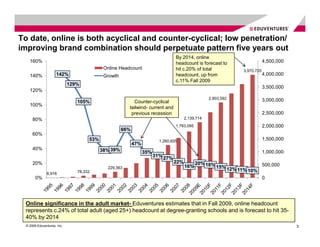

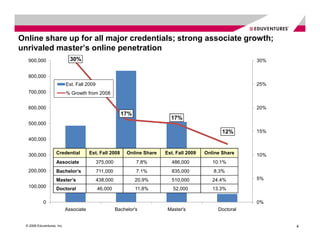

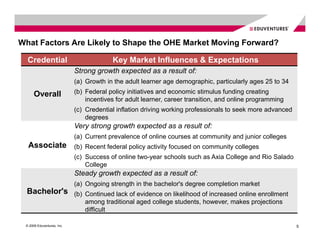

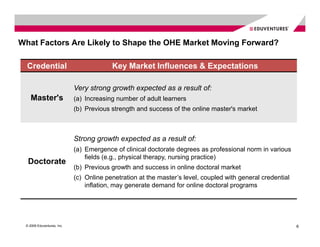

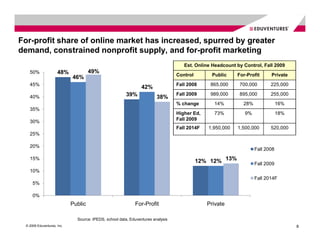

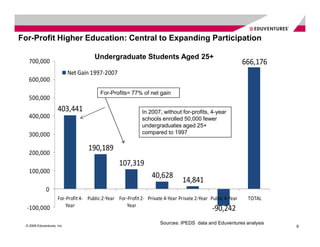

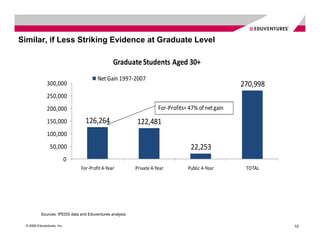

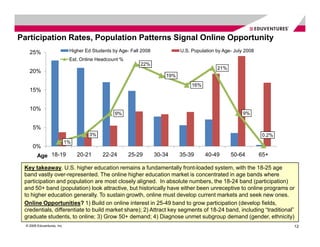

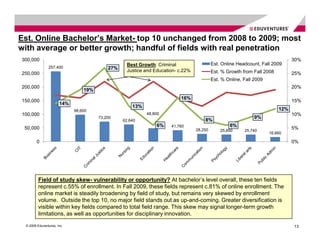

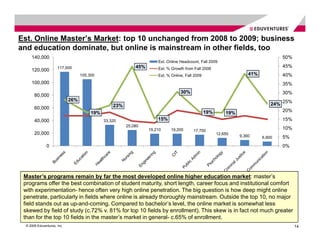

The document discusses the significant growth in the online higher education market, projecting a rise in online enrollment due to various factors like demographic trends and federal policy changes. It highlights the increasing role of for-profit institutions in expanding access and participation, particularly among adult learners. Additionally, it identifies key opportunities for online education providers to attract new demographics and develop programs in response to economic stimulus efforts.