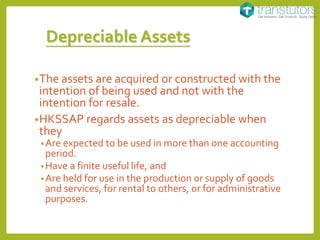

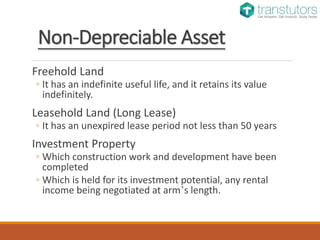

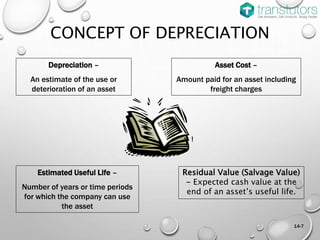

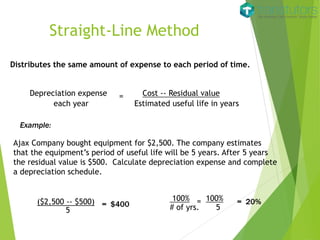

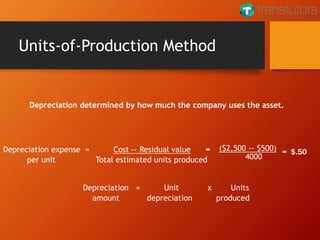

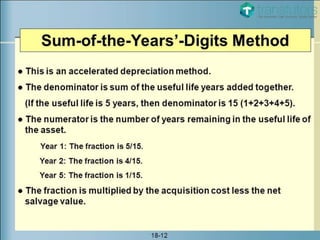

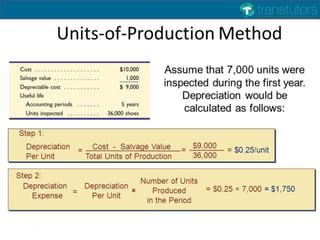

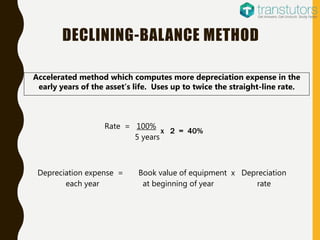

The document defines depreciation as allocating an asset's depreciable amount over its estimated life. Depreciation aims to match revenues and expenses to determine profit and spread an asset's cost over the periods it benefits the company. Depreciable assets are used for more than one period, have a finite life, and are held for business use. Non-depreciable assets include land and some investment property. Methods of depreciation include straight-line, units-of-production, and declining balance, with each calculating depreciation expense differently over the asset's estimated useful life.