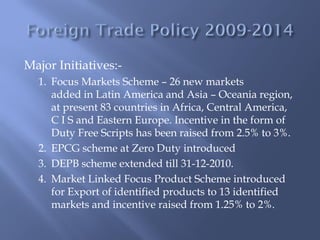

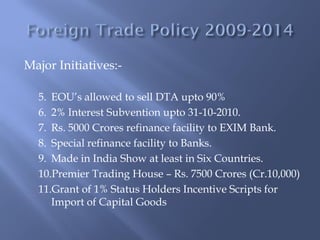

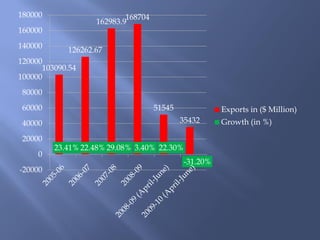

1. The document discusses various export initiatives and targets in India including adding new focus markets, duty incentives, and increasing annual export growth targets.

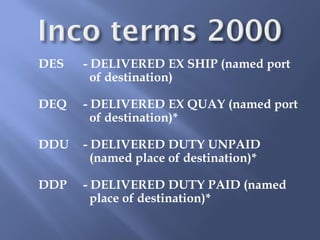

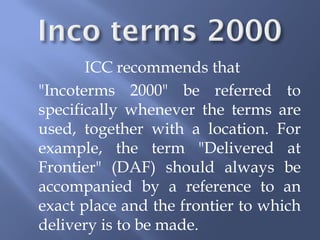

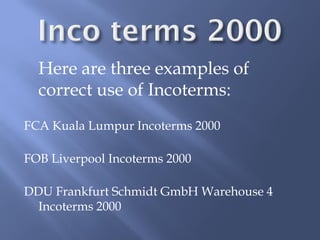

2. It also covers important elements of executing export orders properly such as agreeing on terms, product details, payment and delivery terms, and establishing a confirmed order in writing.

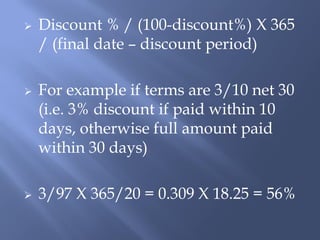

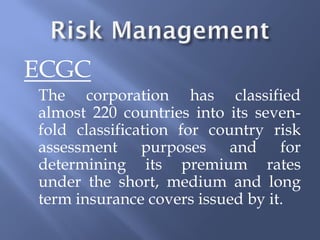

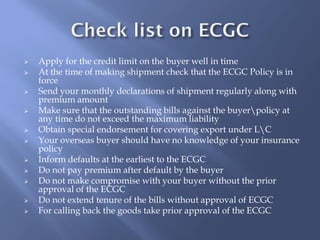

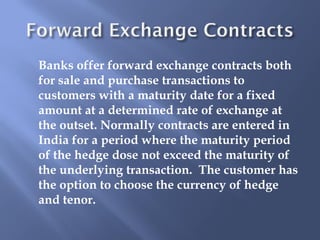

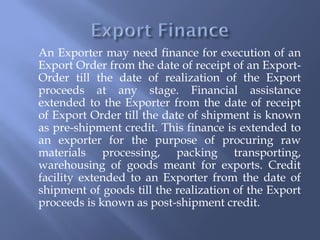

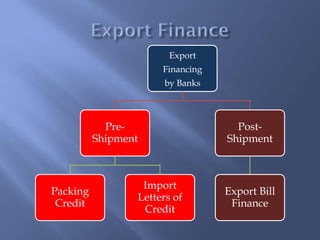

3. Key considerations for working capital management in exports are discussed such as managing receivables, inventory, costs of funds, discounts, and the role of ECGC export credit insurance.