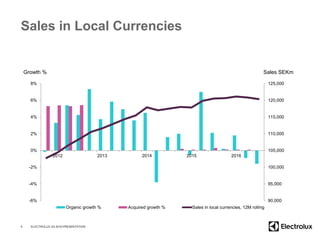

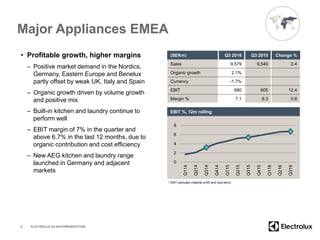

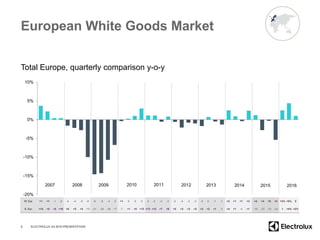

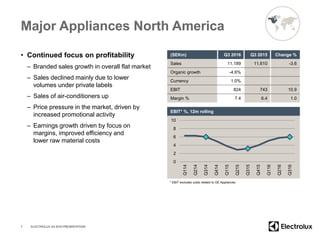

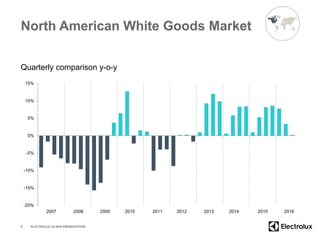

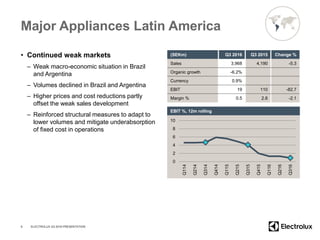

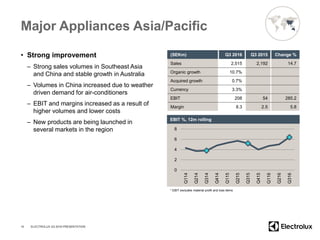

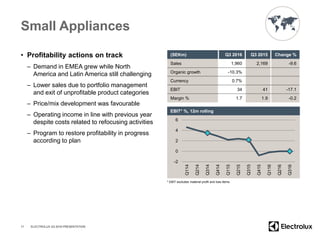

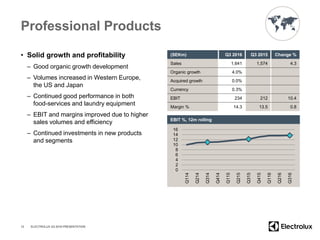

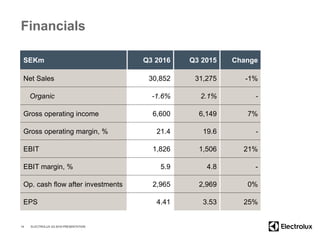

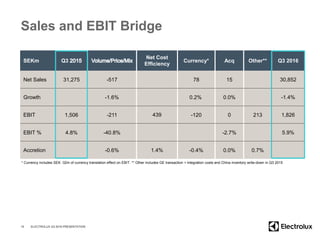

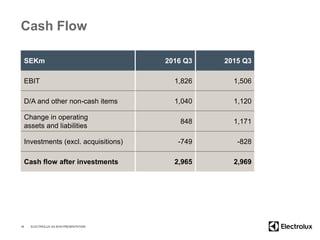

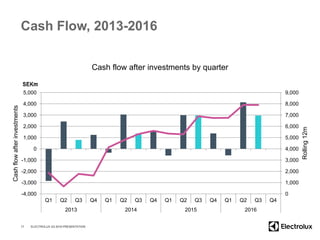

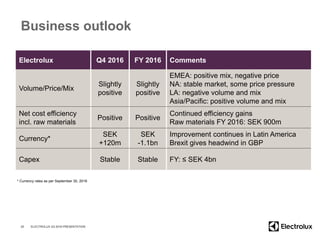

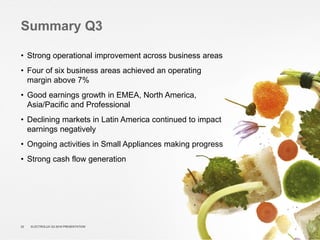

In Q3 2016, Electrolux reported a sales decline of 1.4% compared to Q3 2015, with strong performance in EMEA, North America, Asia/Pacific, and professional products, while Latin America continued to face challenges. The company achieved an EBIT margin of 5.9%, largely due to improved efficiencies and strong cash flow generation. Although the market outlook shows slight growth in several regions, economic uncertainties persist, particularly in Latin America and Brexit-related impacts in the UK.