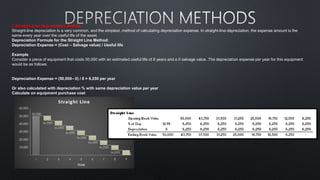

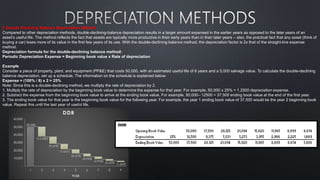

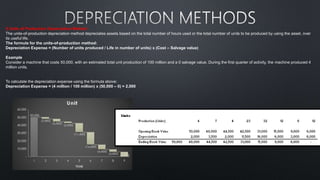

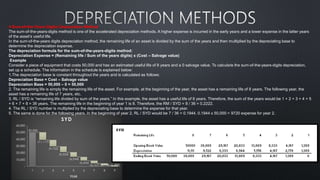

There are four main methods for calculating depreciation expense: straight-line, double declining balance, units of production, and sum of years digits. Depreciation expense allocates the cost of a tangible asset over its useful life and is used to account for reduction in an asset's value due to usage, wear and tear, or obsolescence. Each method is calculated differently, with some like double declining balance and sum of years digits resulting in larger depreciation expenses in earlier years of an asset's life.