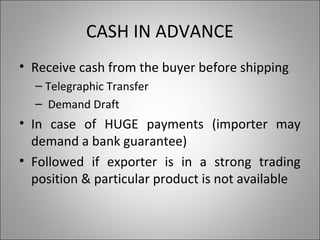

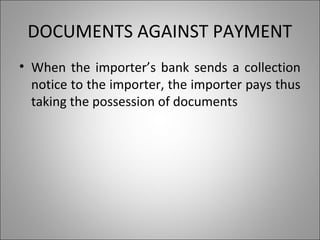

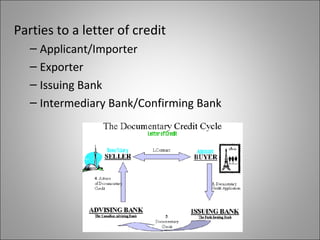

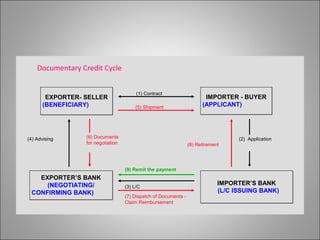

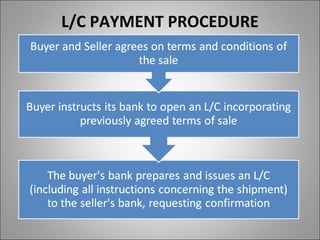

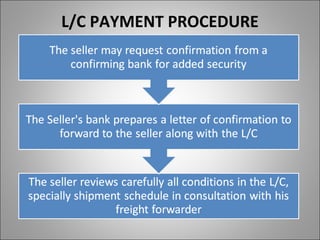

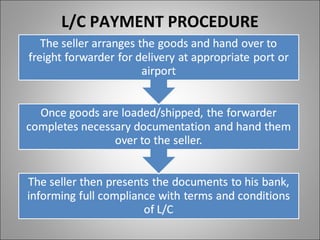

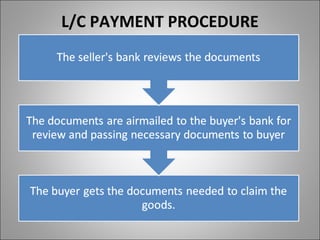

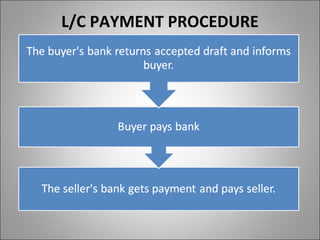

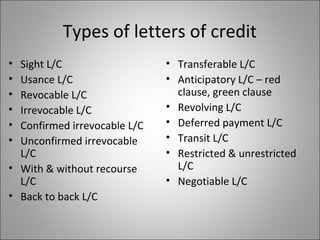

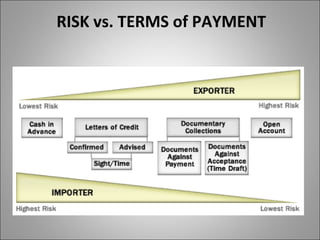

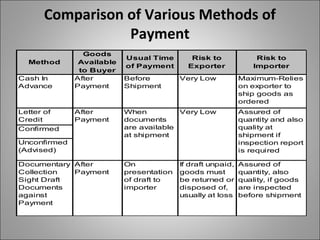

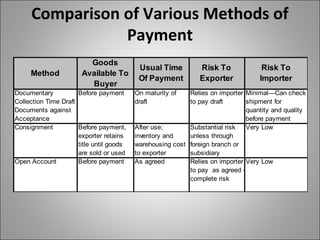

The document discusses various payment terms used in international trade: cash in advance, letter of credit, documentary collection, consignment, and open account. It provides details on the process and risks involved for exporters and importers for each payment method. A letter of credit is described as the most secure option, where payment is guaranteed by the importer's bank within a specified time upon presentation of shipping documents. The risks shift from the exporter to the importer the further down the list the payment terms move from cash in advance to open account.