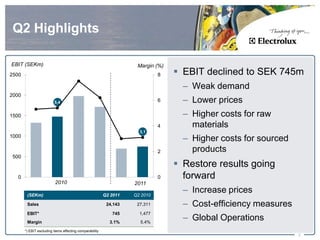

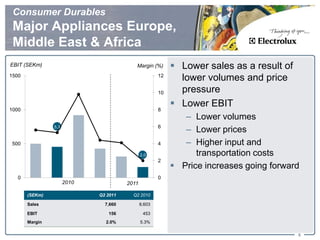

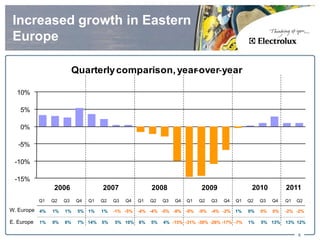

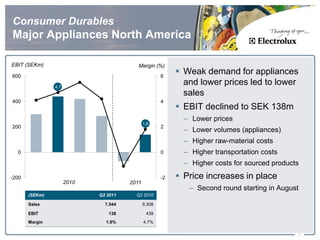

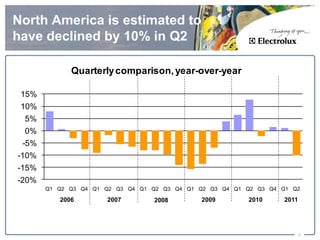

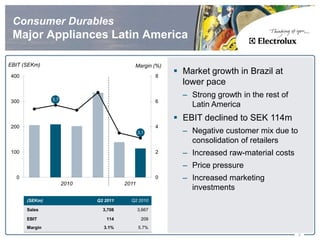

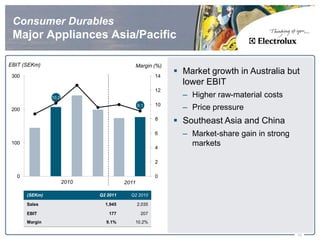

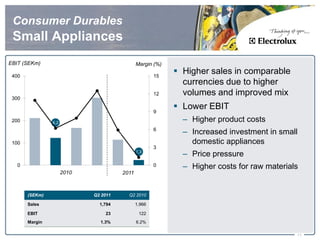

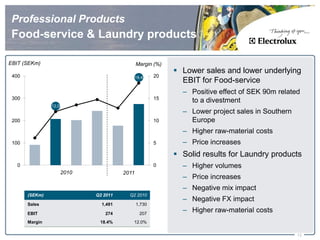

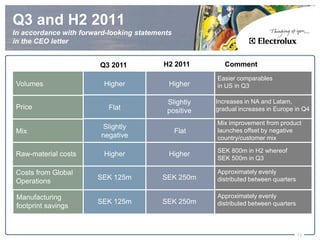

Electrolux's Q2 2011 results showed a decline in EBIT to SEK 745 million due to weak demand, lower prices, and increased costs, resulting in a margin of 3.1%. The company announced the acquisition of Olympic Group to bolster growth in emerging markets and reported a noticeable deterioration in consumer durables sales across various regions, while cash flow showed structural improvements. Future projections highlight expected price increases and operational adjustments to combat ongoing cost pressures.