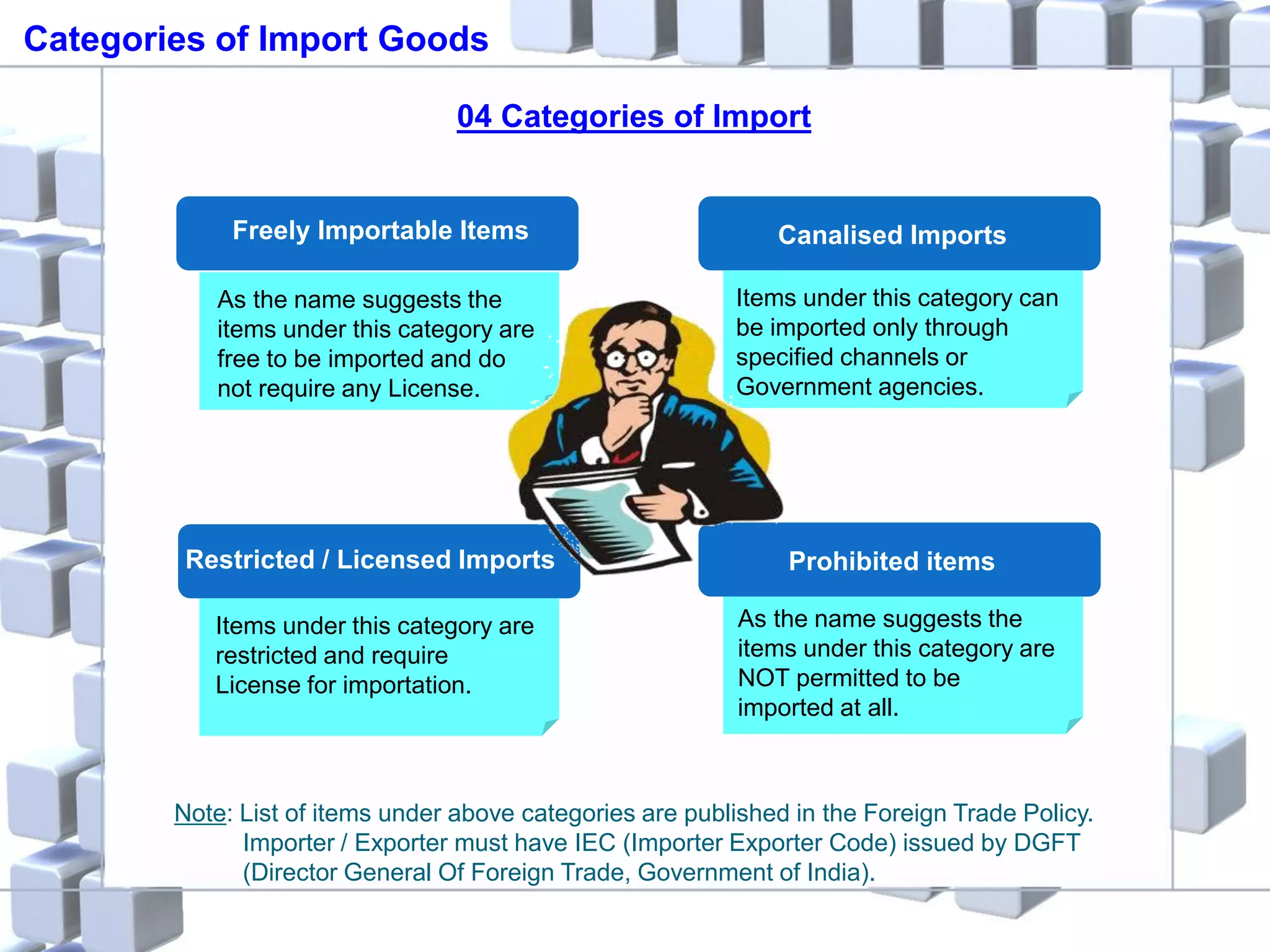

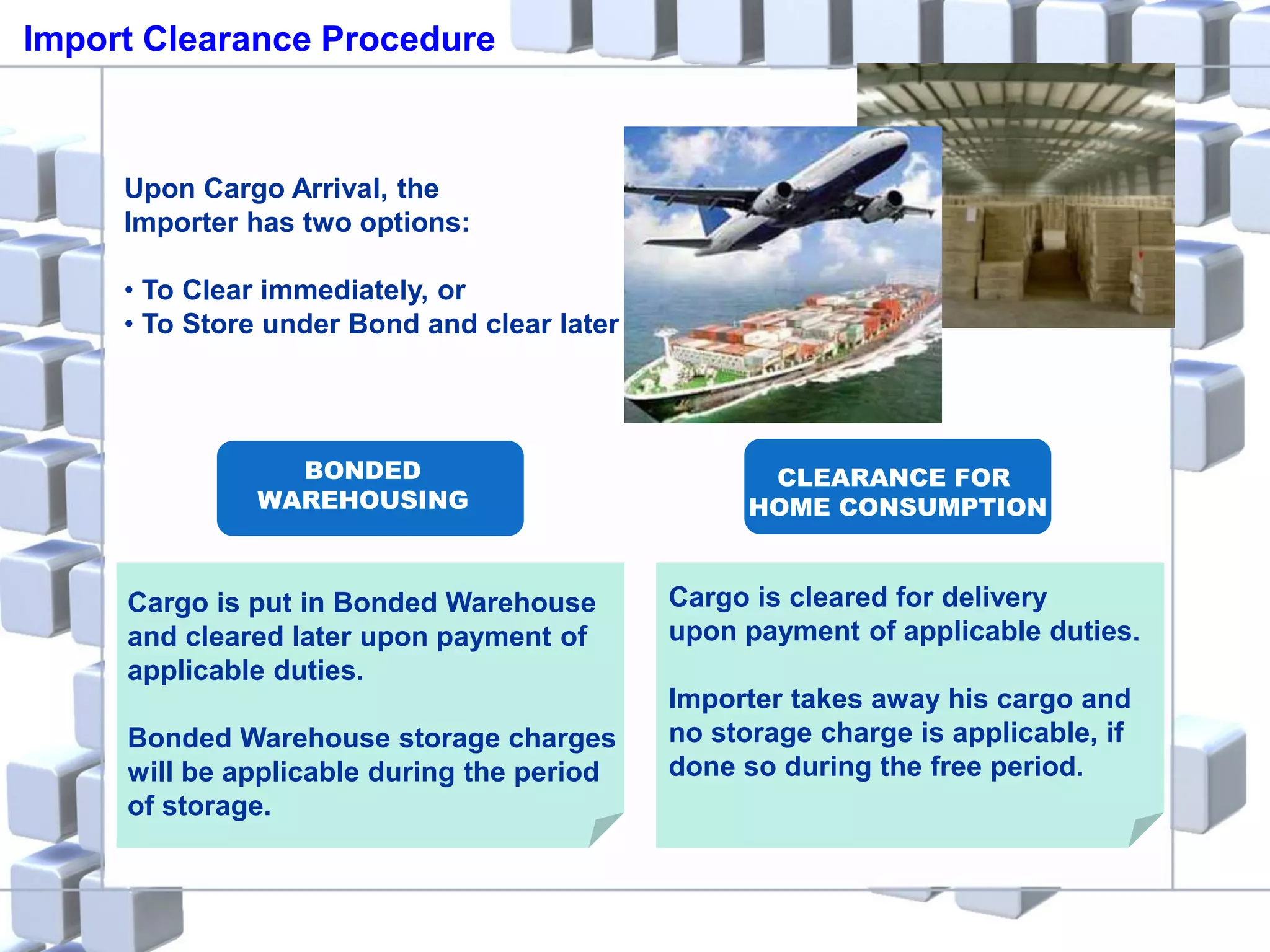

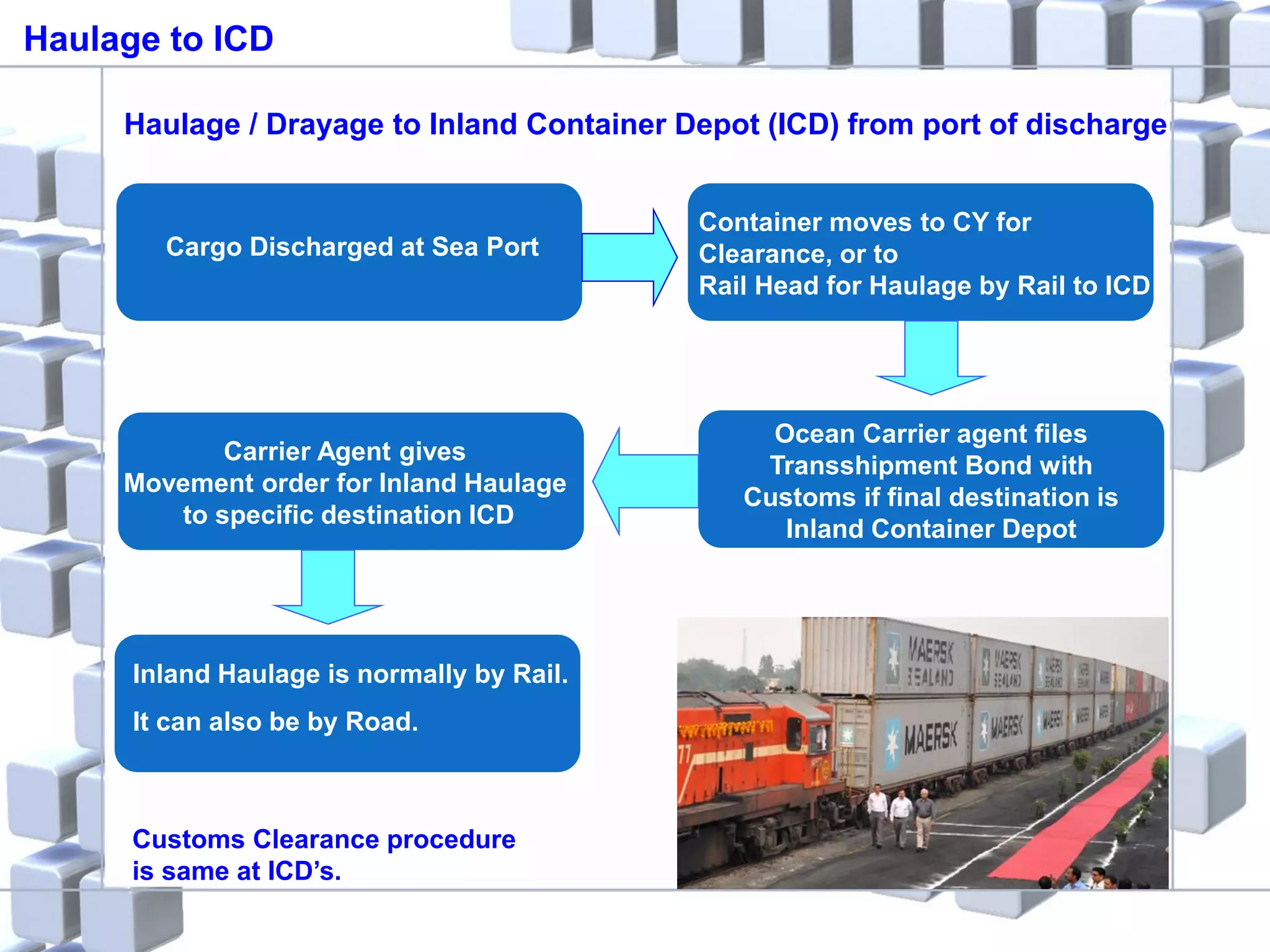

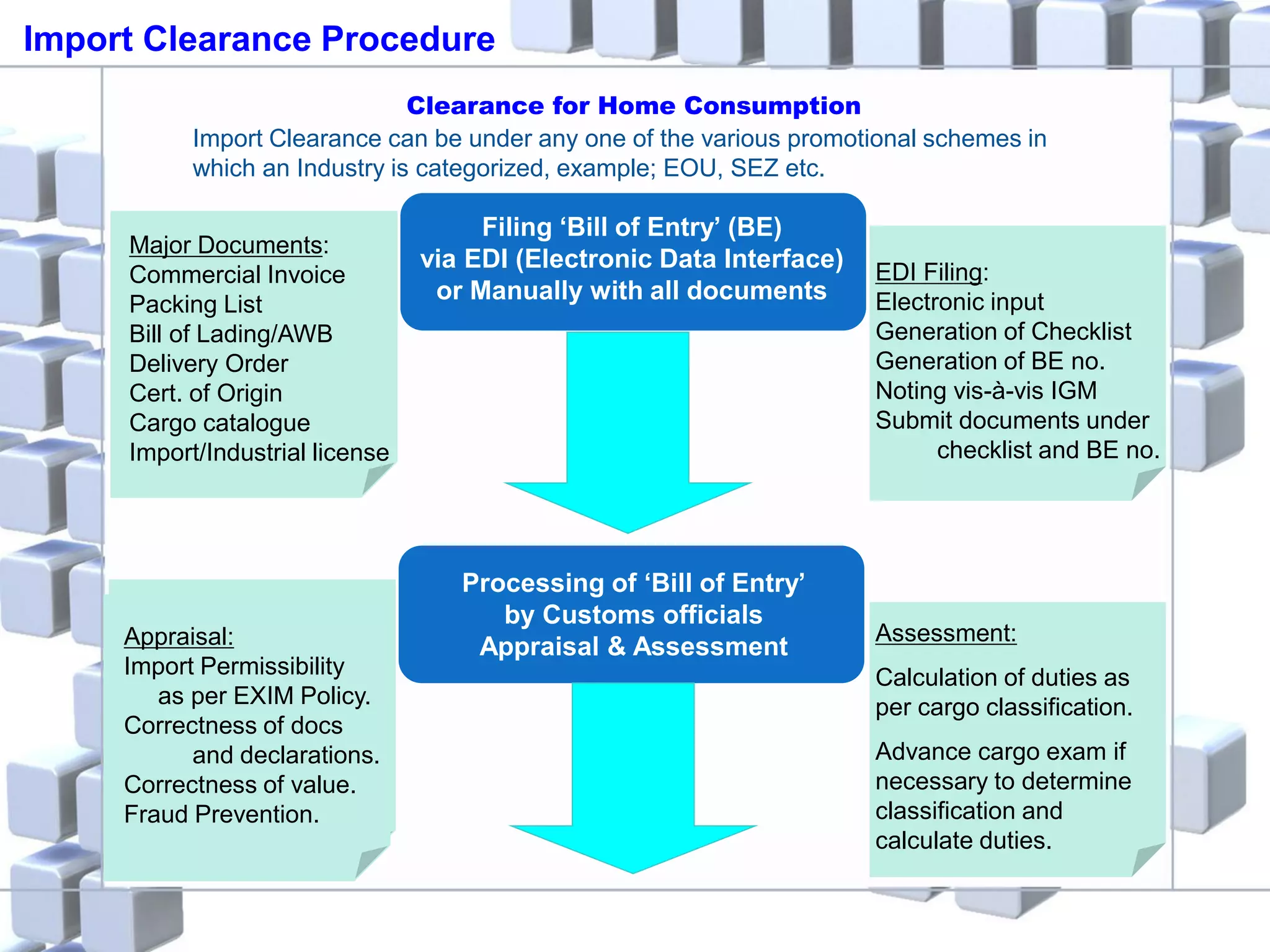

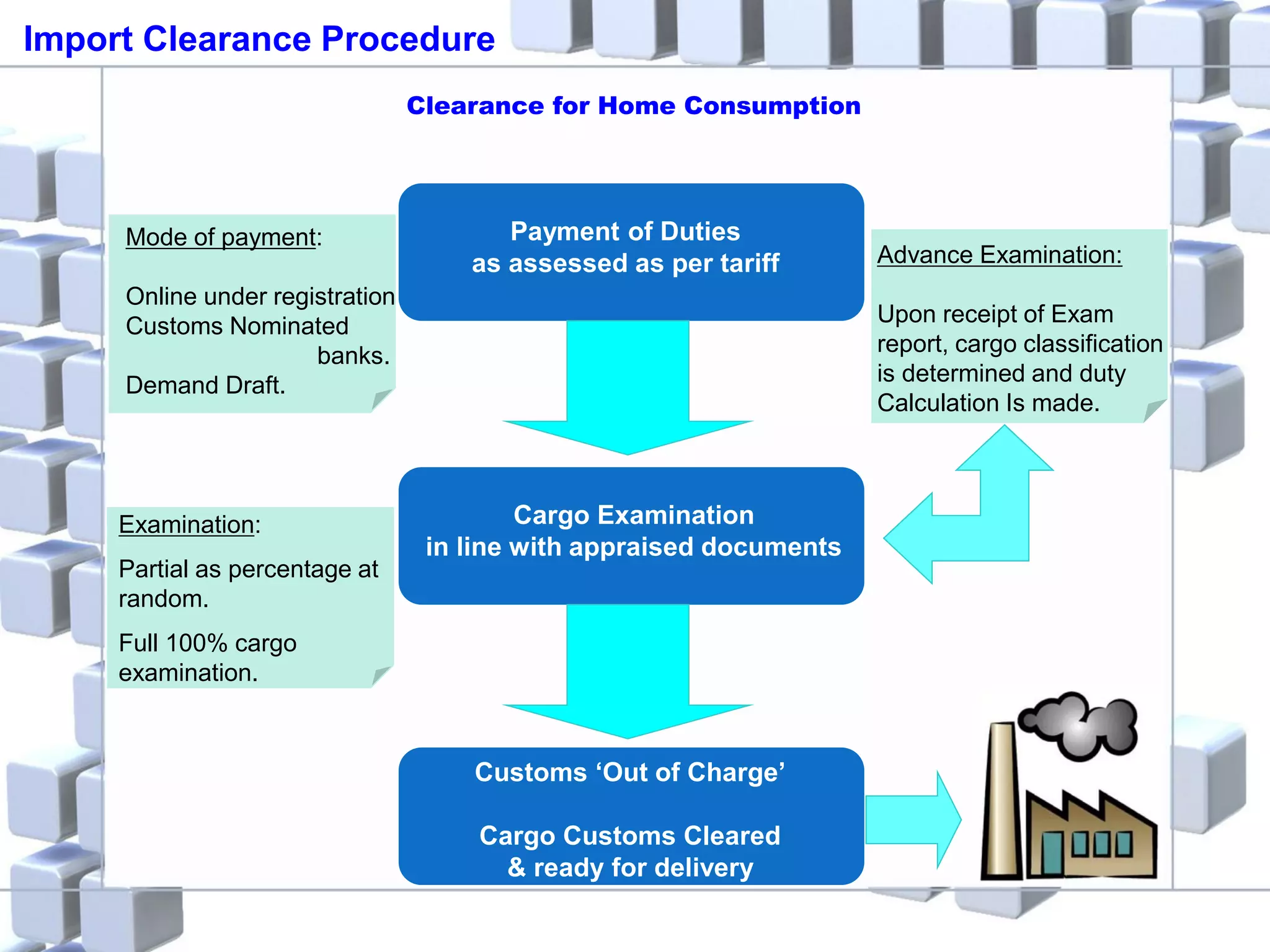

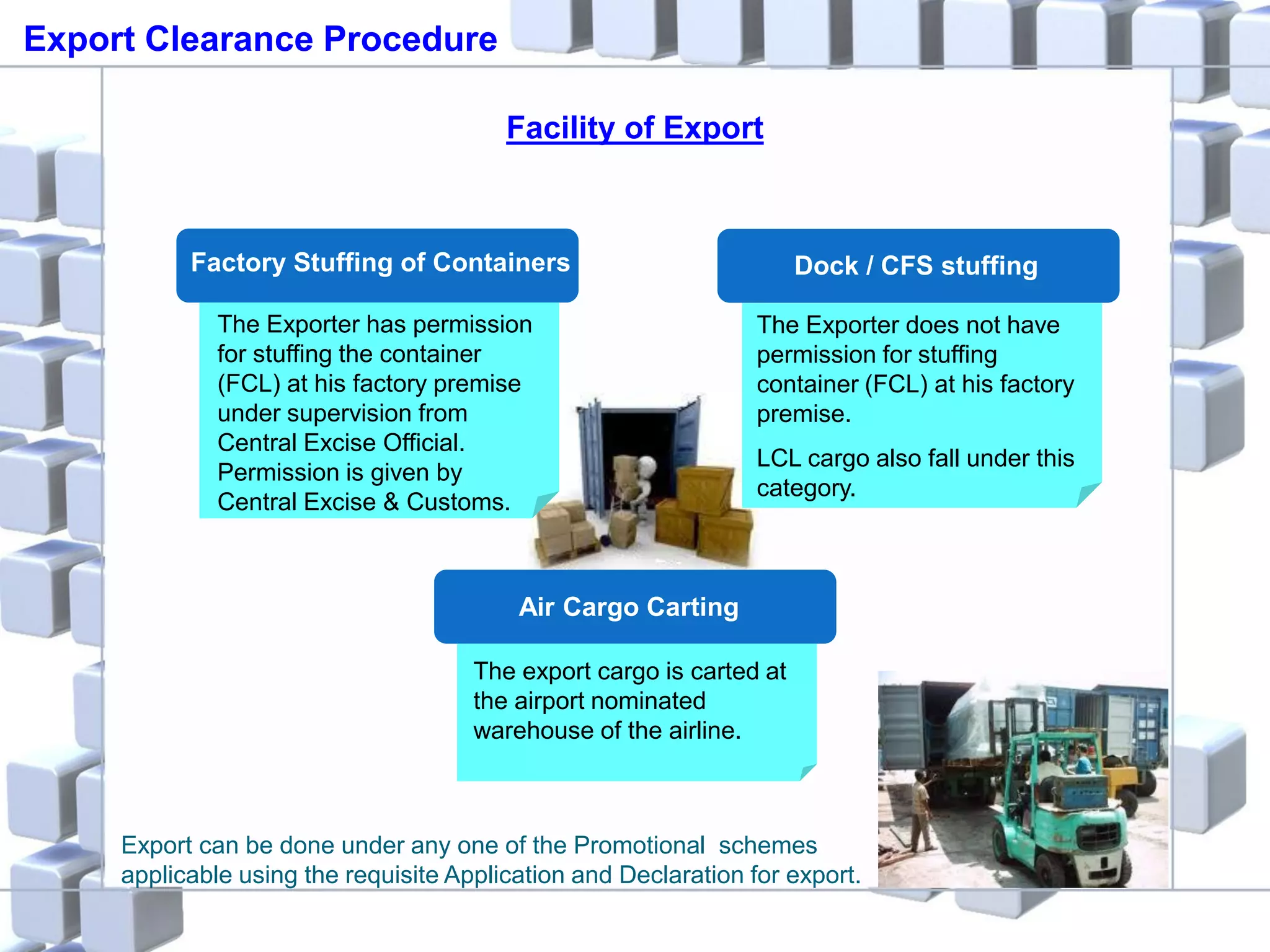

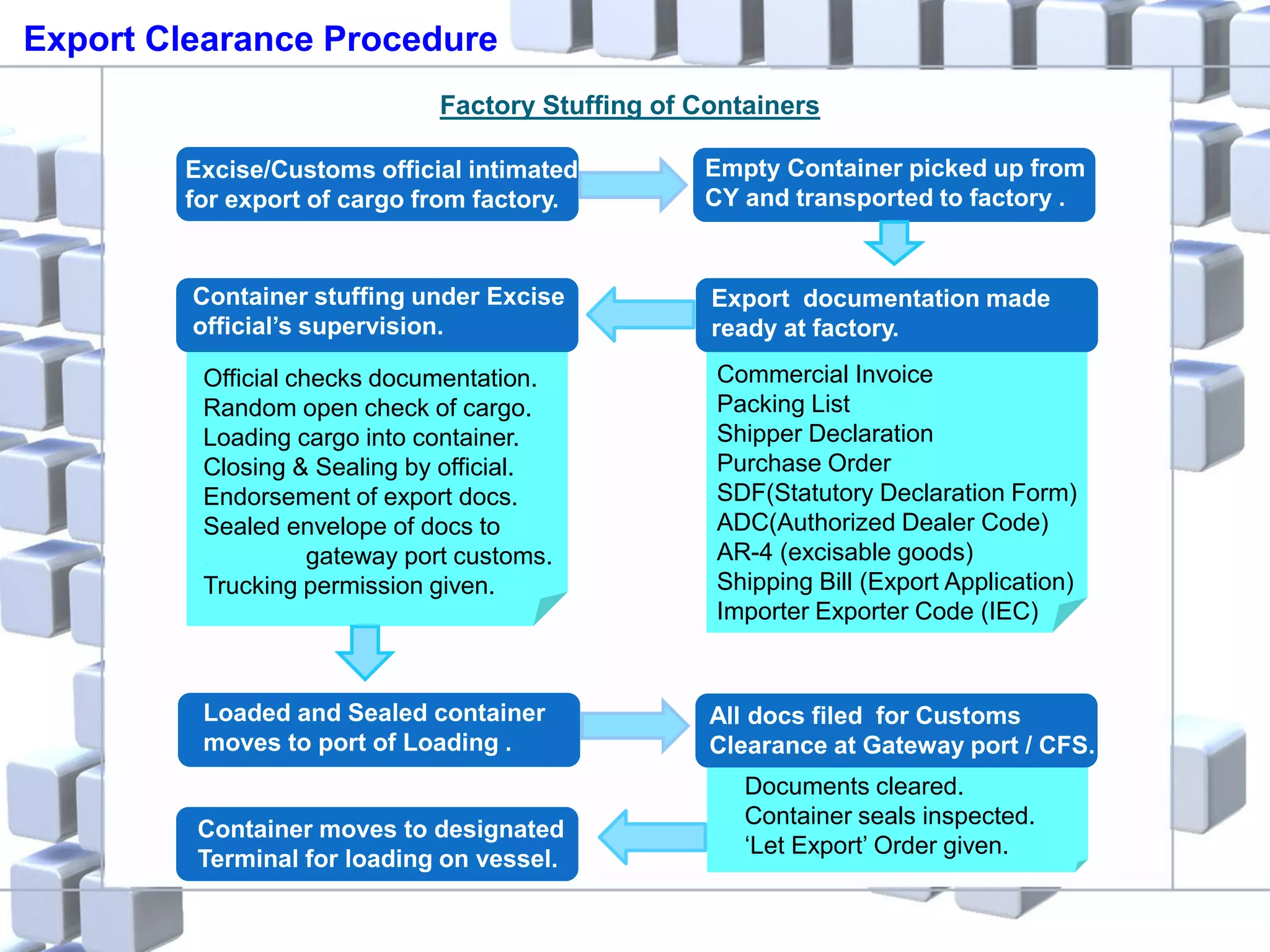

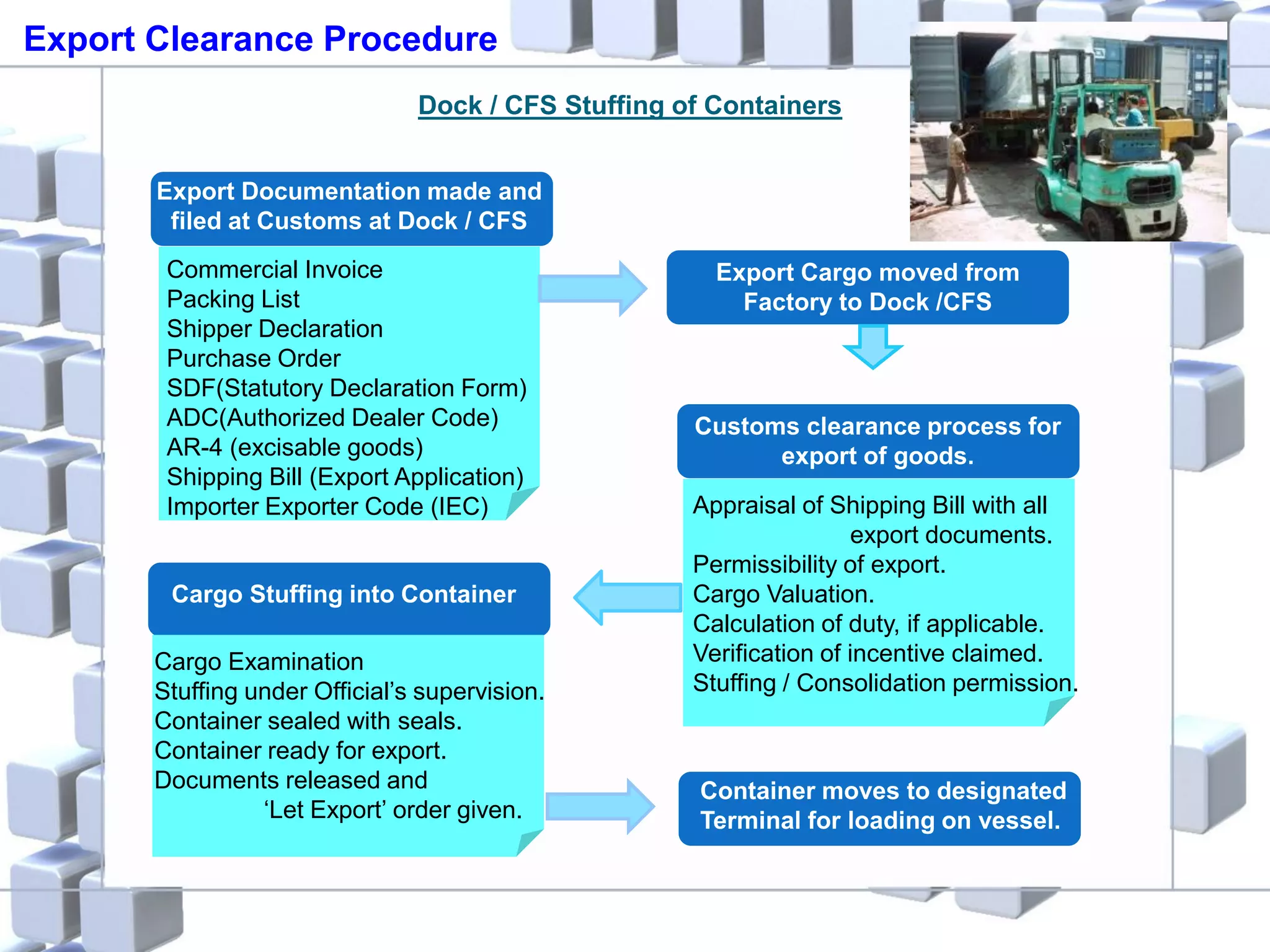

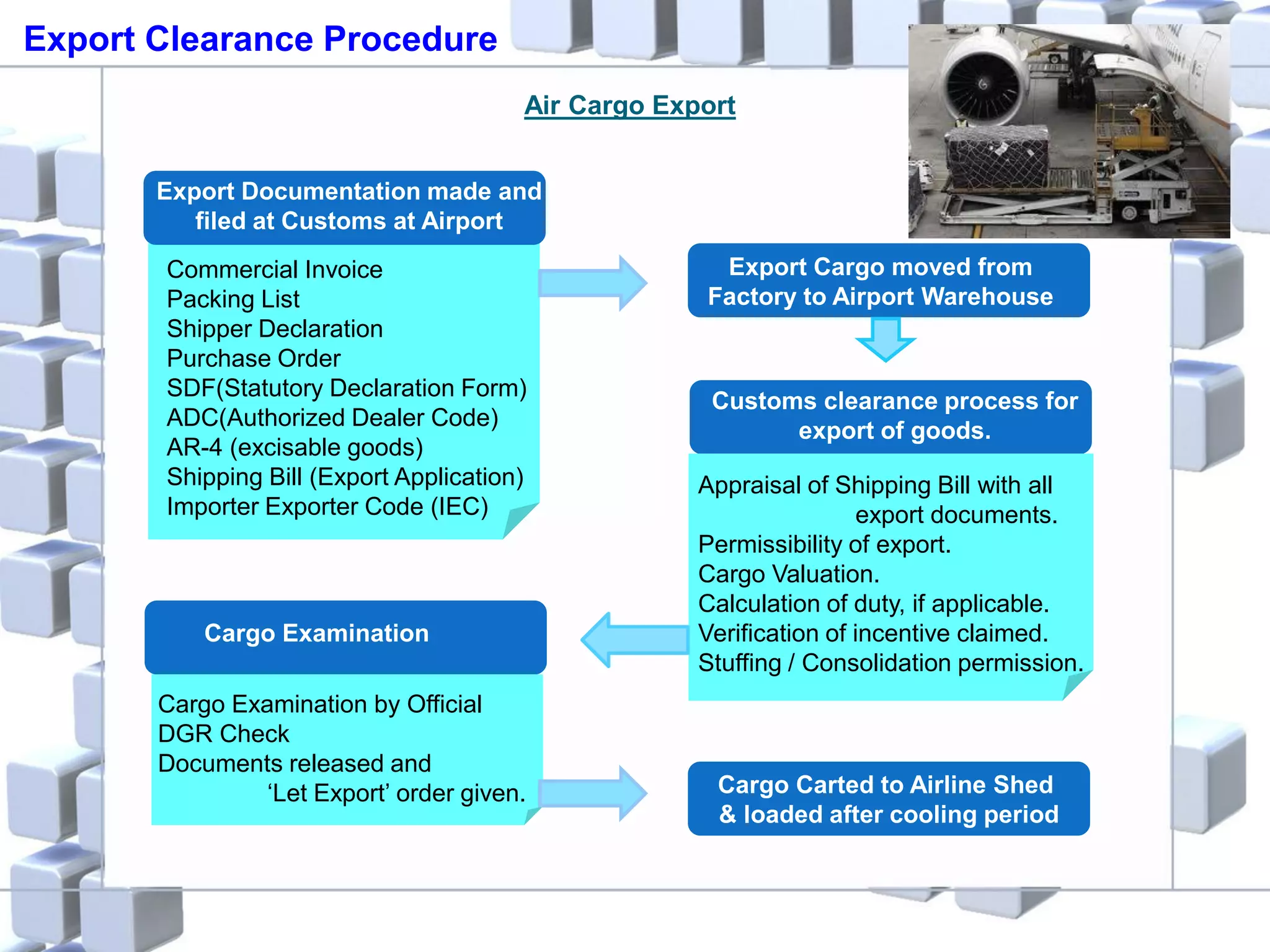

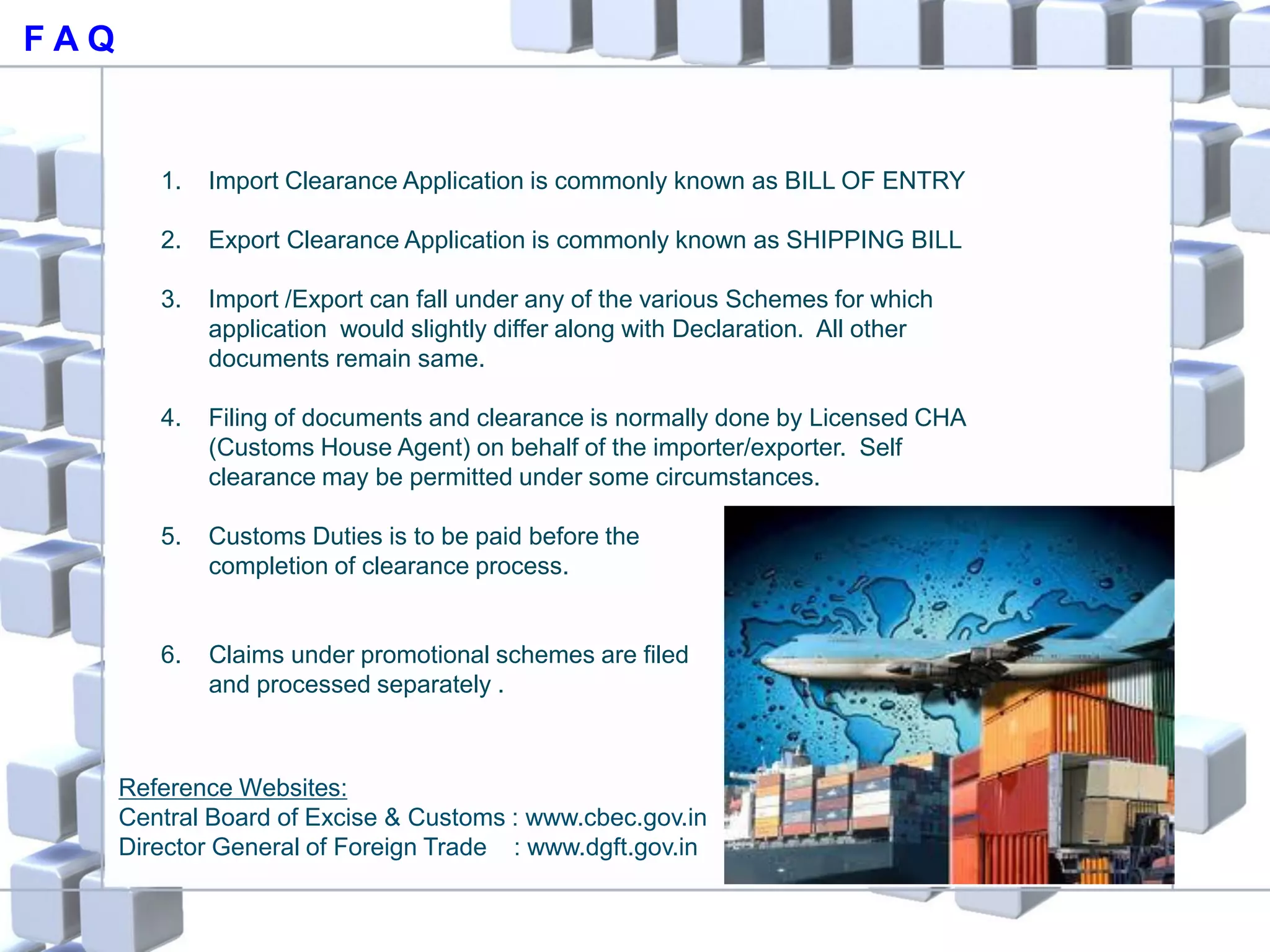

This document provides an overview of customs clearance procedures in India for imports and exports. It outlines the key steps, which include classifying goods, filing necessary documents such as a bill of entry or shipping bill, appraisal and assessment by customs officials, examination of cargo, payment of duties, and release of cargo. Goods are categorized as freely importable/exportable, restricted/licensed, prohibited, or canalized. The process varies slightly based on clearance for home consumption, warehousing, inland container depots, factory stuffing, dock/CFS stuffing, or air cargo but involves similar core steps and documentation requirements.