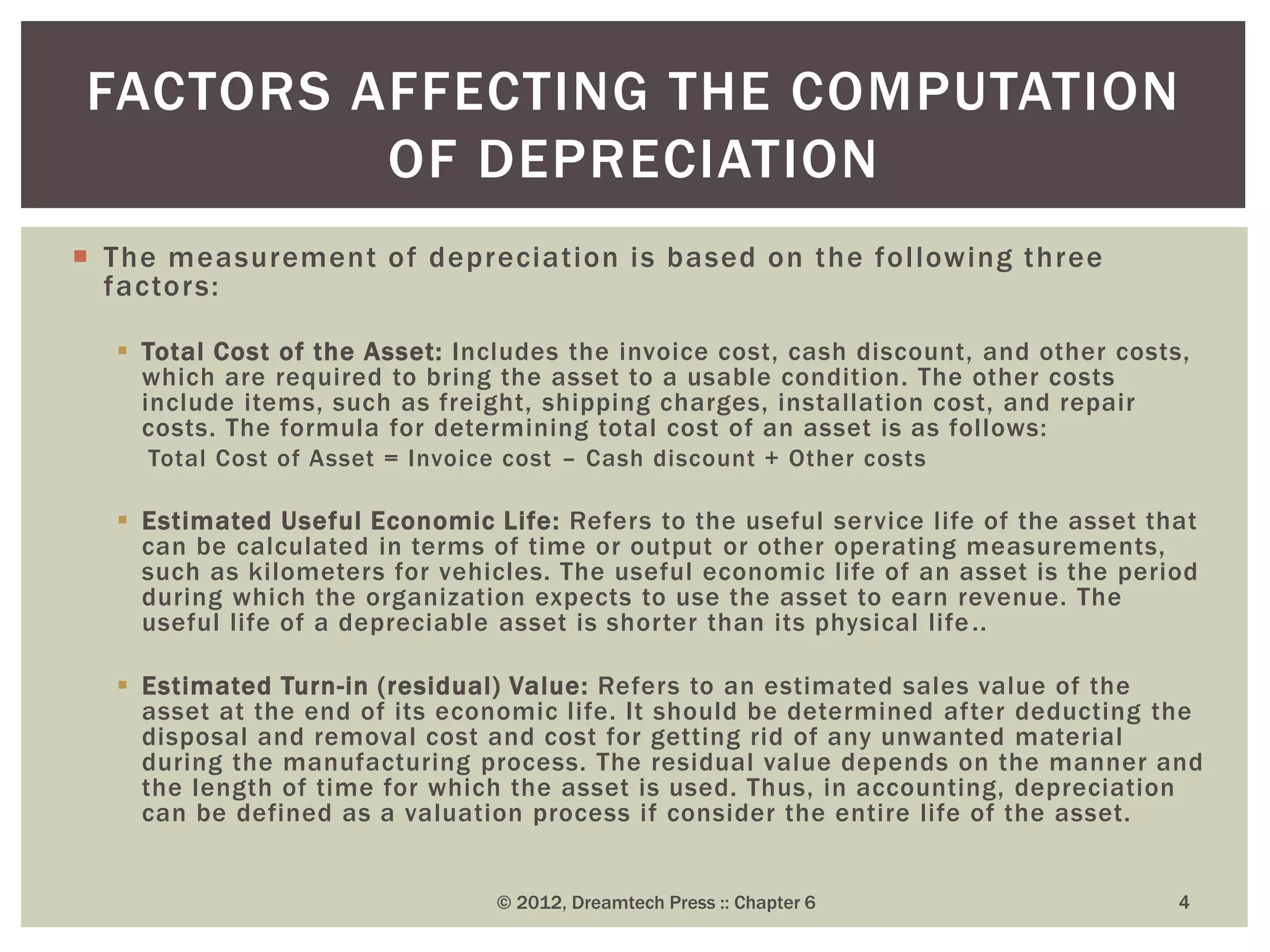

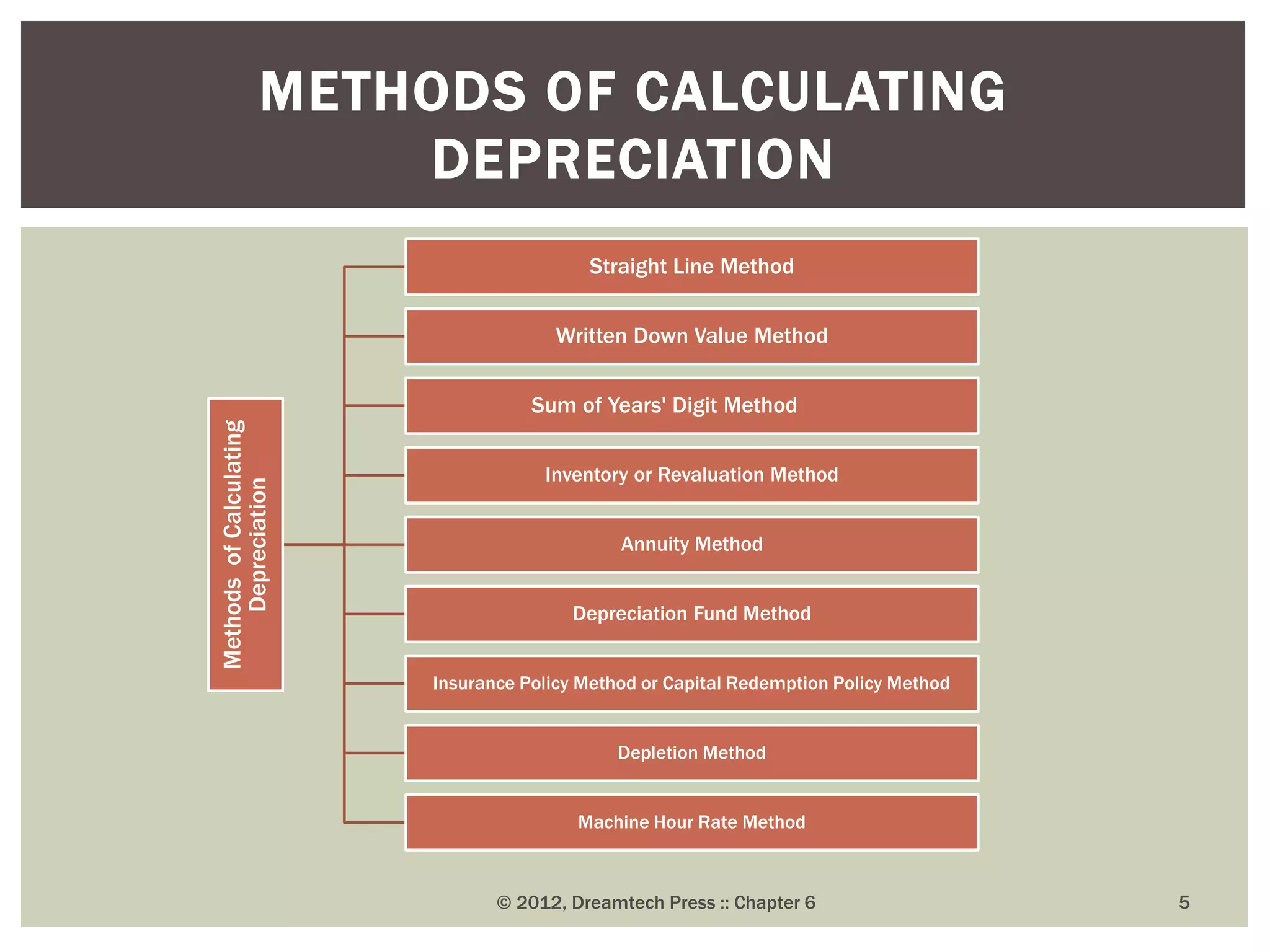

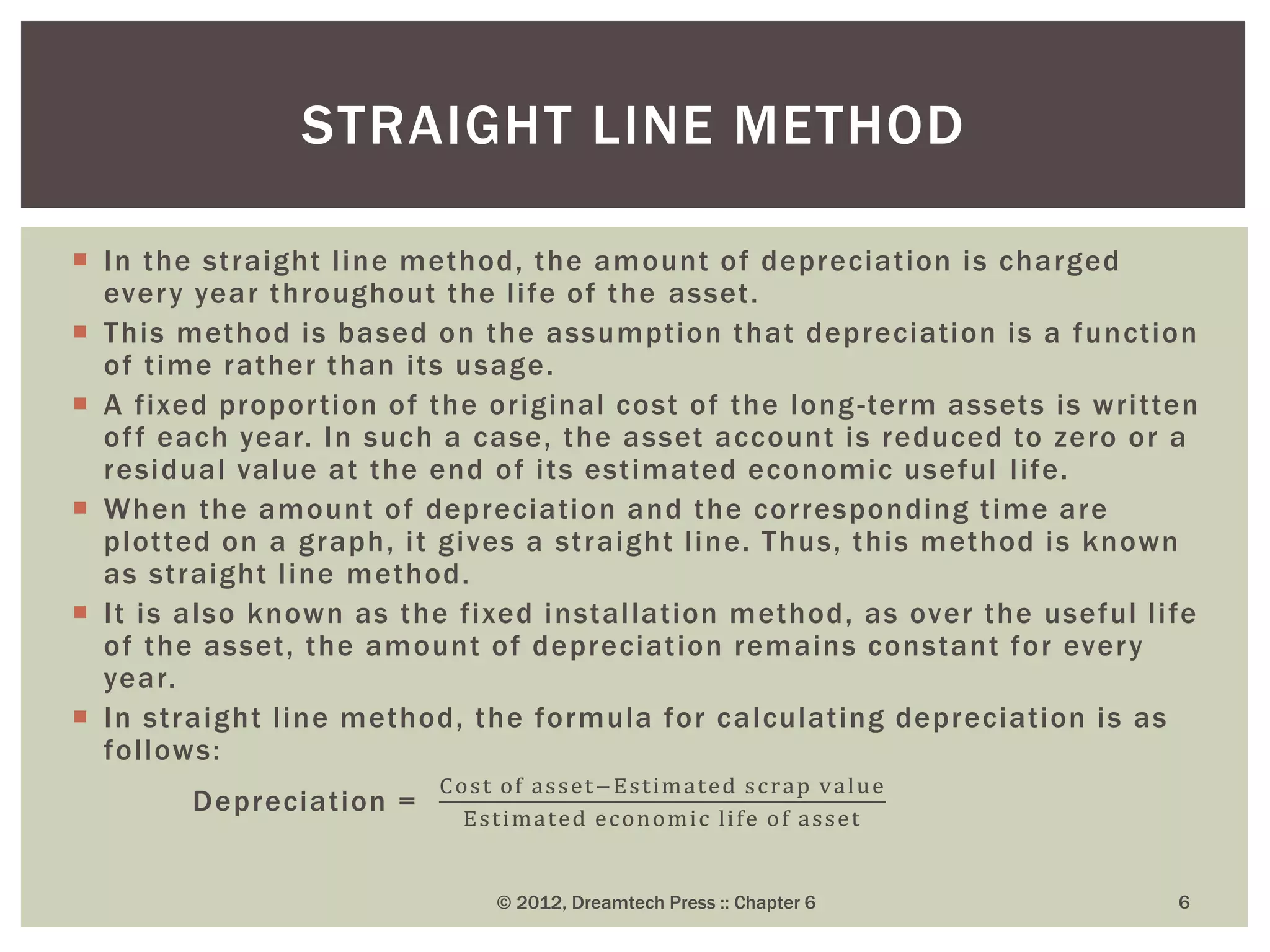

The document discusses various aspects of depreciation. It defines depreciation as the permanent and continuing diminution in the quality, quantity or value of a fixed asset over time due to factors like usage, obsolescence and changes in technology. It then explains the need to charge depreciation to accurately calculate profits, show asset values reasonably and maintain the original investment in the asset. The document also discusses the factors affecting the computation of depreciation and various methods of calculating depreciation like the straight line method, written down value method, and sum of years' digit method.

![ The written down value method is used for the assets, such as

plant and machinery, that show declining efficiency in the

later years of their life.

This method is also known as reducing balance method as the

book value keeps on reducing by an amount equal to the

annual charge of depreciation.

In written down value method, the depreciation rate can be

calculated using the following formula:

R = [1- {n (√S/C)}]

Where, R = Depreciation rate

S = Residual value less removal and disposal cost

C = Acquisition costs including costs of installation

n = Estimated economic life in years

© 2012, Dreamtech Press :: Chapter 6 7

WRITTEN DOWN VALUE METHOD](https://image.slidesharecdn.com/chapter06-180111152829/75/Chapter-06-7-2048.jpg)