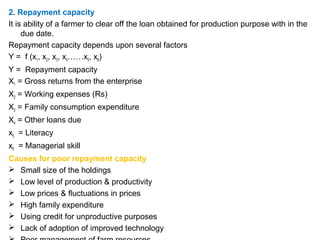

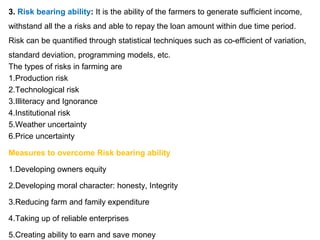

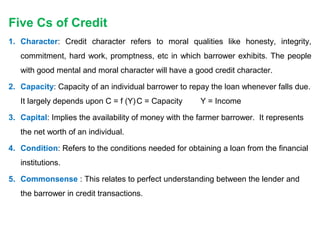

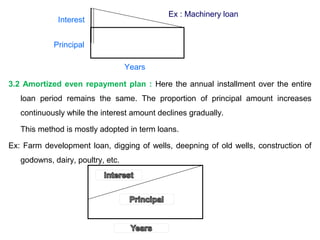

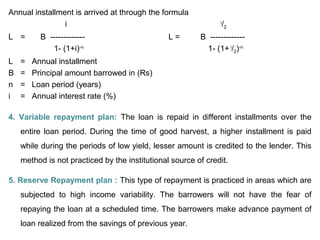

The document discusses guidelines for bankers to analyze credit applications from farmers in India. It outlines factors to consider like returns from investment, repayment capacity, and risk bearing ability. Repayment capacity depends on gross returns, expenses, consumption, other loans, skills. It also discusses the 5 Cs, 7 Ps, and different repayment plans for loans like lump sum, amortized decreasing/even, and variable plans. The key points are evaluating the viability and risks of proposed investments, a farmer's ability to repay based on their financial situation, and choosing appropriate loan repayment structures.