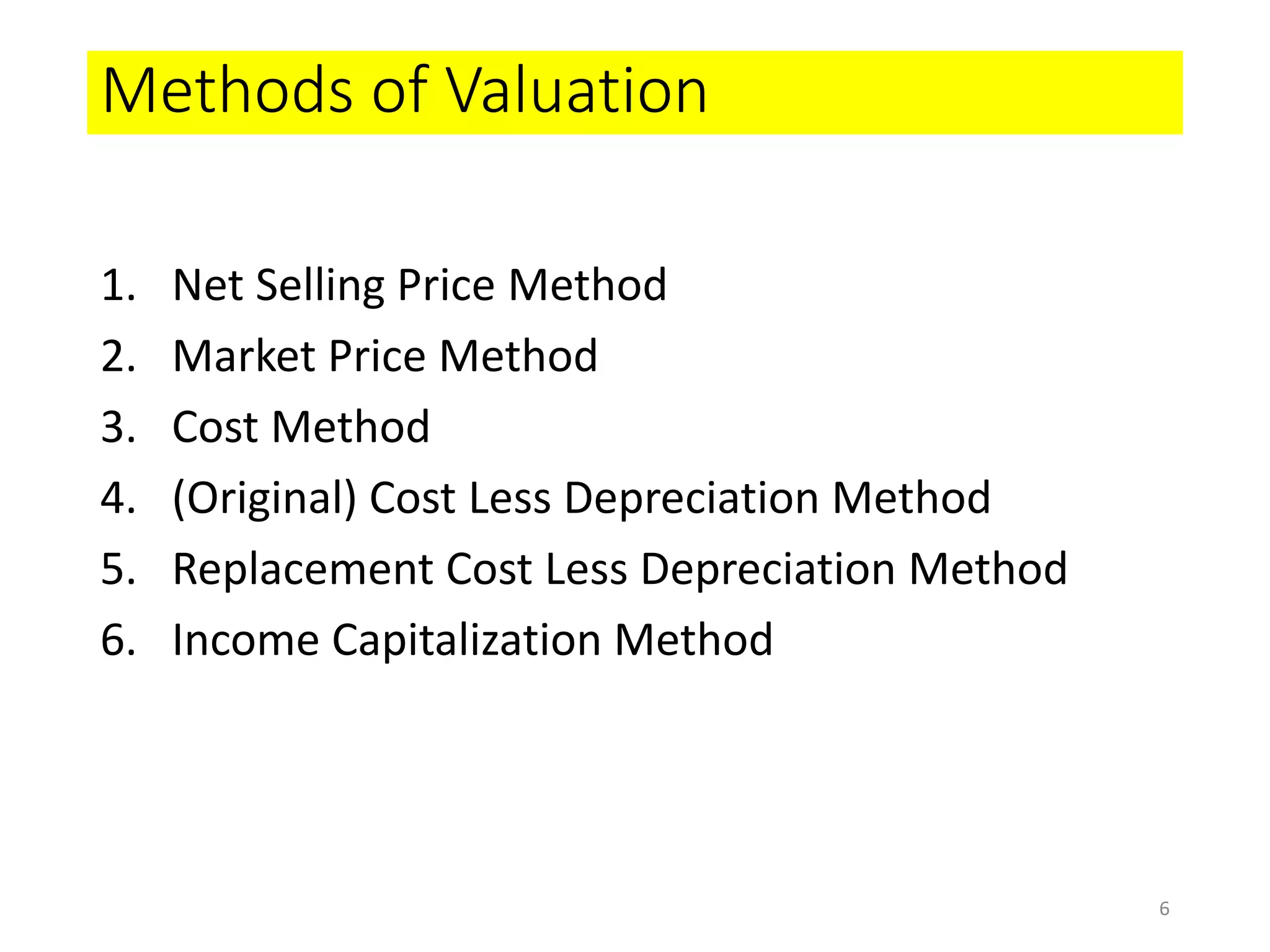

The document discusses the importance and procedures of farm inventory, which includes a complete list of all physical property and their values at a specific date, serving as the basis for financial statements. It outlines the step-by-step process for preparing and valuing the inventory, as well as various valuation methods such as net selling price and cost methods. Additionally, it emphasizes the significance of comparing inventories at the beginning and end of the year to determine appreciation, depreciation, profit, or loss.