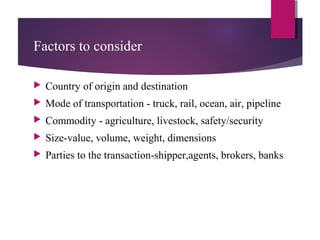

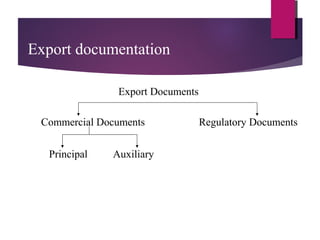

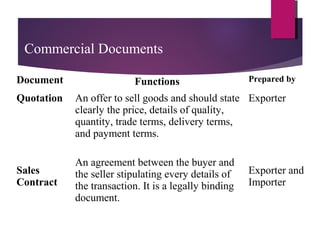

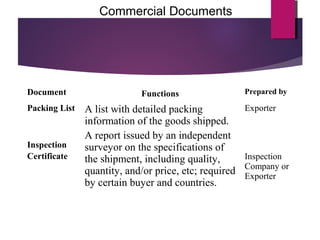

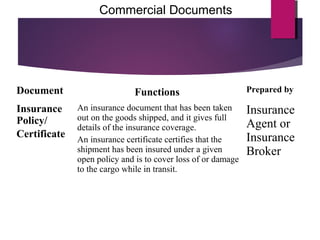

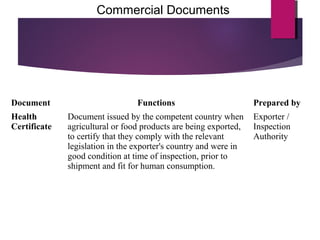

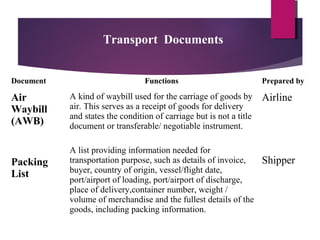

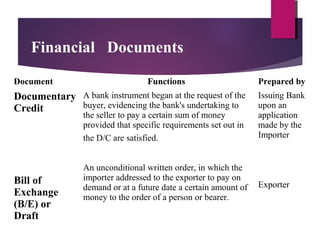

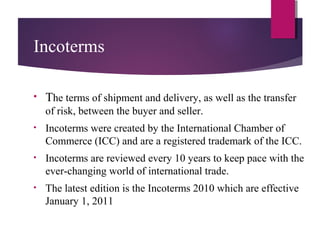

This document provides information on export documentation requirements. It explains that documentation varies by country, commodity, and situation, but generally outlines the sale, shipment, and responsibilities of parties to ensure complete understanding and avoid delays or costs. It identifies key factors to consider like country of origin/destination, transportation mode, and commodity. It then describes various principal and auxiliary export documents, such as commercial invoices, packing lists, bills of lading, certificates of origin, and more. Finally, it discusses factors involved in export documentation preparation and common documentation functions.