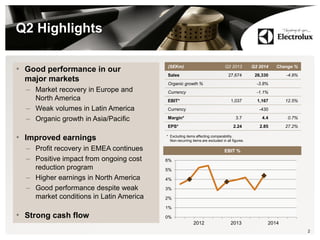

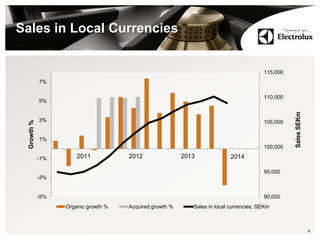

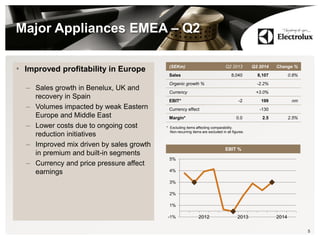

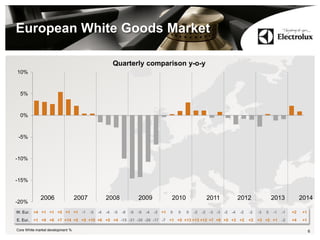

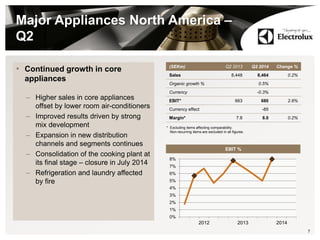

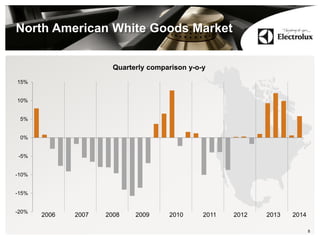

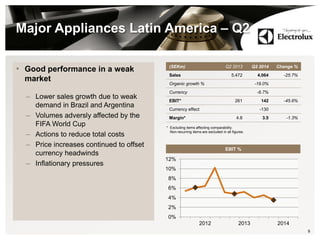

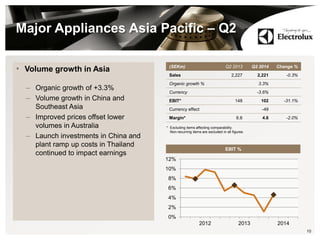

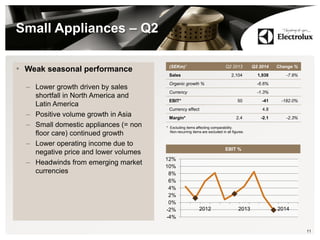

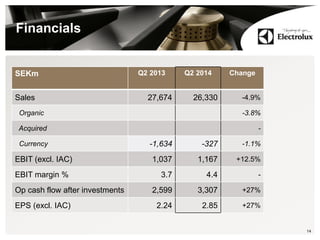

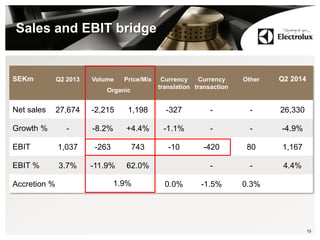

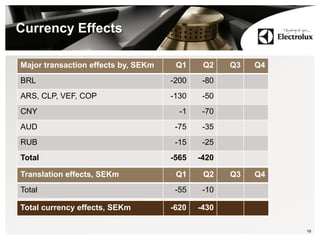

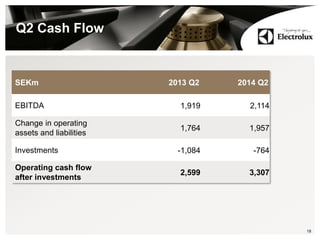

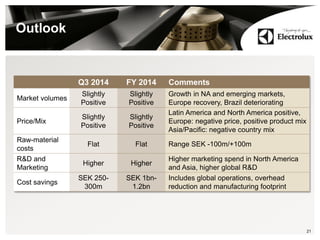

The Q2 2014 report for Electrolux shows a sales decline of 4.9% compared to Q2 2013, with improved EBIT margins attributed to cost reductions and better profitability in core markets, particularly North America and Europe. Despite challenges in Latin America, where sales dropped significantly, there was organic growth in Asia and strong performance in professional products. The outlook for Q3 and FY 2014 remains cautiously optimistic with positive market volume expectations in North America and emerging markets, while acknowledging ongoing pressures in Brazil.