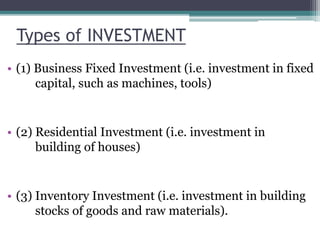

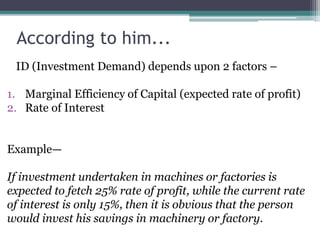

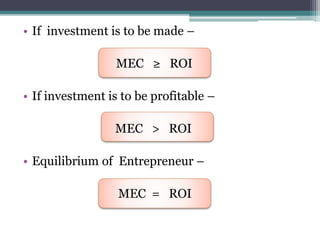

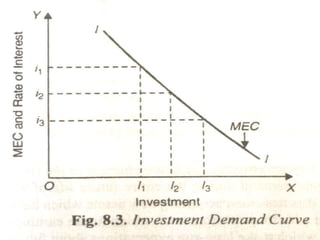

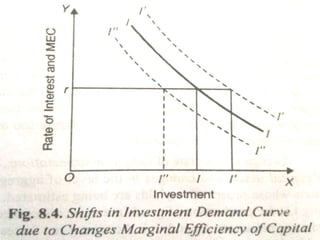

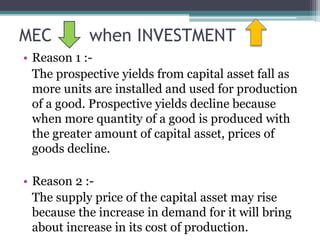

The document discusses investment, defining it as the creation of new capital assets that increase income and employment. It outlines types of investment, Keynes's theory on investment demand—which hinges on marginal efficiency of capital and interest rates—and factors that influence shifts in the investment demand curve such as technology, expected demand, and fiscal policies. Overall, the text emphasizes the role of credit availability and government spending in stimulating private investment.