The Lead Bank Scheme, initiated by the RBI in 1969, designates a bank with the most branches in a district to coordinate credit flow to priority sectors and weaker sections of the economy. The scheme involves a two-phase approach: surveying banking potential in the district and preparing credit plans to enhance productivity and support employment. It aims to empower lead banks as key players in rural development by formulating loan schemes and fostering collaboration among various banks.

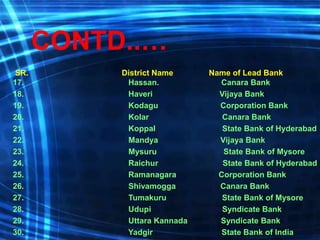

![District Wide Lead Bank List Of Karnataka

State

SR. District Name Name of Lead Bank

1. Bagalkot Syndicate Bank

2 Bengaluru [Rural] Canara Bank

3. Bengaluru [Urban] Canara Bank

4. Belagavi Syndicate Bank

5. Ballari Syndicate Bank

6. Bidar State Bank of India

7. Vijayapura Syndicate Bank

8. Chamarajanagara State Bank of Mysore

9. Chickballapura Canara Bank

10. Chickmagalur Corporation Bank

11. Chitradurga Canara Bank

12. Dakshina Kannada Syndicate Bank

13. Davanager Canara Bank

14. Dharwad Vijaya Bank

15. Gadag State Bank of India

16. Gulbarga State Bank of India](https://image.slidesharecdn.com/leadbankschemeashwinimam-211126093052/85/Lead-bank-scheme-12-320.jpg)