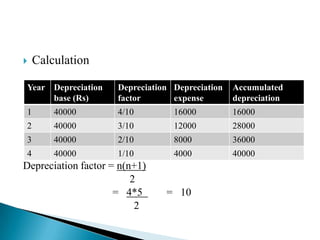

This document defines and explains various accounting concepts related to asset valuation over time. It defines depreciation as a non-cash expense that reduces the value of an asset over its useful life. It then describes different depreciation calculation methods like straight-line, sum-of-years digits, and declining balance. The document also discusses amortization, write-offs, and sinking funds which are methods used to allocate capital costs over a period of time. Examples are provided to illustrate how to calculate depreciation and amortization using different formulas and rates.