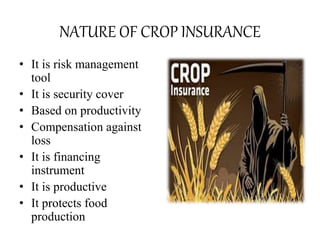

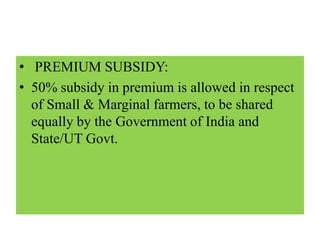

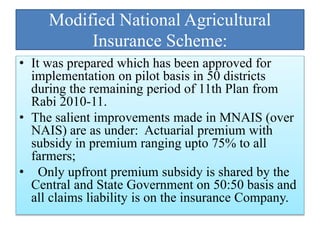

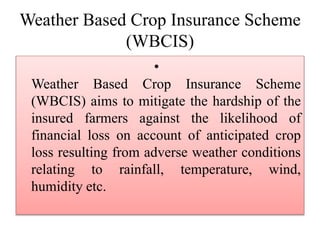

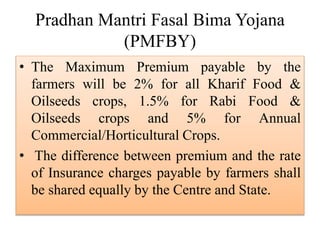

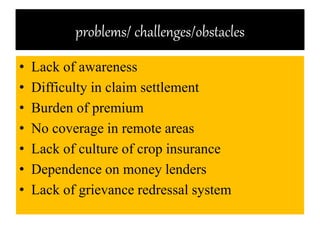

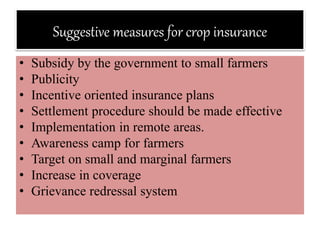

Crop insurance provides protection to farmers against losses from unexpected crop failures. It helps compensate for losses that could otherwise cause financial ruin. There are several types of crop insurance that farmers can purchase, including MPCI, APH, GRP, and CRC policies, which protect against losses from various weather events and price drops. Crop insurance plays an important role in Indian agriculture by reducing risks, compensating for losses, improving financial stability, and promoting rural development. However, there are also challenges to its adoption like lack of awareness, difficulties with claims, and lack of access in remote areas. Measures like subsidies, effective settlement procedures, and farmer education can help address these issues.