implementation) but later added an evaluation stage. It describes each stage in detail.

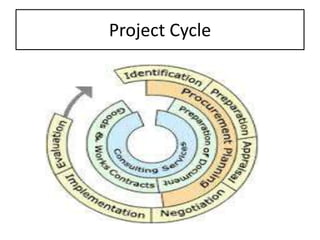

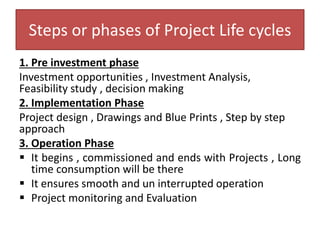

The DEPSA cycle has 3 phases (pre-investment, investment, operation) divided into 6 stages.

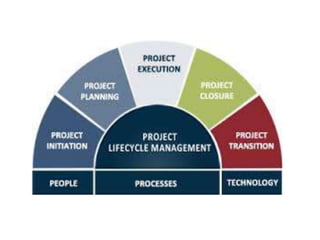

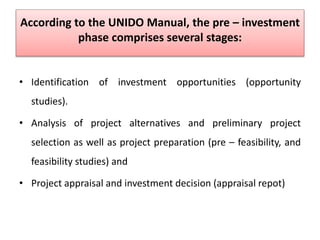

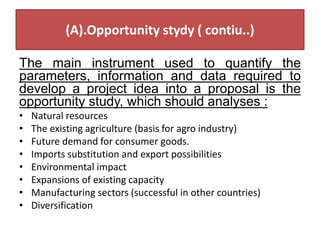

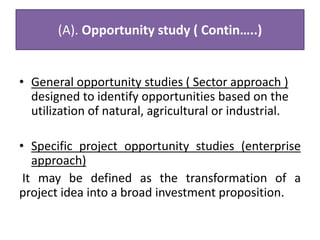

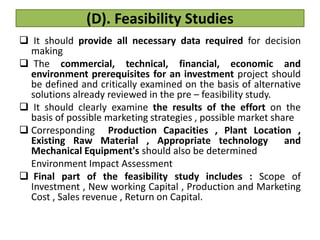

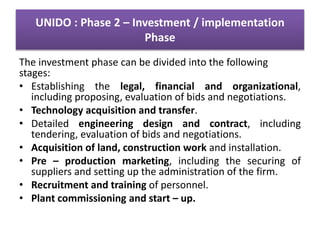

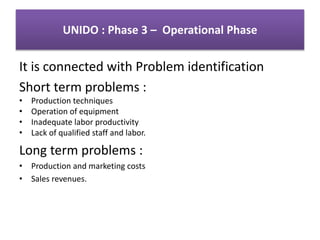

The UNIDO cycle also has 3 phases - pre-investment, investment, operational. The pre-investment phase includes opportunity studies, pre-feasibility studies, functional studies, and feasibility studies. It provides details on the objectives and components of each.