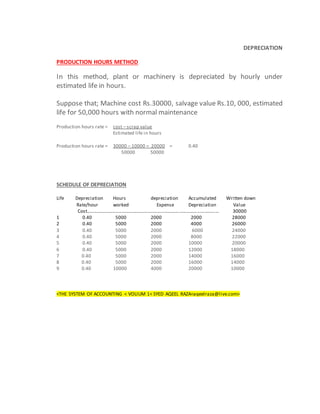

The document discusses the concept of depreciation in accounting, highlighting its role as an income tax deduction for recovering the cost of assets over their useful life. It explains various methods of calculating depreciation, such as straight-line, sum-of-years-digits, units of output, production hours, diminishing balance, and double declining balance methods, along with examples for each. Additionally, it emphasizes the impact of depreciation on financial statements and tax reporting, concluding with the author's views on the implications of depreciation for businesses.