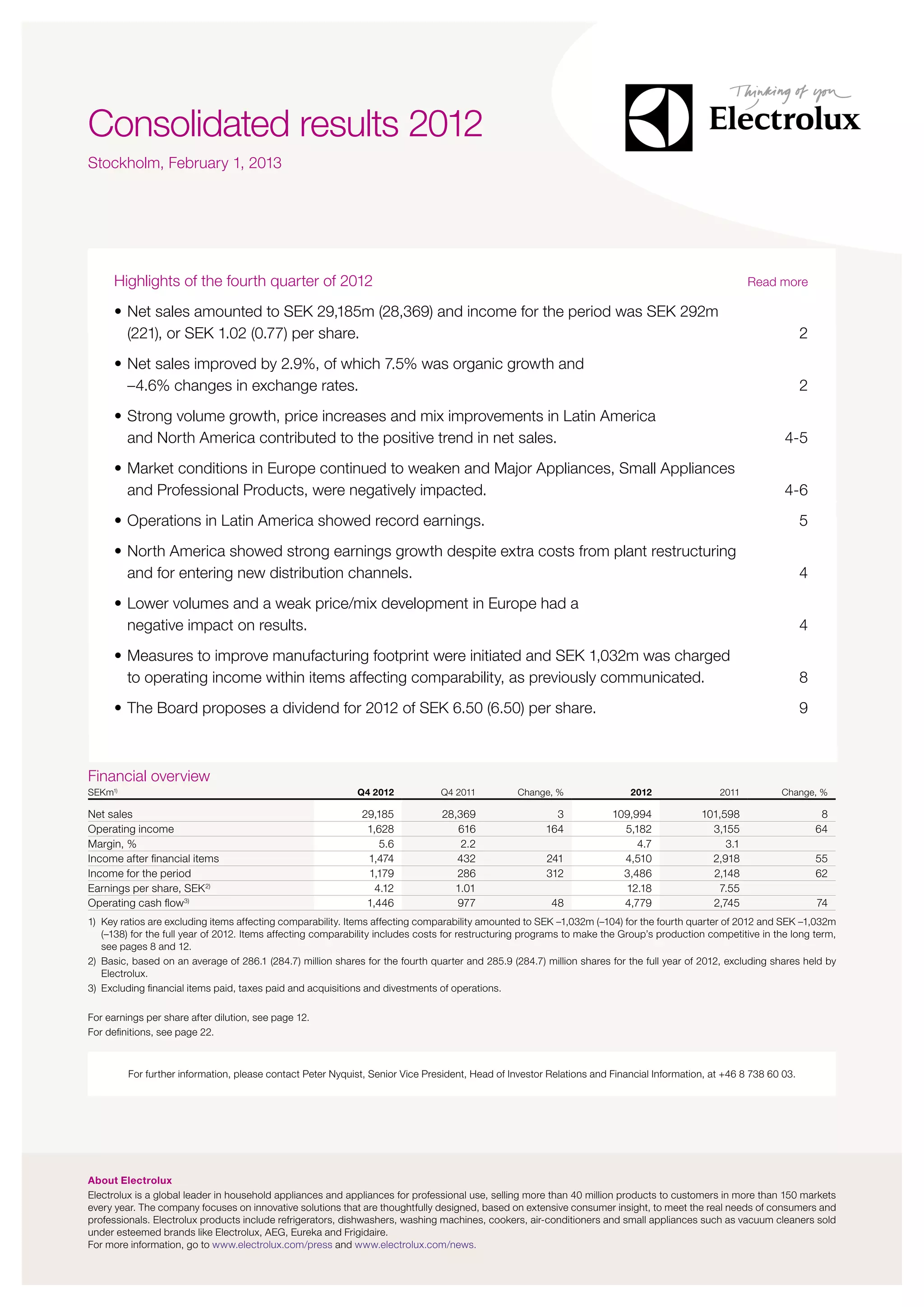

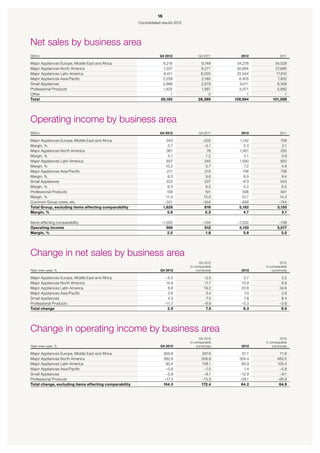

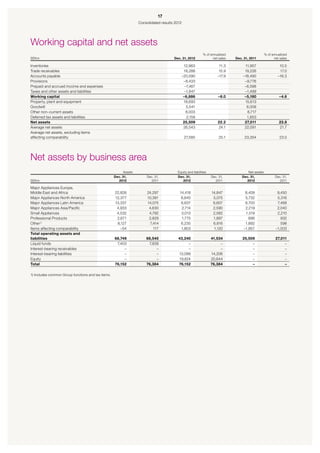

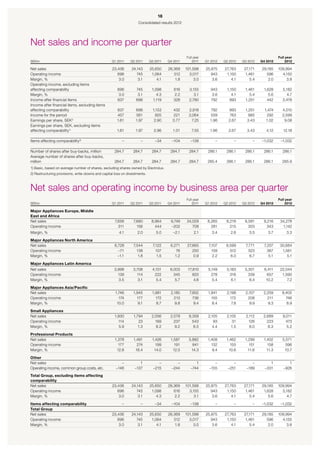

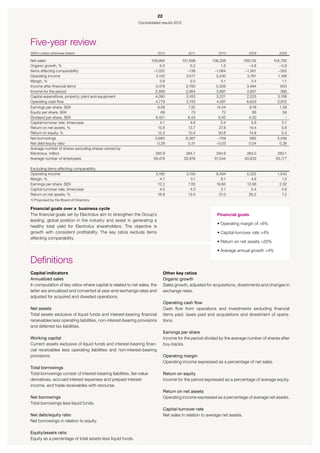

In the fourth quarter of 2012, Electrolux reported net sales of SEK 29,185 million and income of SEK 292 million, with organic growth of 7.5% and notable performance in North America and Latin America. However, European market conditions weakened, negatively impacting sales and operating income in that region. The company plans to initiate measures to improve its manufacturing footprint, and a dividend of SEK 6.50 per share is proposed for 2012.