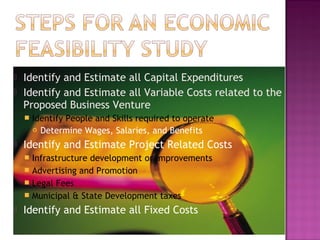

The document discusses the purpose and process of conducting a feasibility study for a potential business project. A feasibility study examines the operational, technical, and economic viability of an idea by analyzing factors such as costs, profits, and cash flows. The study should provide decision-makers with quality information to help determine if a project is worth funding and pursuing further. The document outlines the key components of a feasibility study, including collecting primary and secondary data, estimating capital and operating expenses, projecting revenues and profits, and assessing risks and limitations.