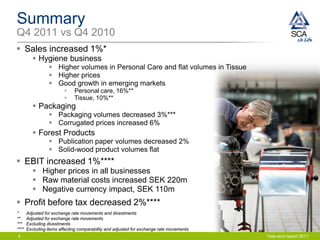

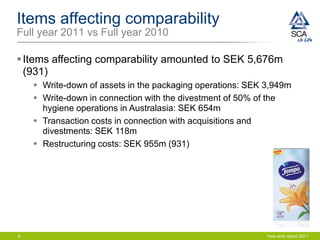

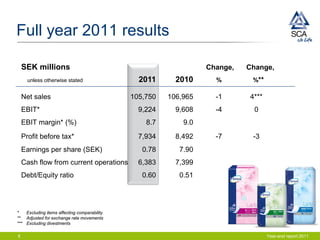

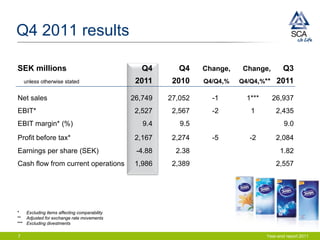

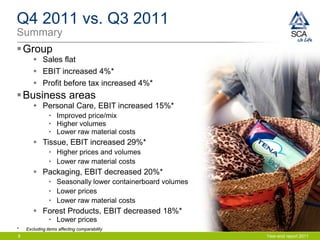

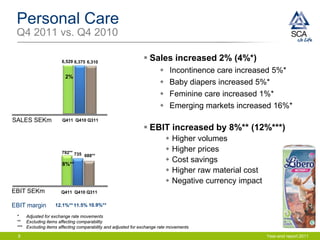

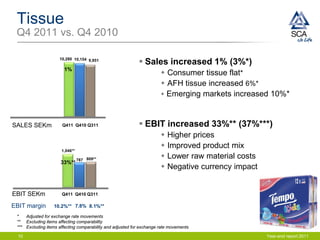

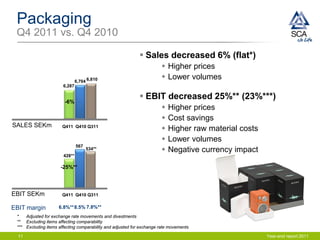

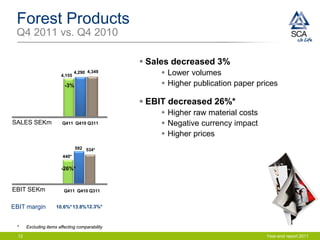

SCA reported its year-end results for 2011. Sales increased 4% over the previous year driven by higher volumes and prices in the hygiene business. EBIT remained flat due to higher raw material costs and currency impacts offsetting the increased sales and cost savings. Profit before tax decreased 3% for the full year. For the fourth quarter, sales increased 1% while EBIT grew 1% as higher prices were offset by increased raw material costs and currency effects. The company proposed a 5% increase in dividend and discussed several strategic acquisitions and divestments.