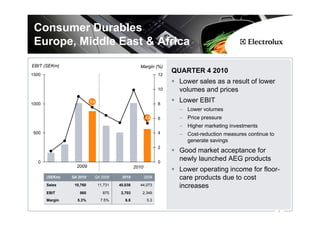

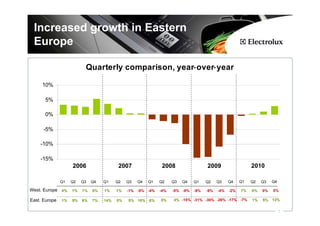

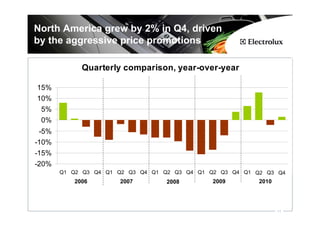

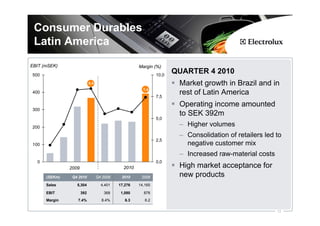

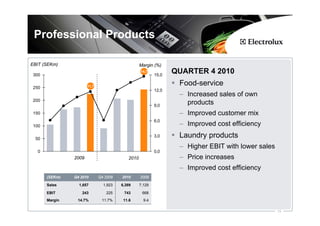

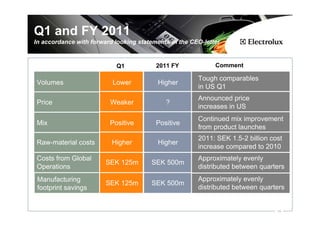

The document presents the financial results and operational highlights of Electrolux for Q4 2010, noting a net sales increase of 7.2% and an EBIT margin decline due to raw material challenges and price pressures. It highlights the company's performance in various regions, including growth in Latin America and Asia/Pacific, while facing declines in Europe and North America. Forward-looking statements indicate expectations for future pricing and cost dynamics amid market uncertainties.