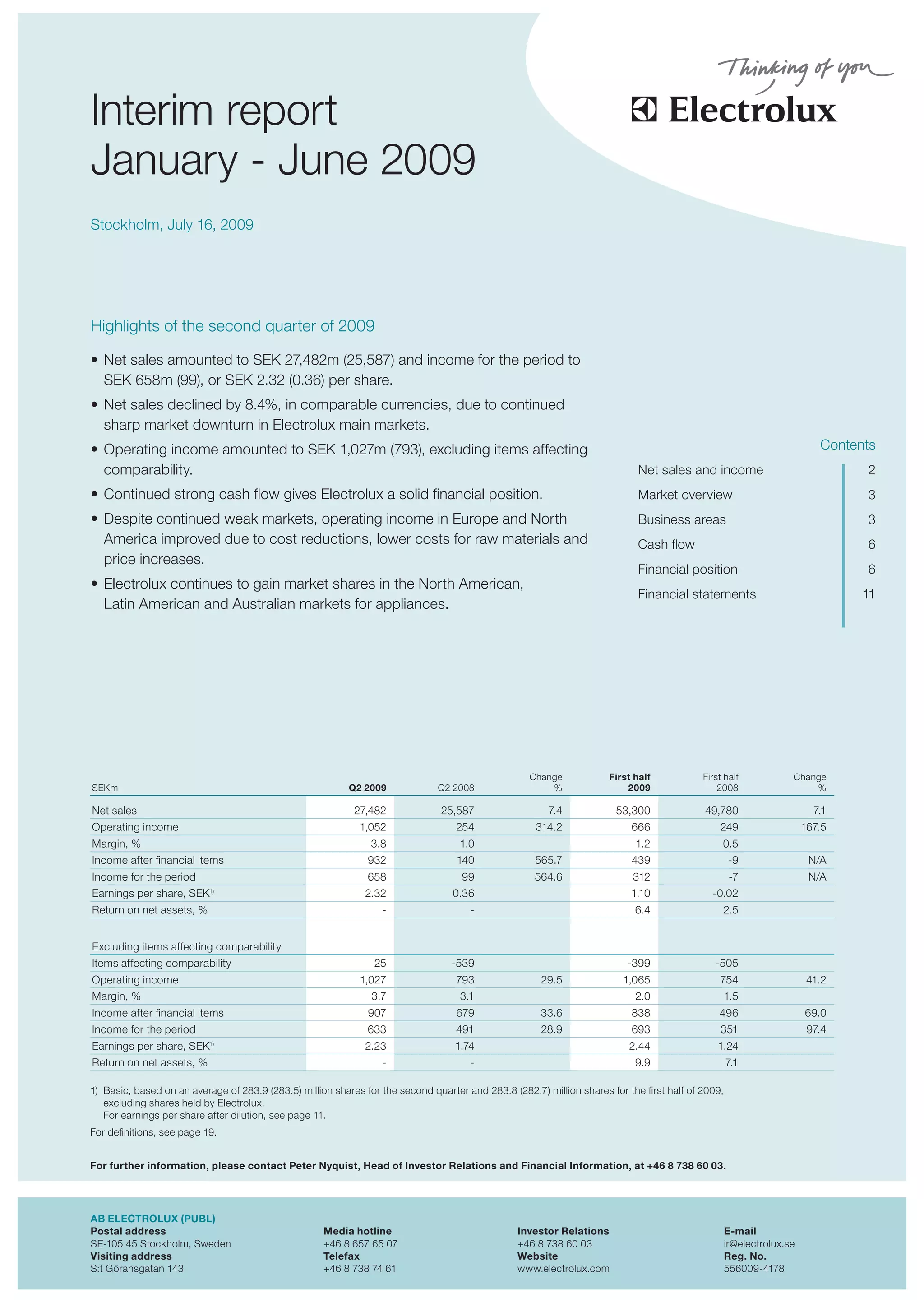

Electrolux reported net sales of SEK 27,482 million for Q2 2009, an increase from SEK 25,587 million in Q2 2008, despite a decline of 8.4% in comparable currencies due to market downturns. Operating income improved to SEK 1,052 million compared to SEK 254 million the previous year, driven by cost reductions and lower raw material costs. The company continues to gain market share in North America and Latin America, although overall market demand for appliances remains weak.

![19

Interim report January - June 2009

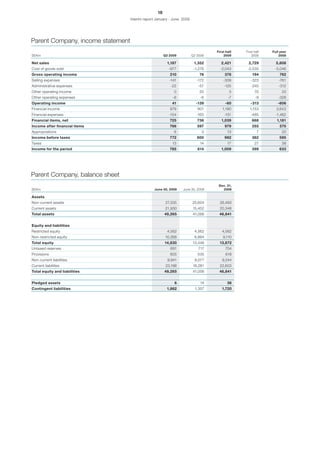

Five-year review

Including Husqvarna

2008 2007 2006 2005 2005 2004¹)

Net sales, SEKm 104,792 104,732 103,848 100,701 129,469 120,651

Operating income, SEKm 1,188 4,475 4,033 1,044 3,942 4,807

Margin, % 1.1 4.3 3.9 1.0 3.0 4.0

Margin, excluding items affecting

comparability, % 1.5 4.6 4.4 4.0 5.4 5.6

Income after financial items, SEKm 653 4,035 3,825 494 3,215 4,452

Margin, % 0.6 3.9 3.7 0.5 2.5 3.7

Margin, excluding items

affecting comparability, % 1.0 4.2 4.2 3.4 4.8 5.3

Income for the period, SEKm 366 2,925 2,648 -142 1,763 3,259

Earnings per share, SEK 1.29 10.41 9.17 -0.49 6.05 10.92

Average number of shares after

buy-backs, million 283.1 281.0 288.8 291.4 291.4 298.3

Dividend, SEK - 4.25 4.00 7.50 7.50 7.00

Value creation, SEKm -1,040 2,053 2,202 1,305 2,913 3,054

Return on equity, % 2.4 20.3 18.7 - 7.0 13.1

Return on net assets, % 5.8 21.7 23.2 5.4 13.0 17.5

Net debt/equity ratio 0.28 0.29 -0.02 - 0.11 0.05

Capital expenditure, SEKm 3,158 3,430 3,152 3,654 4,765 4,515

Average number of employees 55,177 56,898 55,471 57,842 69,523 72,382

1) Restated to comply with IFRS, except for IAS 39. If IAS 39 had been applied in 2004, the volatility in income,

net borrowings and equity would most probably have been higher.

Definitions

Capital indicators Other key ratios

Annualized sales Earnings per share

In computation of key ratios where capital is related to net sales, the Income for the period divided by the average number of shares after

latter are annualized and converted at year-end-exchange rates buy-backs.

and adjusted for acquired and divested operations.

Operating margin

Net assets Operating income expressed as a percentage of net sales.

Total assets exclusive of liquid funds and interest-bearing financial

receivables less operating liabilities, non-interest-bearing provisions EBITDA

and deferred tax liabilities. Operating income before depreciation and amortization.

Working capital Value creation

Current assets exclusive of liquid funds and interest-bearing finan- Operating income excluding items affecting comparability less the

cial receivables less operating liabilities and non-interest-bearing weighted average cost of capital (WACC) on average net assets

provisions. excluding items affecting comparability: [(Net sales – operating

costs = operating income) – (WACC x average net assets)]. The

Net borrowings WACC rate before tax for 2009, 2008 and 2007 is calculated at 12%

Total borrowings less liquid funds. compared to 11% for 2006, 12% for 2005 and 2004.

Net debt/equity ratio Return on equity

Net borrowings in relation to equity. Income for the period expressed as a percentage of average

equity.

Equity/assets ratio

Equity as a percentage of total assets less liquid funds. Return on net assets

Operating income expressed as a percentage of average net

assets.](https://image.slidesharecdn.com/electrolux-2009-q2-report-100712103242-phpapp02/85/Electrolux-Interim-Report-Q2-2009-19-320.jpg)