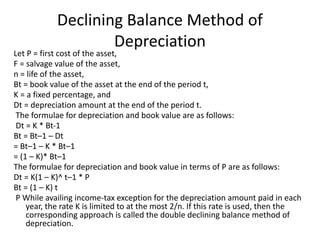

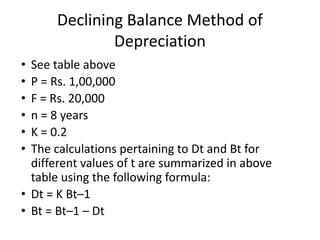

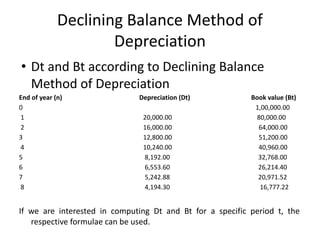

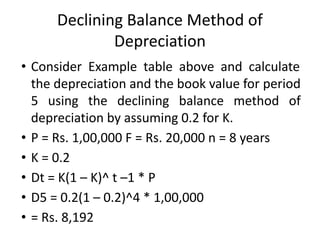

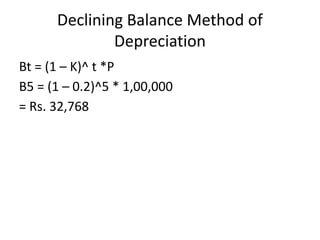

This document discusses various concepts and methods related to depreciation. It defines depreciation as the decrease in value of a tangible asset over its useful life. It then describes different depreciation methods like straight-line and declining balance. Straight-line depreciation allocates an equal amount of depreciation expense each period by dividing the asset cost minus salvage value by its useful life. Declining balance depreciation uses a fixed percentage of the book value from the previous period as the depreciation expense each period, resulting in higher expenses at the start.

![Numerical example

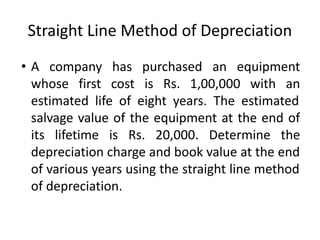

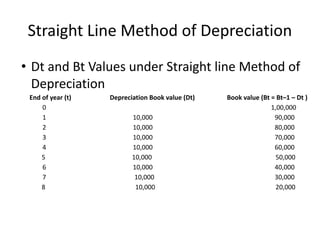

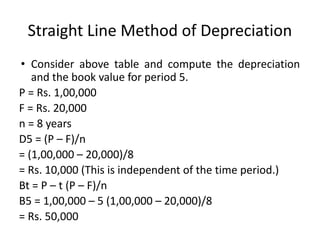

Straight Line Method of Depreciation

• Let

• P = first cost of the asset,

• F = salvage value of the asset,

• n = life of the asset,

• Bt = book value of the asset at the end of the period t,

• Dt = depreciation amount for the period t.

• The formulae for depreciation and book value are as

follows:

• Dt = (P – F)/n

• Bt = Bt–1 – Dt

• = P – t [(P – F)/n]](https://image.slidesharecdn.com/unit5-221222130429-39080344/85/unit-5-pdf-12-320.jpg)