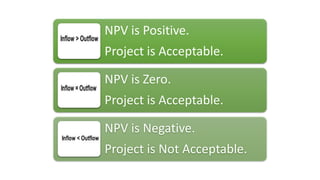

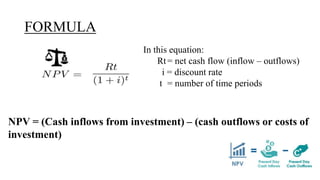

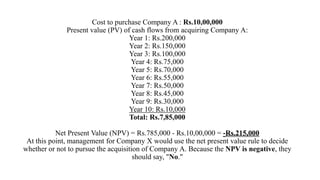

This document discusses net present value (NPV) as a method for evaluating investment projects. It defines NPV as the difference between the present value of cash inflows and outflows. Positive NPV means the project is acceptable, zero means it may be acceptable, and negative means it should be rejected. The document provides a formula for calculating NPV and an example of applying the method to evaluate acquiring another company. Advantages include accounting for the time value of money, while disadvantages include difficulty of use and determining accurate discount rates.