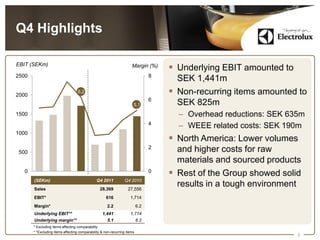

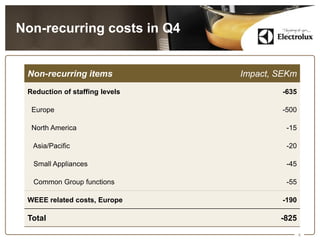

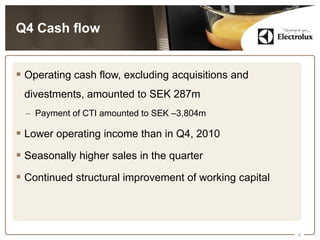

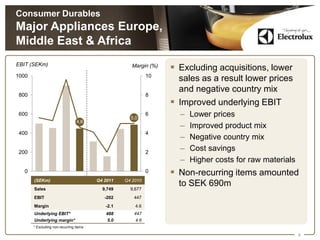

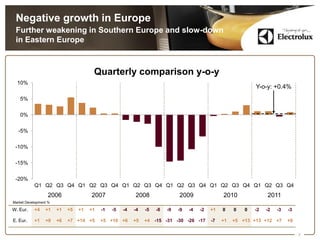

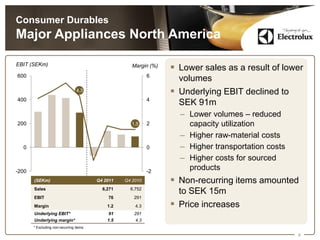

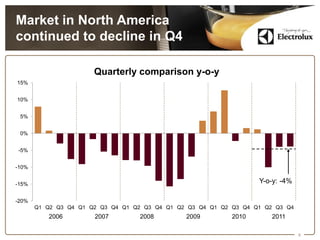

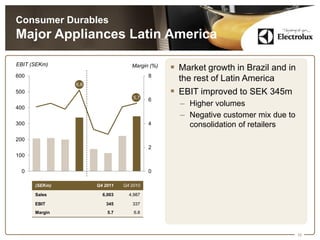

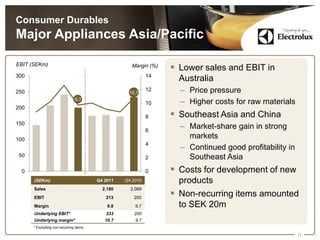

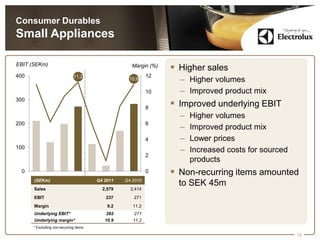

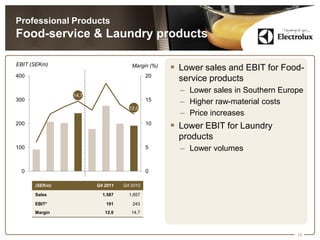

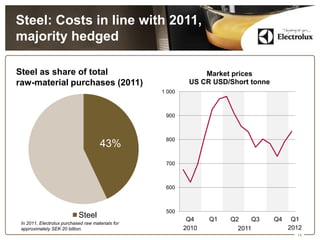

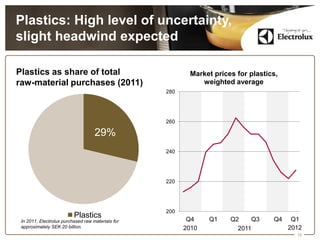

In 2011, Electrolux faced challenges such as price pressure and weak demand, particularly in mature markets, while managing to achieve an underlying EBIT of SEK 4 billion. The company successfully adapted production capacity, reduced overhead costs, and made significant acquisitions, all contributing to strong underlying cash flow. Q4 results showed an underlying EBIT decline due to lower volumes and increased raw material costs, along with non-recurring items affecting overall profitability.