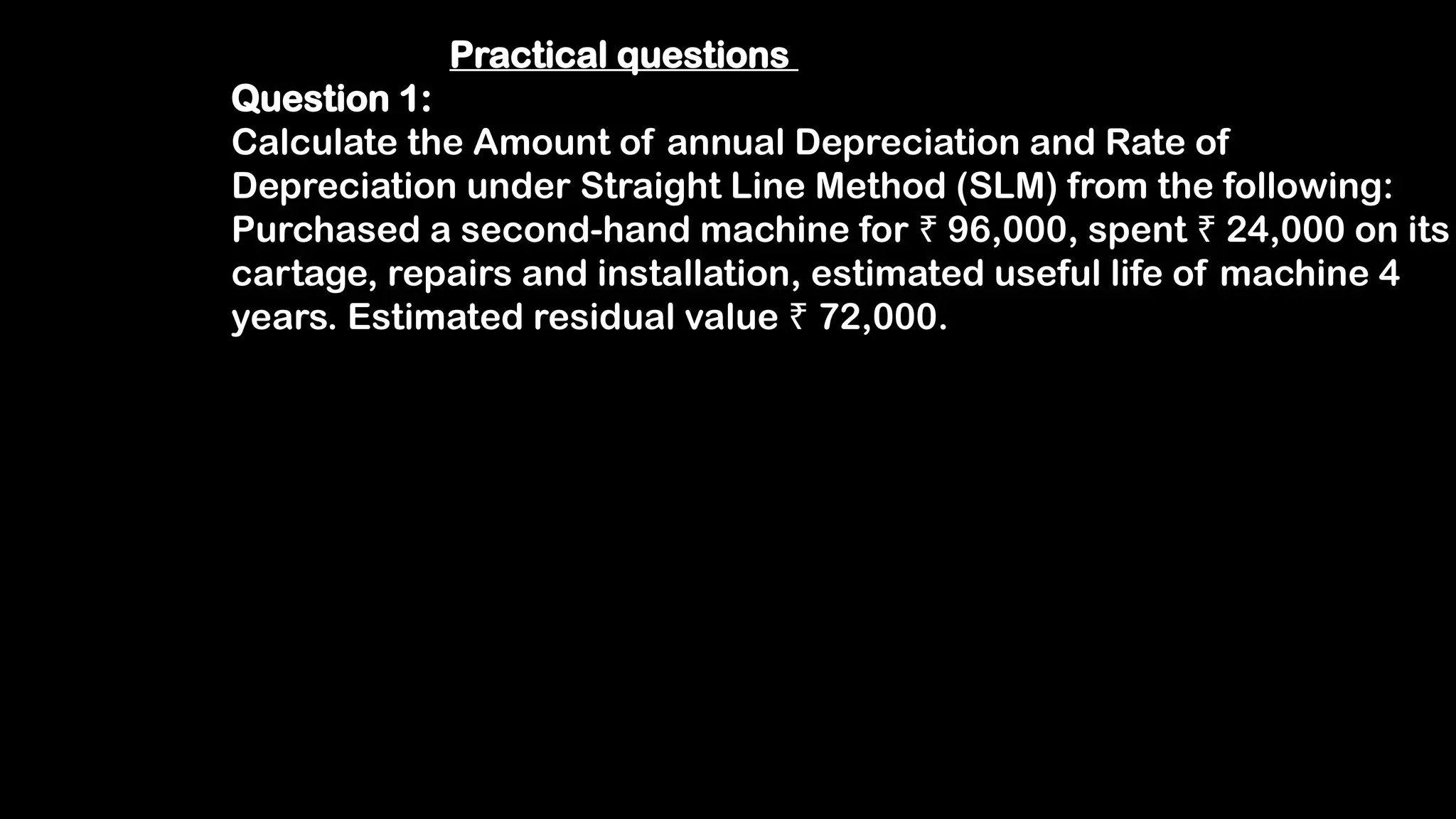

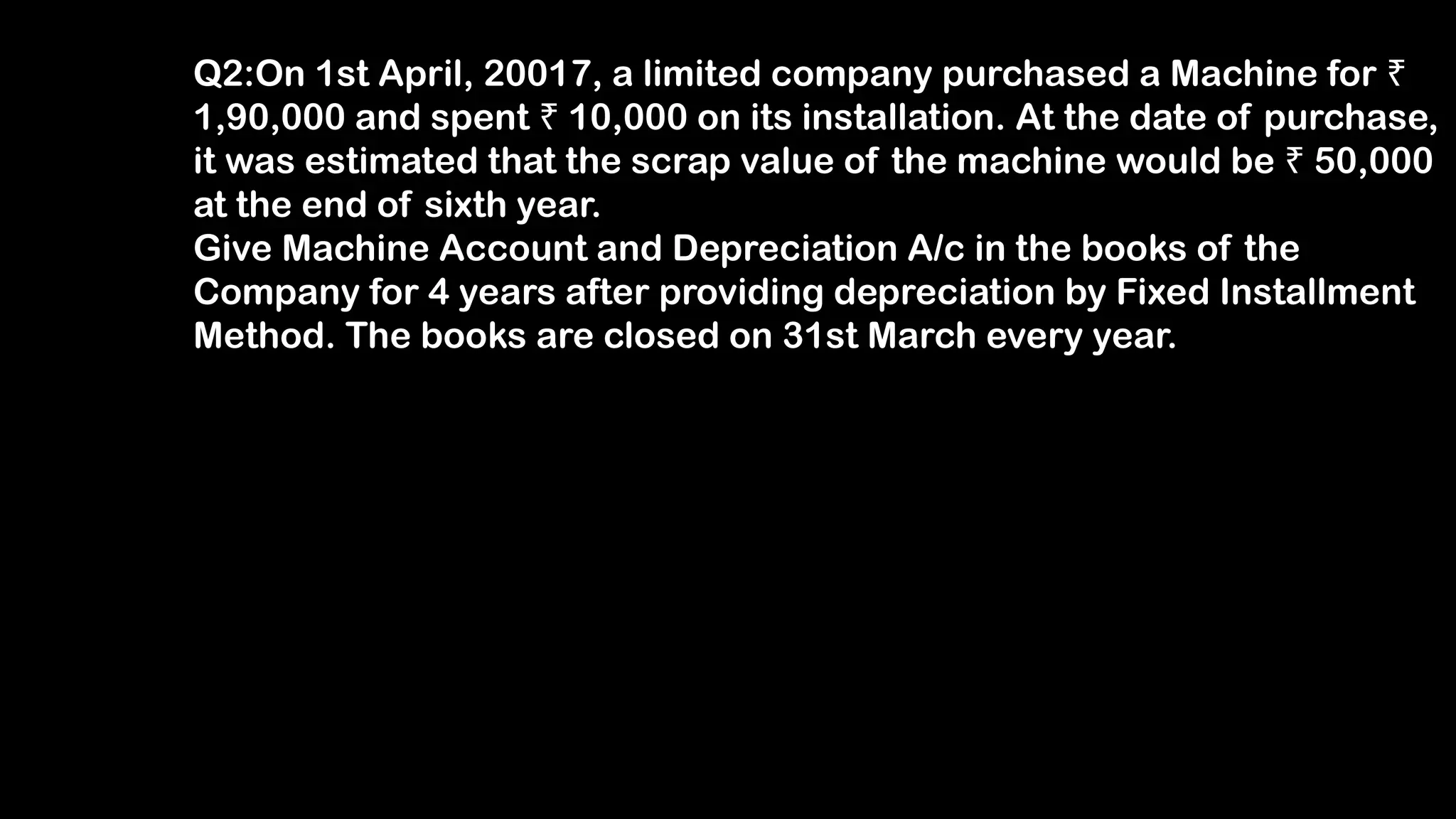

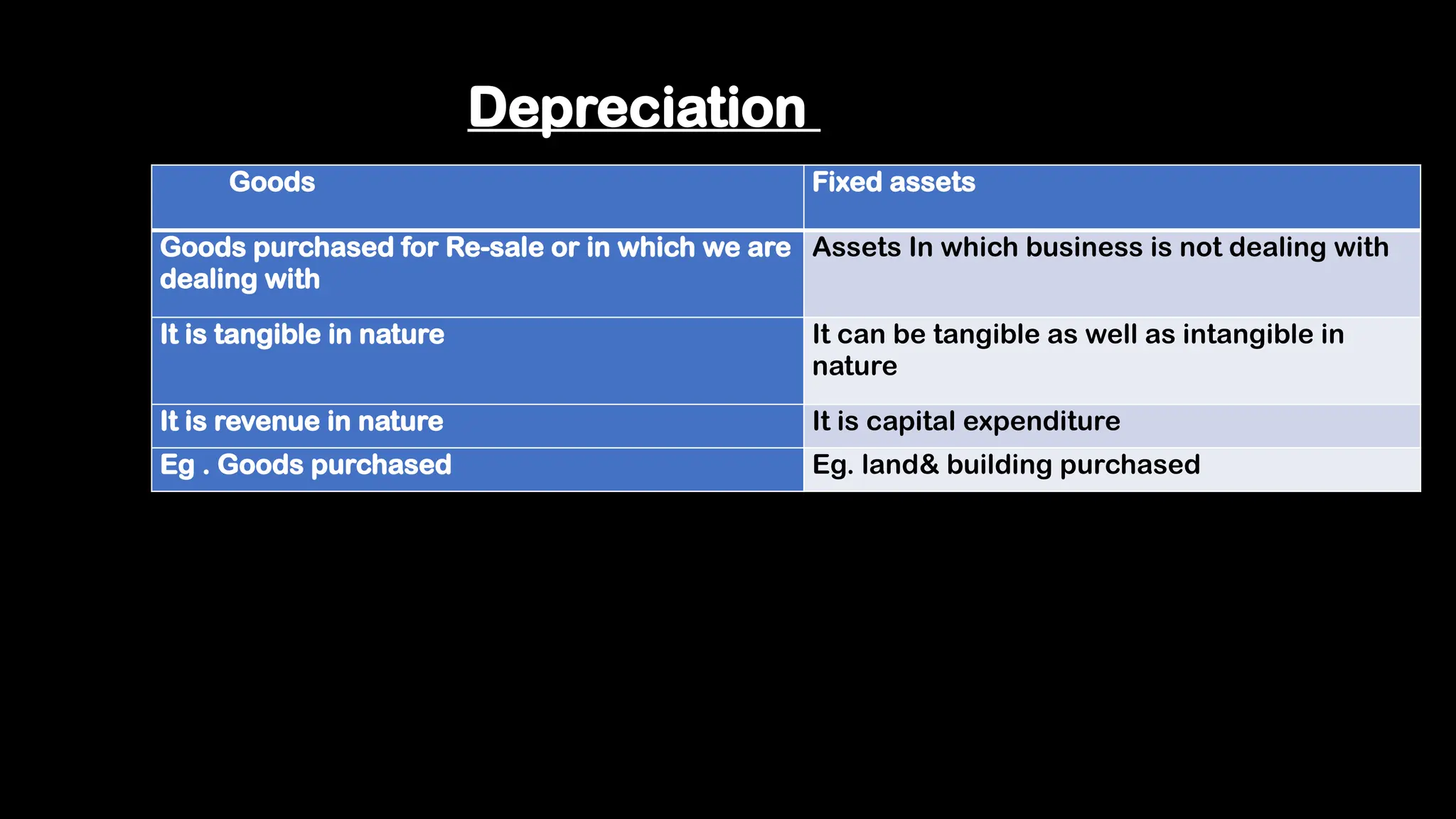

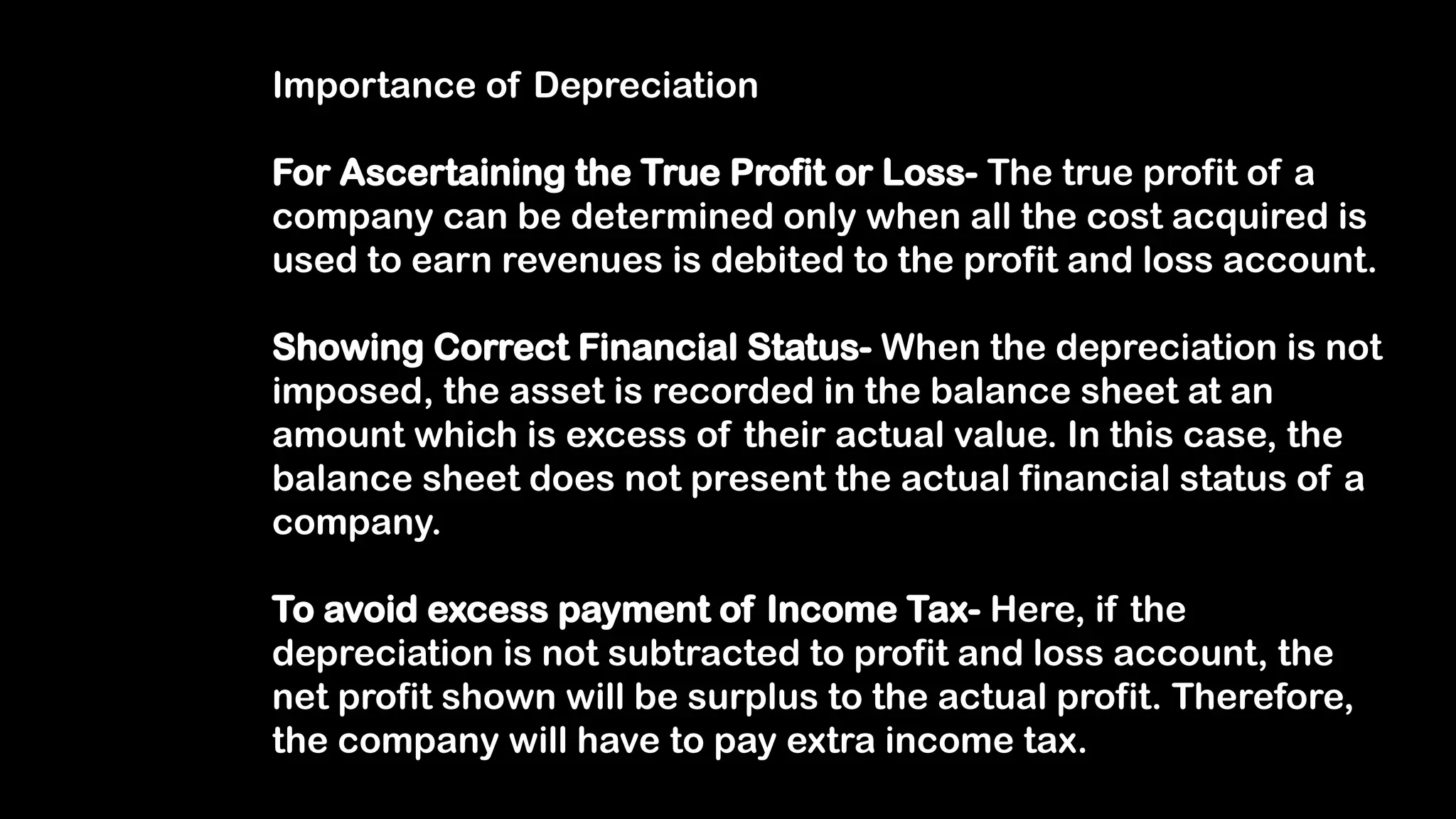

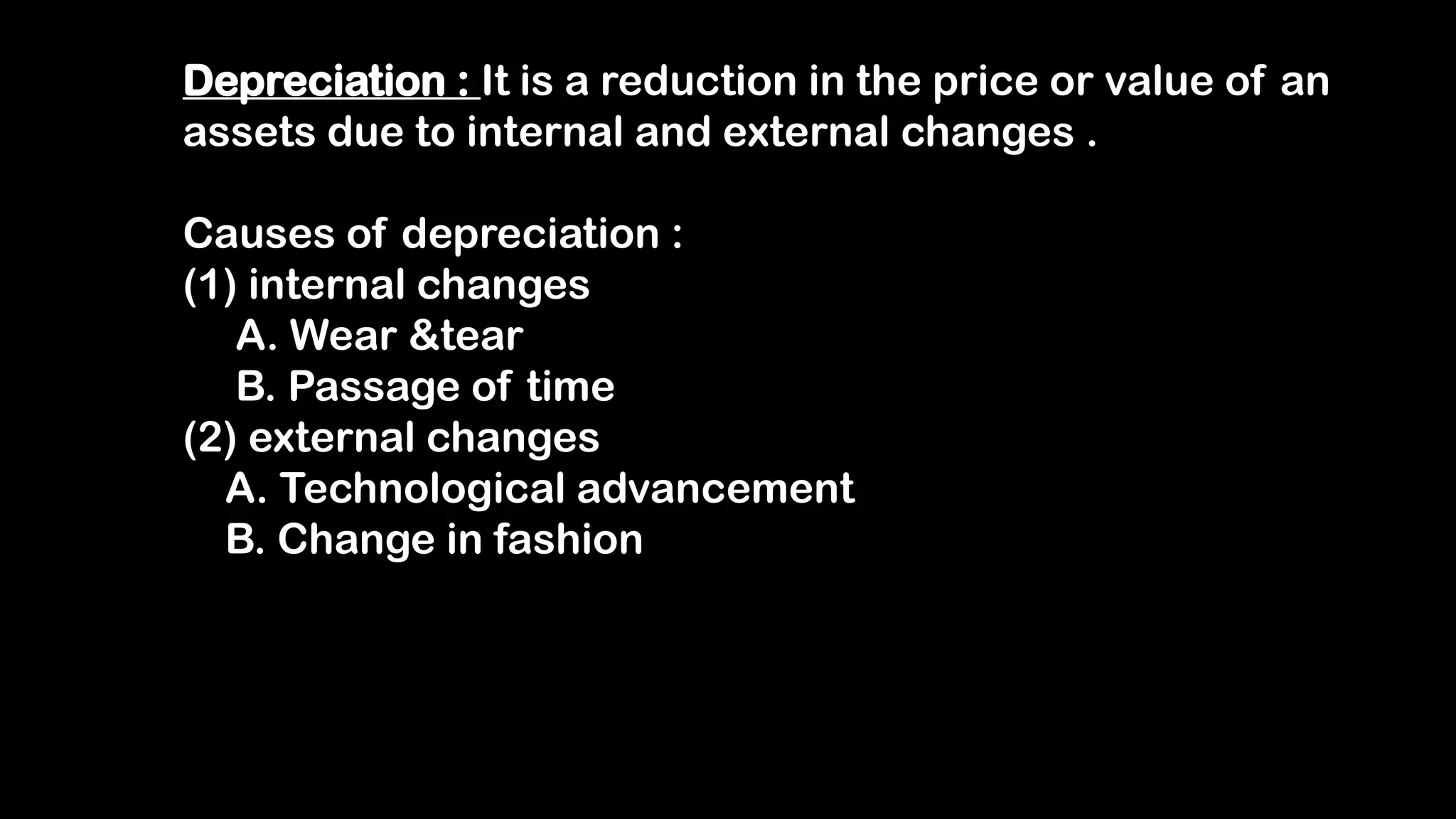

The document discusses depreciation, detailing its importance for determining true profit, correcting financial status, and reducing income tax liabilities. It explains two primary methods of calculating depreciation: the straight line method and the written down value method, along with journal entries and practical questions for illustration. Additionally, it outlines causes of depreciation and provides examples for annual depreciation calculations.

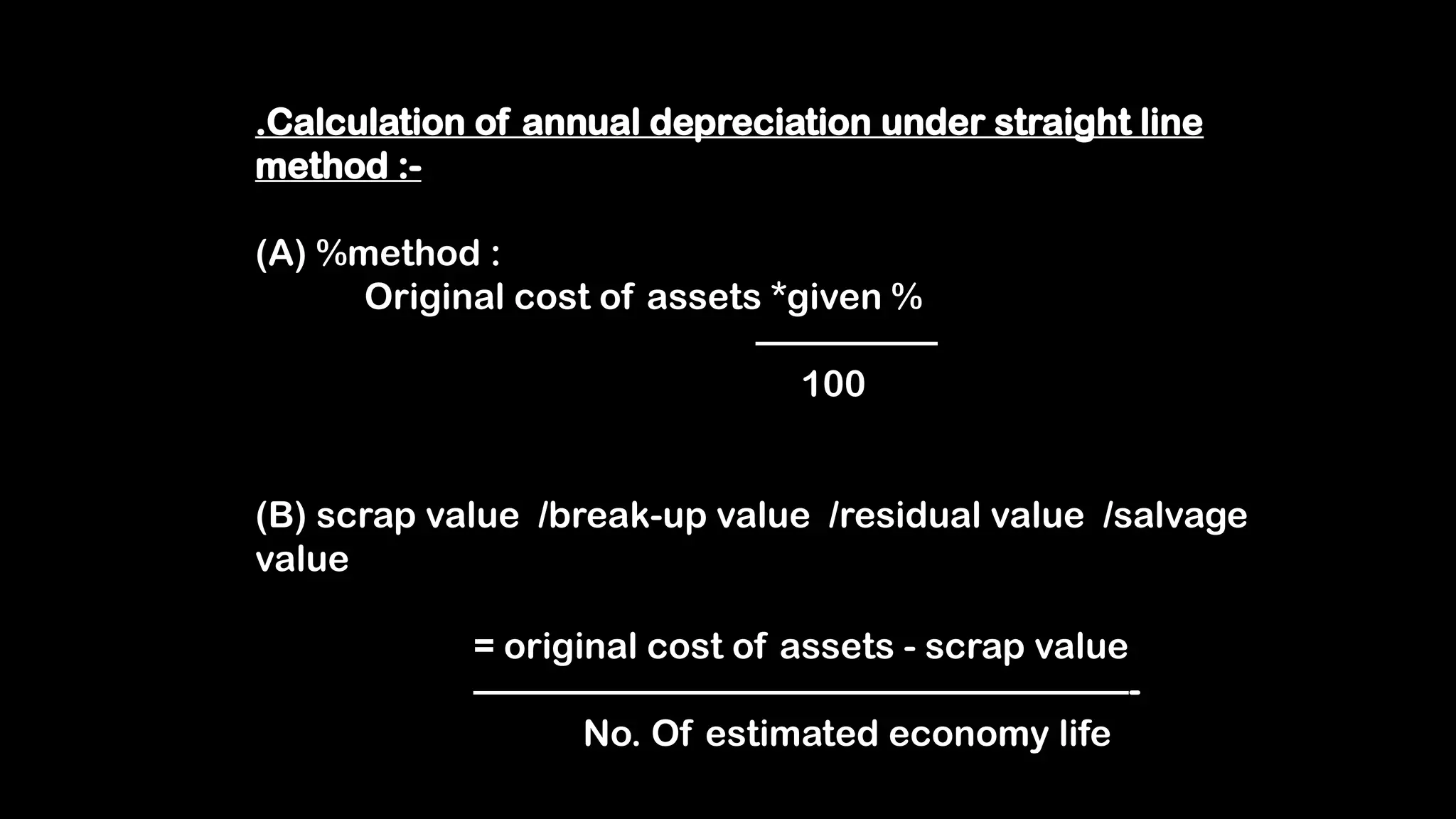

![2. Written down value method / diminishing balance method

/fixed instalment method :

Under this method the amount of depreciation we charge on

the reducing balance of assets after ist year .

2. Calculation of annual depreciation under written down value

method

=original cost of assets *given %

—————

100

[****original cost method= cost os assets

purchased+additional expenditure till installation]](https://image.slidesharecdn.com/presentation-250119110613-1c2c96c9/75/Presentation-pptxd-ddddddddddddddddddddddddddddddddd-7-2048.jpg)