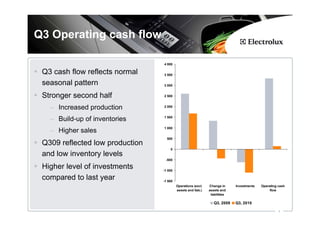

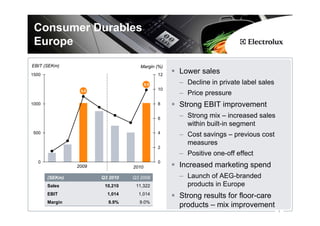

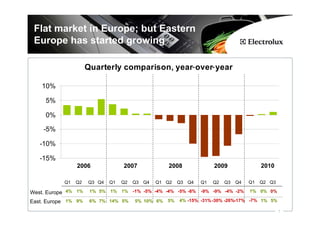

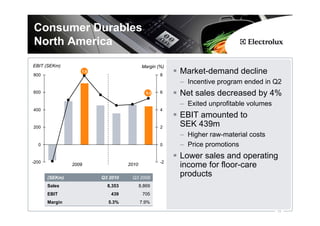

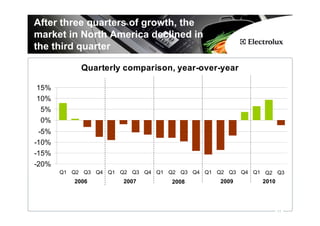

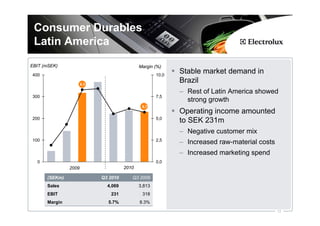

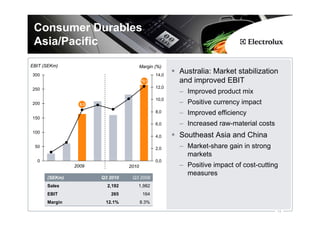

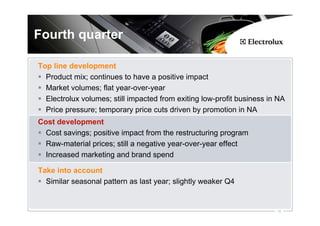

The Q3 results from Electrolux show a slight decrease in net sales and EBIT margin but highlight the company's ongoing growth strategies, including acquisitions and operational improvements. The company has made significant strides in emerging markets, particularly in Egypt and Eastern Europe, and aims to achieve a 6% operating margin by year-end. Challenges such as raw material cost increases and market demand fluctuations in North America are noted, alongside strong performances in Asia and Latin America.